Highlights

- This report provides information on actual unaudited spending by the Government of Ontario (the Province) through the end of the 2023-24 fiscal year (March 31, 2024).

- The information in this report is based on the FAO’s analysis of transactions recorded in the Province’s Integrated Financial Information System (IFIS) as of April 22, 2024. All figures are unaudited, as final audited figures are not available until the release of the Public Accounts of Ontario.

2023-24 Spending Plan

- The Province’s yearly spending plan represents the legal spending authority for ministries as granted by the Legislature through the process of supply.[1] The Province started the 2023-24 fiscal year with a spending plan of $197.3 billion.[2]

Changes to the 2023-24 Spending Plan

- The Province may change its spending plan throughout the year, either by requesting additional spending authority from the Legislature or by reallocating spending among different programs through Treasury Board Orders.

- By the end of the fiscal year, March 31, 2024, the Province’s spending plan was up $7.6 billion to $204.9 billion.

- By sector, the largest spending plan increase during the fiscal year was in health, at $3,561 million, followed by education ($3,149 million), ‘other programs’ ($2,315 million), justice ($651 million) and children, community and social services ($57 million). Postsecondary education had a spending plan decrease (-$5 million) during the 2023-24 fiscal year. Additionally, there was a $2,145 million net decrease in the Contingency Fund.

Actual Unaudited Spending versus Planned Spending

- The Province planned to spend $204.9 billion in the 2023-24 fiscal year. At the end of the 2023-24 fiscal year, actual unaudited spending was $197.1 billion, based on information as of April 22, 2024. This was $7.8 billion (3.8 per cent) less than planned.

- All sectors spent less than planned, led by ‘other programs’ (-$2,409 million, -6.7 per cent), followed by interest on debt (-$1,828 million, -13.3 per cent), health (-$1,296 million, -1.6 per cent), justice (-$118 million, -1.9 per cent), children, community and social services (-$118 million, -0.6 per cent), postsecondary education (-$108 million, -1.5 per cent) and education (-$87 million, -0.2 per cent).

- For information on spending by all of the Province’s programs and ministries, visit the FAO’s website at: https://tinyurl.com/yc3z92b3.

2023-24 Spending versus 2022-23 Spending

- This report also compares 2023-24 actual unaudited spending against 2022-23 actual audited spending to provide context for provincial spending trends and to identify significant year-over-year spending changes.

- Spending in the 2023-24 fiscal year was $7.8 billion (4.1 per cent) higher than in 2022-23.

- The largest year-over-year spending increase was in health ($5,139 million, 6.9 per cent), followed by education ($4,785 million, 13.8 per cent), children, community and social services ($1,236 million, 6.8 per cent), postsecondary education ($394 million, 5.9 per cent), and justice ($388 million, 6.7 per cent). Two sectors spent less in 2023-24 compared to 2022-23: ‘other programs’ (-$3,613 million, -9.7 per cent) and interest on debt (-$558 million, -4.5 per cent).

- Higher spending in the education and health sectors is largely due to compensation for the impact of wage restraint under Bill 124, the Protecting a Sustainable Public Sector for Future Generations Act, 2019. A portion of the spending related to Bill 124 will not have a fiscal impact in 2023-24 because it was already recorded as a liability in 2022-23.

2023-24 Total Consolidated Spending Projection

- The FAO’s projection for total consolidated spending in 2023-24 is $203.9 billion. This total consolidated spending includes the $197.1 billion in ministry spending previously discussed in this report and an estimated $6.8 billion in additional spending by the broader public sector organizations controlled by the Province (hospitals, school boards, colleges and Children’s Aid Societies), the Province’s agencies and the legislative offices, as well as other spending adjustments.

- The FAO’s projection for total consolidated spending of $203.9 billion for 2023-24 is $3.4 billion less than the Province’s projection of $207.3 billion in the 2024 Ontario Budget. The difference between the two forecasts is primarily due to more up-to-date spending information available to the FAO.[3]

- Over the past four years, the FAO’s projection for total consolidated spending in the Fourth Quarter Expenditure Monitor has been on average $1.5 billion (0.8 per cent) different from the final audited spending reported in the Public Accounts of Ontario.

Status of the Contingency Fund

- The Contingency Fund is used to address spending pressures or fund program changes during the fiscal year. The funds within the Contingency Fund cannot be spent directly by the Province but must be transferred to government programs through Treasury Board Orders.

- The Province started the 2023-24 fiscal year with a total of $4.0 billion in the Contingency Fund. In the first and second quarters, the Province transferred $849 million and $277 million, respectively, from the Contingency Fund to various programs. In the third quarter, the Province topped up the Contingency Fund by $2,500 million and transferred out $288 million to fund various programs. In the fourth quarter, the Province transferred $5,107 million from the Contingency Fund to various programs and $1,876 million from various programs to the Contingency Fund. At year-end, the Contingency Fund had a remaining balance of $1.9 billion.

Introduction

This report provides information on spending by the Government of Ontario (the Province) through the end of the 2023-24 fiscal year (March 31, 2024). The report:

- identifies changes made to the Province’s 2023-24 spending plan;

- reviews actual unaudited spending in 2023-24 against both the Province’s spending plan and actual audited spending in 2022-23;

- projects total 2023-24 consolidated spending; and

- tracks transfers to and from the Province’s Contingency Fund.

The information in this report is based on the FAO’s analysis of transactions recorded in the Province’s Integrated Financial Information System (IFIS) as of April 22, 2024. All figures are unaudited, and there will be additional spending transactions that are recorded between April 22, 2024 and the release of the 2023-24 Public Accounts of Ontario in September 2024. Depending on these transactions, the 2023-24 Public Accounts of Ontario may contain material changes from the information presented in this report.

2023-24 Spending Plan

The Province’s yearly spending plan represents the legal spending authority for ministries as granted by the Legislature through the process of supply.[4] The Province started the 2023-24 fiscal year with a spending plan of $197.3 billion.[5]

Changes to the 2023-24 Spending Plan

The Province may change its spending plan throughout the year, either by requesting additional spending authority from the Legislature or by reallocating spending among different programs through Treasury Board Orders. By the end of the fiscal year, March 31, 2024, the Province’s spending plan was up $7.6 billion, from $197.3 billion to $204.9 billion.

By sector, the largest spending plan increase during the fiscal year was in health, at $3,561 million, followed by education ($3,149 million), ‘other programs’ ($2,315 million), justice ($651 million) and children, community and social services ($57 million). Postsecondary education had a spending plan decrease (-$5 million) during the 2023-24 fiscal year.

The Province started the 2023-24 fiscal year with a total of $4.0 billion in unallocated funds in the Contingency Fund. After accounting for top-ups to the Contingency Fund and transfers to various programs during the year, the remaining Contingency Fund balance at the end of 2023-24 was $1.9 billion. The remaining funds in the Contingency Fund will reduce both the budget deficit and Ontario’s net debt.

| Sector | 2023-24 Spending Plan | Q1 Changes | Q2 Changes | Q3 Changes | Q4 Changes | Total Changes | Revised 2023-24 Spending Plan |

|---|---|---|---|---|---|---|---|

| Health | 77,090 | -14 | 180 | – | 3,395 | 3,561 | 80,651 |

| Education | 36,281 | 2 | – | – | 3,147 | 3,149 | 39,430 |

| Postsecondary Education | 7,226 | 1 | – | -8 | 1 | -5 | 7,221 |

| Children, Community and Social Services | 19,526 | 33 | – | – | 24 | 57 | 19,583 |

| Justice | 5,664 | 190 | 21 | – | 439 | 651 | 6,315 |

| Other Programs | 33,756 | 604 | 76 | 139 | 1,497 | 2,315 | 36,071 |

| Unallocated Funds: | |||||||

| Contingency Fund | 4,000 | -849 | -277 | 2,212 | -3,231 | -2,145 | 1,855 |

| Interest on Debt | 13,764 | – | – | – | – | – | 13,764 |

| Total | 197,307 | -32 | 0 | 2,343 | 5,272 | 7,582 | 204,889 |

Fourth Quarter Analysis

This section highlights key fourth quarter spending plan changes by sector and vote-item. For information on all of the Province’s transfer payment programs and ministries, visit the FAO’s website at: https://tinyurl.com/yc3z92b3.

Health: $3,395 million increase. Notable changes include:

- $2,598 million increase for Health Services (Vote-Item 1416-1), largely for the Operation of Hospitals. The spending plan increase is partially due to compensation for the impact of wage restraint under Bill 124, the Protecting a Sustainable Public Sector for Future Generations Act, 2019. A portion of the spending related to Bill 124 will not have a fiscal impact in 2023-24 because it was already recorded as a liability in 2022-23.

- $474 million increase for Programs and Administration (Vote-Item 1416-2), including $196 million for Digital Health and $105 million for Cancer Treatment Services.

- $455 million increase for Ontario Health Insurance (Vote-Item 1405-1), largely for payments to physicians and practitioners.

- $248 million increase for Provincial Programs (Vote-Item 1412-1), largely for Community and Priority Services.

- $121 million increase for Population and Public Health (Vote-Item 1406-4), largely for Official Local Health Agencies.

- $101 million increase for Health Policy and Research (Vote-Item 1402-1), largely for the Clinical Education program.

- $137 million decrease for Digital Health and Information Management (Vote-Item 1403-1), largely for Digital Health Strategy and Programs.

- $193 million decrease for the Long-Term Care Homes Program (Vote-Item 4502-1), largely for the operation of long-term care homes.

- $389 million decrease for Health Capital (Vote-Item 1407-1), for Major Hospital Projects.

Education: $3,147 million increase. Notable changes include:

- $3,144 million increase for Policy and Program Delivery (Vote-Item 1002-1), largely for School Board Operating Grants. The spending plan increase is largely due to compensation for the impact of wage restraint under Bill 124, the Protecting a Sustainable Public Sector for Future Generations Act, 2019. A portion of the spending related to Bill 124 will not have a fiscal impact in 2023-24 because it was already recorded as a liability in 2022-23.

- $300 million increase for Support for Elementary and Secondary Education (Capital) (Vote-Item 1002-3), largely for School Board Capital Grants.

- $205 million decrease for Policy Development and Program Delivery (Vote-Item 1004-1), including a $293 million decrease for the Child Care and Early Years program and a $92 million increase for the Ontario Child Care Tax Credit.

- $102 million decrease for Child Care and Early Years (Capital) (Vote-Item 1004-2).

Children’s and Social Services: $24 million increase. Notable changes include:

- $35 million increase for Supports to Individuals and Families (Vote-Item 702-21), largely for Autism.

Justice: $439 million increase. Notable changes include:

- $197 million increase for Institutional Services (Vote-Item 2605-3) for the operation of Ontario’s correctional institutions for incarcerated adults.

- $61 million increase for Administration of Justice (Vote-Item 305-1), which administers criminal, civil, family and small claims courts in Ontario.

- $46 million increase for statutory spending in the Legal Services Program (Vote 304-S).

Other Programs: $1,497 million increase. Notable changes include:

- $1,016 million increase for Ministry of Transportation, Agency Oversight and Partnerships (Capital) (Vote-Item 2702-3), including a $1,169 million increase for Metrolinx (Capital) and a $154 million decrease for Municipal Transit (Capital).

- $759 million increase for Ministry of Transportation, Agency Oversight and Partnerships (Operating) (Vote-Item 2702-2), including $423 million for Metrolinx Operating Subsidies and $300 million for Municipal Transit (Operating).

- $369 million increase for Ministry of Mines, Environmental Remediation for Mining (Capital) (Vote-Item 4902-5).

- $223 million increase for Ministry of Municipal Affairs and Housing, Community and Market Housing (Vote-Item 1904-2), primarily for Homelessness Programs – New Deal, which provides operating support for homelessness and shelters in Toronto as part of the Ontario-Toronto New Deal agreement.

- $209 million increase for Ministry of Natural Resources and Forestry, Infrastructure for Natural Resource Management (Capital) (Vote-Item 2103-3), which oversees the management of fish culture facilities, Crown land, environmental remediation and other infrastructure.

- $169 million increase for Ministry of Transportation, Operations and Maintenance (Vote-Item 2707-1), for the operation and maintenance of provincial transportation networks.

- $150 million increase for Ministry of Transportation, Engineering and Construction (Capital) (Vote-Item 2704-2), including a $162 million increase for Third Party Works for Highways (Capital) and a $12 million decrease for Highway 407 Municipal (Capital).

- $88 million increase for Ministry of the Environment, Conservation and Parks for Environmental Remediation (Capital) (Vote-Item 1116-5).

- $80 million increase for Treasury Board Secretariat, Supply Chain Transformation Office (Vote-Item 3416-1).

- $150 million decrease for Ministry of Energy, Electricity Price Mitigation (Vote-Item 2905-1), primarily for the Ontario Electricity Rebate.

- $194 million decrease for Ministry of Labour, Immigration, Training and Skills Development for Employment Ontario System (Capital) (Vote-Item 1607-4), largely due to a decrease for the Skills Development Fund (Capital).

- $322 million decrease for Ministry of Infrastructure, Government Infrastructure Projects (Capital) (Vote-Item 4007-2), including a $333 million decrease for East Harbour Transit-Oriented Communities.

- $487 million decrease for Ministry of Economic Development, Job Creation and Trade, Economic Development, Job Creation and Trade (Vote-Item 902-13), including a $266 million decrease for Strategic Investments and a $115 million decrease for Industrial Land Development.

- $578 million decrease for Ministry of Infrastructure, Infrastructure Policy, Planning and Projects (Vote-Item 4003-2), including a $455 million decrease for Broadband and Cellular Infrastructure (Capital).

- A net $165 million increase for 152 additional vote-items in the ‘other programs’ sector. For more information, visit the FAO’s website at: https://tinyurl.com/yc3z92b3.

Actual Unaudited Spending

Actual Unaudited Spending versus Planned Spending

The Province planned to spend $204.9 billion in the 2023-24 fiscal year. As of April 22, 2024, actual unaudited spending was $197.1 billion. This was $7.8 billion (3.8 per cent) less than planned.

In 2023-24, all sectors spent less than planned. By sector, lower-than-planned spending was led by ‘other programs’ (-$2,409 million, -6.7 per cent), followed by interest on debt (-$1,828 million, -13.3 per cent), health (-$1,296 million, -1.6 per cent), justice (-$118 million, -1.9 per cent), children, community and social services (‑$118 million, -0.6 per cent), postsecondary education (-$108 million, -1.5 per cent) and education (-$87 million, -0.2 per cent). Also, a $1.9 billion end-of-year balance remained unspent in the Contingency Fund.

| Sector | Revised 2023-24 Spending Plan |

2023-24 Actual Unaudited Spending |

Actual vs. Revised Spending Plan | Actual vs. Revised Spending Plan (%) |

|---|---|---|---|---|

| Health | 80,651 | 79,355 | -1,296 | -1.6% |

| Education | 39,430 | 39,343 | -87 | -0.2% |

| Postsecondary Education | 7,221 | 7,113 | -108 | -1.5% |

| Children, Community and Social Services | 19,583 | 19,465 | -118 | -0.6% |

| Justice | 6,315 | 6,197 | -118 | -1.9% |

| Other Programs | 36,071 | 33,662 | -2,409 | -6.7% |

| Unallocated Funds: | ||||

| Contingency Fund | 1,855 | – | -1,855 | N/A |

| Interest on Debt | 13,764 | 11,936 | -1,828 | -13.3% |

| Total | 204,889 | 197,072 | -7,818 | -3.8% |

The rest of this section highlights key vote-item spending that was above and below plan in 2023-24. For information on spending by all of the Province’s programs and ministries, visit the FAO’s website at: https://tinyurl.com/yc3z92b3.

Health sector spending: $1,296 million (1.6 per cent) less than planned. Highlights include:

- $75 million less than planned in Drug Programs (Vote-Item 1405-2).

- $81 million less than planned in Population and Public Health (Vote-Item 1406-4), including $40 million less than planned for Outbreaks of Diseases.

- $85 million less than planned in Health Capital Program (Vote-Item 1407-1), including $154 million less than planned for Major Hospital Projects, partially offset by $45 million higher than planned for Small Hospital Projects and $21 million higher than planned for Community Health Programs.

- $141 million less than planned in Health Services (Vote-Item 1416-1), including $111 million less than planned for the Operation of Hospitals.

- $260 million less than planned in Long-Term Care Homes Program (Operating) (Vote-Item 4502-1), which funds the operation and development of long-term care homes.

- $397 million less than planned for the procurement of Personal Protective Equipment (PPE) and other supplies through the Population and Public Health Program.[6]

Postsecondary education sector spending: $108 million (1.5 per cent) less than planned. Highlights include:

- $81 million less than planned in Colleges, Universities and Student Support (Vote-Item 3002-1), including $44 million less than planned for Grants for College Operating Costs.

Justice sector spending: $118 million (1.9 per cent) less than planned across a number of programs.

Other programs sector spending: $2,409 million (6.7 per cent) less than planned. Highlights include:

- $74 million less than planned in Ministry of Transportation, Transit (Operating) (Vote-Item 2702-2), including $57 million less than planned for Metrolinx Operating Subsidies.

- $78 million less than planned in Ministry of Infrastructure, Infrastructure Policy, Planning and Projects (Vote-Item 4003-2), including $65 million less than planned for Broadband and Cellular Infrastructure (Capital).

- $96 million less than planned in Ministry of Economic Development, Job Creation and Trade, Economic Development, Job Creation and Trade (Vote-Item 902-13), including $53 million less than planned for Strategic Investments.

- $107 million less than planned in Treasury Board Secretariat, Supply Chain Transformation Office (Vote-Item 3416-1).

- $207 million less than planned for the procurement of PPE and other supplies through Enterprise Business and Financial Services, within the Ministry of Public and Business Service Delivery.[7]

- $213 million less than planned in Ministry of Transportation, Transit Investment and Programs (Capital) (Vote-Item 2702-3), including $180 million less than planned for Municipal Transit (Capital).

- $231 million less than planned in Ministry of Energy, Electricity Price Mitigation (Vote-Item 2905-1), including $200 million less than planned for the Ontario Electricity Rebate.

- $353 million less than planned in Ministry of Finance, Ontario Electricity Financial Corporation Dedicated Electricity Earnings (Vote-Item 1203-12), which reflects the transfer of dedicated electricity earnings from the Province to the Ontario Electricity Financial Corporation (OEFC).[8]

- $545 million less than planned in Treasury Board Secretariat, Employee and Pensioner Benefits (Employer Share) Program (Vote 3403).

- A net $505 million less than planned in the remaining 287 vote-items in the ‘other programs’ sector. For more information, visit the FAO’s website at: https://tinyurl.com/yc3z92b3.

Interest on Debt: $1,828 million (13.3 per cent) less than planned as a result of higher-than-planned interest revenue on the Province’s cash reserves.[9]

2023-24 Spending versus 2022-23 Spending

This report also compares 2023-24 actual unaudited spending against 2022-23 actual audited spending to provide context for provincial spending trends and to identify significant year-over-year spending changes.

As noted above, the Province spent $197.1 billion in 2023-24. This was $7.8 billion (4.1 per cent) more than was spent in 2022-23. The largest year-over-year spending increase was in health ($5,139 million, 6.9 per cent), followed by education ($4,785 million, 13.8 per cent), children, community and social services ($1,236 million, 6.8 per cent), postsecondary education ($394 million, 5.9 per cent) and justice ($388 million, 6.7 per cent). Two sectors spent less in 2023-24 compared to 2022-23: ‘other programs’ (-$3,613 million, -9.7 per cent) and interest on debt (-$558 million, -4.5 per cent).

| Sector | 2022-23 Actual Audited Spending | 2023-24 Actual Unaudited Spending | 2023-24 vs. 2022-23 | 2023-24 vs. 2022-23 (%) |

| Health | 74,215 | 79,355 | 5,139 | 6.9 |

| Education | 34,558 | 39,343 | 4,785 | 13.8 |

| Postsecondary Education | 6,719 | 7,113 | 394 | 5.9 |

| Children, Community and Social Services | 18,229 | 19,465 | 1,236 | 6.8 |

| Justice | 5,809 | 6,197 | 388 | 6.7 |

| Other Programs | 37,275 | 33,662 | -3,613 | -9.7 |

| Interest on Debt | 12,494 | 11,936 | -558 | -4.5 |

| Total | 189,299 | 197,072 | 7,772 | 4.1 |

- The health sector spent $5,139 million (6.9 per cent) more in 2023-24 compared to 2022-23, largely due to higher spending for:

- Operation of Hospitals ($2,958 million), partially due to compensation for the impact of wage restraint under Bill 124, the Protecting a Sustainable Public Sector for Future Generations Act, 2019;

- payments to physicians and practitioners ($1,026 million), due to increases in physician fees and higher utilization;

- the operation of long-term care homes ($707 million);

- Major Hospital Projects ($512 million);

- Home Care ($471 million), due to increases in contract rates for home care providers and the expansion of home care services;

- Clinical Education ($137 million), due to increased health workforce investments;

- Outbreaks of Diseases ($126 million);

- Digital Health ($107 million); and

- Drug Programs (Vote-Item 1405-2) ($106 million);

offset by lower spending on:- Population and Public Health (Vote-Item 1406-4) (-$181 million), largely due to the conclusion of the COVID-19 Response program in 2022-23; and

- the procurement of Personal Protective Equipment (PPE) and other supplies through the Population and Public Health Program (-$1,324 million).[10]

- The education sector spent $4,785 million (13.8 per cent) more in 2023-24 compared to 2022-23, largely due to higher spending for:

- School Board Operating Grants and Education Property Tax Non-Cash Expense ($3,793 million), largely due to compensation for the impact of wage restraint under Bill 124, the Protecting a Sustainable Public Sector for Future Generations Act, 2019;

- the Child Care and Early Years program ($671 million), which includes the Province’s commitment to provide an average of $10-a-day child care by 2025;[11]

- School Board Capital Grants ($440 million); and

- the Child Care and Early Years Capital program ($107 million);

- Priority and Partnerships Funding – Third Parties (-$402 million);

- The postsecondary education sector spent $394 million (5.9 per cent) more in 2023-24 compared to 2022-23, largely due to higher spending for:

- Student Financial Assistance Programs ($297 million); and

- Grants for University Operating Costs ($139 million);

offset by lower spending on:- Grants for College Operating Costs (-$70 million).

- The children, community and social services sector spent $1,236 million (6.8 per cent) more in 2023-24 compared to 2022-23, largely due to higher spending for:

- the Ontario Disability Support Program – Financial Assistance ($410 million);

- Supports to Individuals and Families (Vote-Item 702-21) ($303 million), which includes Developmental Services Supportive Living ($124 million) and Autism ($63 million);

- Ontario Works – Financial Assistance ($295 million); and

- the Ontario Child Benefit (Vote-Item 702-22) ($166 million).[12]

- The justice sector spent $388 million (6.7 per cent) more in 2023-24 compared to 2022-23, partially due to higher spending for:

- Institutional Services (Vote-Item 2605-3) for salaries and wages ($80 million).

- The other programs sector spent $3,613 million (9.7 per cent) less in 2023-24 compared to 2022-23, largely due to lower spending for:

- the procurement of PPE and other supplies through Enterprise Business and Financial Services, within the Ministry of Public and Business Service Delivery (-$150 million);[13]

- Ministry of Tourism, Culture and Sport for Tourism Recovery and Support – Personal Income Tax Staycation Tax Credit (-$200 million), due to the conclusion of the tax credit in 2022;

- Ministry of Finance for Ontario Electricity Financial Corporation Dedicated Electricity Earnings (Vote-Item 1203-12) (-$200 million);[14]

- Ministry of Labour, Immigration, Training and Skills Development for Ontario Jobs Training Tax Credit, due to the conclusion of the tax credit in 2022 (-$203 million);

- Ministry of Transportation, Transportation Safety (Vote-Item 2703-1) for services (-213 million);

- Ministry of Municipal Affairs and Housing for Priority Projects for Municipalities and Municipal Organizations, which provided one-time funding to support the City of Toronto’s budget shortfall in 2022 (-$239 million);

- Ministry of Public and Business Service Delivery for statutory spending for Transfers from Designated Purpose Account, Motor Vehicle Claims Act (-$251 million), due to a change in the accounting treatment for the Motor Vehicle Claims Fund;

- Ministry of Transportation for Municipal Transit (Operating) (-$285 million), due to the conclusion of the Safe Restart Agreement, partially offset by the introduction of a one-time $300 million subsidy to support transit operations in Toronto; and

- Ministry of Indigenous Affairs for Negotiated Settlements (-$6,250 million), due to one-time spending in 2022-23 for the Province’s contribution to the settlement agreement between the governments of Ontario and Canada and 21 Robinson Huron First Nations over unpaid annuities;

offset by higher spending on:- Ministry of Transportation for Metrolinx infrastructure projects ($1,572 million);

- Ministry of Mines for Environmental Remediation for Mining, Capital Expense ($283 million);

- Ministry of Economic Development, Job Creation and Trade for Ontario Made Manufacturing Investment Tax Credit ($220 million), due to the introduction of the tax credit in 2023;

- Ministry of Natural Resources and Forestry, Infrastructure for Natural Resource Management (Vote-Item 2103-3) for other transactions ($211 million);

- Ministry of Municipal Affairs and Housing for Homelessness Programs – New Deal ($200 million), which provides operating support for homelessness and shelters in Toronto as part of the Ontario-Toronto New Deal agreement;

- Ministry of Transportation for Third Party Works for Highways (Capital) ($198 million);

- Ministry of Transportation for Metrolinx Operating Subsidies ($170 million);

- Ministry of Transportation, Oversight and Agency Governance (Vote-Item 2708-1) for services ($163 million);

- Ministry of Municipal Affairs and Housing for National Housing Strategy Programs ($105 million);

- Ministry of Natural Resources and Forestry for Public Protection (Vote-Item 2104-1) ($101 million);

- Ministry of Finance for Guaranteed Annual Income System ($89 million); and

- Ministry of Energy for the Ontario Electricity Rebate ($85 million).

- Interest on debt spending was $558 million (4.5 per cent) less in 2023-24 compared to 2022-23, due to higher interest revenue on the Province’s cash reserves earned in 2023-24.[15]

2023-24 Total Consolidated Spending Projection

The FAO projects total year-end consolidated spending of $203.9 billion in 2023-24. This total consolidated spending includes the $197.1 billion in ministry spending previously discussed in this report and an estimated $6.8 billion in additional spending by the broader public sector organizations controlled by the Province (hospitals, school boards, colleges and Children’s Aid Societies), the Province’s agencies and the legislative offices, as well as other spending adjustments.

The FAO’s projection for total consolidated spending of $203.9 billion for 2023-24 is $3.4 billion less than the Province’s projection of $207.3 billion in the 2024 Ontario Budget. The difference between the two forecasts is due to more up-to-date spending information available to the FAO.[16] Actual audited 2023-24 total consolidated spending will be released as part of the 2023-24 Public Accounts of Ontario in September 2024.

| Province | FAO | Difference | |

| Consolidated Spending* | |||

| Health | 84,467 | 83,249 | -1,217 |

| Education** | 38,248 | 38,142 | -106 |

| Postsecondary Education | 12,576 | 12,664 | 88 |

| Children’s and Social Services | 19,438 | 19,326 | -111 |

| Justice | 6,090 | 5,739 | -351 |

| Other Programs** | 33,653 | 32,938 | -715 |

| Interest on Debt | 12,843 | 11,808 | -1,035 |

| Total Consolidated Spending | 207,313 | 203,865 | -3,448 |

How Accurate is the FAO’s Total Consolidated Spending Forecast?

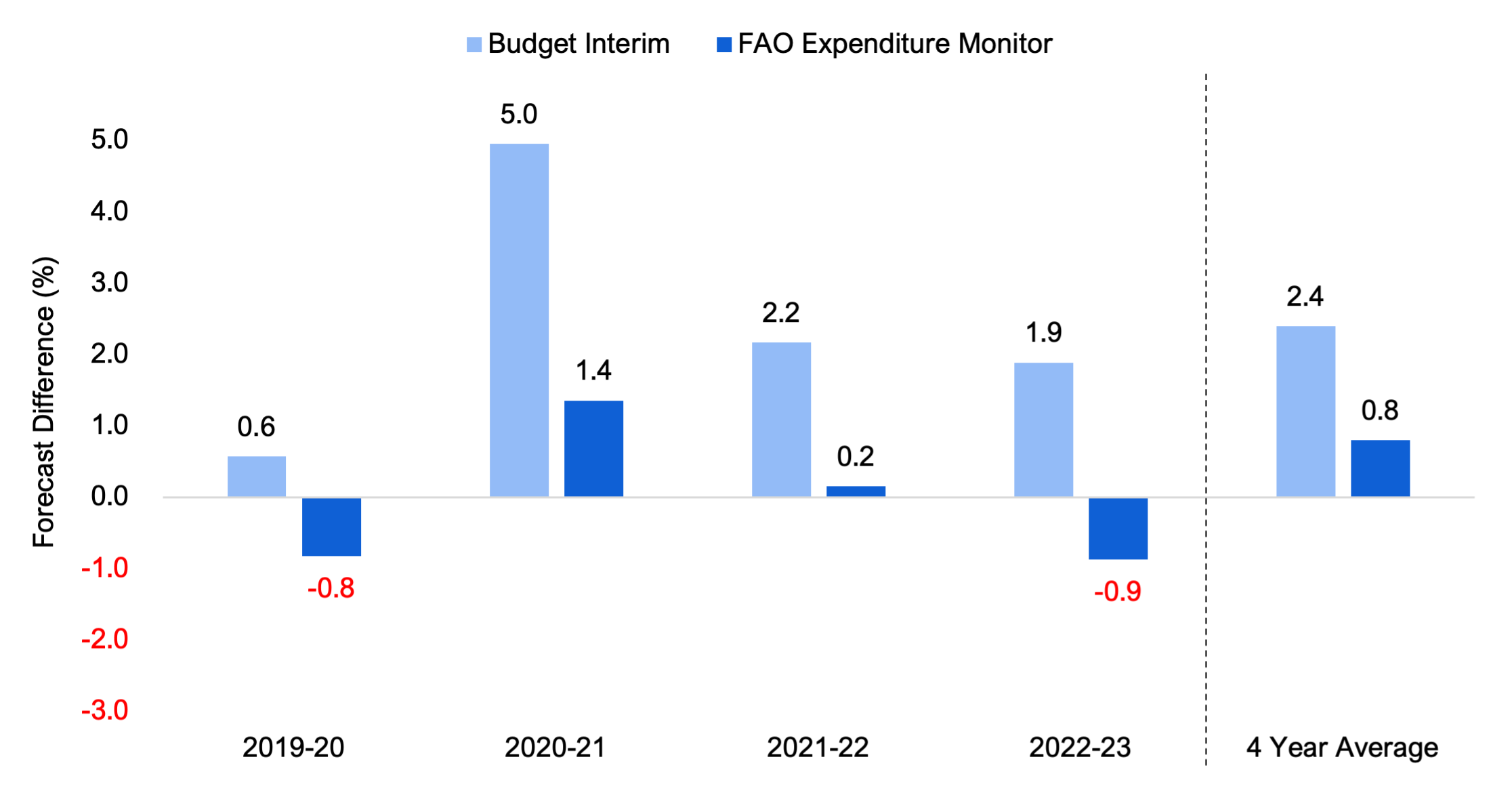

Over the past four years, the FAO’s projection for total consolidated spending in the Fourth Quarter Expenditure Monitor has been on average $1.5 billion different from final audited spending reported in the Public Accounts of Ontario. This represents an average absolute difference of 0.8 per cent.

In contrast, the Province’s equivalent projection for total consolidated spending in the Ontario Budget (known as the ‘Interim’ forecast) has been on average $4.5 billion different from final audited spending reported in the Public Accounts of Ontario. This represents an average absolute difference of 2.4 per cent.

Overall, the FAO’s total consolidated spending forecast has been more accurate than the government’s Interim forecast since 2020-21, while in 2019-20, the government was more accurate than the FAO.

Figure 1 Total consolidated spending forecast accuracy compared to the Public Accounts of Ontario, FAO vs. Province, 2019-20 to 2022-23, %

Note: “Budget Interim” represents the Interim forecast for total consolidated spending in the Ontario Budget. “FAO Expenditure Monitor” represents the total consolidated spending forecast in the Fourth Quarter Expenditure Monitor. Positive values indicate that the forecast was higher than actual spending in the Public Accounts of Ontario, while negative values indicate that the forecast was lower than actual spending in the Public Accounts of Ontario. The four-year average is calculated in absolute terms, i.e., negative values are treated as positive values.

Source: The Public Accounts of Ontario from 2019-20 to 2022-23, the March 2020 Economic and Fiscal Update, the Ontario Budgets from 2020 to 2023 and FAO analysis of information provided by Treasury Board Secretariat.

Accessible version

| 2019-20 | 2020-21 | 2021-22 | 2022-23 | 4 Year Average | |

| Budget Interim | 0.6 | 5.0 | 2.2 | 1.9 | 2.4 |

| FAO Expenditure Monitor | -0.8 | 1.4 | 0.2 | -0.9 | 0.8 |

Status of the Contingency Fund

The Contingency Fund is used to address spending pressures or fund program changes during the fiscal year. The funds within the Contingency Fund cannot be spent directly by the Province but must be transferred to government programs through Treasury Board Orders.

The Province started the 2023-24 fiscal year with a total of $4.0 billion in the Contingency Fund. In the first and second quarters, the Province transferred $849 million and $277 million, respectively, from the Contingency Fund to various programs. In the third quarter, the Province topped up the Contingency Fund by $2,500 million and transferred out $288 million to fund various programs. In the fourth quarter, the Province transferred $5,107 million from the Contingency Fund to various programs and $1,876 million from various programs to the Contingency Fund.

At year-end, the Contingency Fund had a remaining balance of $1,855 million. The remaining funds in the Contingency Fund will reduce both the budget deficit and Ontario’s net debt.

| Opening Balance | Q1 Transfers to Ministries | Q2 Transfers to Ministries | Q3 Top-Up | Q3 Transfers to Ministries | Q4 Transfers to Ministries | Q4 Transfers to C-Fund | Balance at Year-End |

| 4,000 | -849 | -277 | 2,500 | -288 | -5,107 | 1,876 | 1,855 |

| Ministry/Program | $ millions | |

| Opening Contingency Fund Balance as of April 1, 2023 | 4,000 | |

| Less: First Quarter Transfers to Ministries | -849 | |

| Less: Second Quarter Transfers to Ministries | -277 | |

| Add: Third Quarter Top-Up | 2,500 | |

| Less: Third Quarter Transfers to Ministries | -288 | |

| Less: Fourth Quarter Transfers to Ministries | ||

| Ministry of the Attorney General | ||

| Various Programs | -100 | |

| Indigenous Justice | -7 | |

| Political Contribution Tax Credit | -2 | |

| Ministry of Children, Community and Social Services | ||

| Children’s Activity Tax Credit | -<1 | |

| Ministry of Economic Development, Job Creation and Trade | ||

| Regional Opportunities Investment Tax Credit | -36 | |

| Ontario Made Manufacturing Investment Tax Credit | -5 | |

| Ministry of Education | ||

| Ontario Child Care Tax Credit | -92 | |

| Ministry of the Environment, Conservation and Parks | ||

| Environmental Remediation – Capital* | -50 | |

| Ministry of Health | ||

| Operation of Hospitals* | -2,449 | |

| Payments made for services and for care provided by physicians and practitioners | -453 | |

| Various Programs* | -120 | |

| Healthy Homes Renovation Tax Credit | -<1 | |

| Ministry of Indigenous Affairs | ||

| Various Programs | -13 | |

| Ministry of Labour, Immigration, Training and Skills Development | ||

| Ontario Co-operative Education Tax Credit | -23 | |

| Ontario Jobs Training Tax Credit | -8 | |

| Ministry of Mines | ||

| Environmental Remediation for Mining, Capital Expense* | -368 | |

| Focused Flow-through Share Tax Credit | -3 | |

| Ministry of Municipal Affairs and Housing | ||

| Homelessness Programs – New Deal* | -200 | |

| Homelessness Programs | -40 | |

| Local Government | -3 | |

| National Housing Strategy Programs | -2 | |

| Ministry of Natural Resources and Forestry | ||

| Infrastructure for Natural Resource Management | -210 | |

| Ministry of Northern Development | ||

| Northern Development (Capital Asset) | -58 | |

| Ministry of the Solicitor General | ||

| Institutional Services* | -55 | |

| Community Correctional Services* | -9 | |

| Various Programs* | -1 | |

| Ministry of Tourism, Culture and Sport | ||

| Ontario Production Services Tax Credit | -14 | |

| Ontario Computer Animation and Special Effects Tax Credit | -10 | |

| Ministry of Transportation | ||

| Municipal Transit (Operating) | -300 | |

| Third Party Works for Highways (Capital) | -198 | |

| Metrolinx Operating Subsidies | -170 | |

| Third Party Works for Highways (Operating) | -7 | |

| Dedicated Funding for Public Transportation | -3 | |

| Ontario Seniors Public Transit Tax Credit | -1 | |

| Treasury Board Secretariat | ||

| Supply Ontario | -74 | |

| Other Programs Across All Ministries* | -22 | |

| Total Fourth Quarter Transfer to Ministries | -5,107 | |

| Add: Fourth Quarter Transfers to the Contingency Fund from Ministries | ||

| Cabinet Office | ||

| Main Office | 1 | |

| Ministry of Agriculture, Food and Rural Affairs | ||

| Better Public Health and Environment (Operating Asset) | 2 | |

| Ministry of Economic Development, Job Creation and Trade | ||

| Strategic Investments | 266 | |

| Industrial Land Development | 115 | |

| Economic Development, Job Creation and Trade | 60 | |

| Economic Development, Job Creation and Trade (Operating Asset) | 50 | |

| Invest Ontario Fund | 29 | |

| Jobs and Prosperity Fund and Other Business Support Programs | 29 | |

| Critical Technologies Initiative | 18 | |

| Life Sciences Strategy | 9 | |

| Commercialization and Innovation Network Support | 1 | |

| Ministry of Energy | ||

| Ontario Electricity Rebate | 150 | |

| Northern Ontario Energy Credit | <1 | |

| Ministry of the Environment, Conservation and Parks | ||

| Environmental Compliance and Enforcement – Wastewater Monitoring and Public Reporting | 3 | |

| Conservation and Water Protection | <1 | |

| Environmental Compliance and Enforcement – Other | <1 | |

| Ministry of Finance | ||

| Temporary and Other Local Assistance | 13 | |

| Provincial-Local Finance | 5 | |

| Ontario Infrastructure Investment | 4 | |

| Guaranteed Annual Income System | 2 | |

| Taxation Policy | 2 | |

| Government Business Enterprise | 2 | |

| Tax and Benefits Administration – Other | 1 | |

| Income Security and Pension Policy | 1 | |

| Economic Policy | <1 | |

| Tax Compliance Partnership Agreements | <1 | |

| Ministry of Infrastructure | ||

| East Harbour Transit-Oriented Communities | 320 | |

| Green Infrastructure (Federal Contributions) | 49 | |

| Green Infrastructure (Provincial Contributions) | 40 | |

| Rural and Northern Infrastructure – Federal Contribution | 21 | |

| Broadband and Cellular Infrastructure (Operating) | 17 | |

| Rural and Northern Infrastructure – Provincial Contribution | 9 | |

| Strategic Priorities and Infrastructure Fund | 4 | |

| Community, Culture and Recreation (Provincial Contributions) | 2 | |

| Ministry of Labour, Immigration, Training and Skills Development | ||

| Skills Development Fund (Capital) | 224 | |

| Settlement and Integration Transfer Payment | 4 | |

| OHS Prevention (Capital Asset) | 1 | |

| Occupational Health and Safety (Capital Asset) | <1 | |

| Employment Ontario Program (Capital Asset) | <1 | |

| Ministry of Long-Term Care | ||

| Long-Term Care Homes – Operations | 194 | |

| Ministry of Natural Resources and Forestry | ||

| Public Safety and Emergency Response (Capital Asset) | 24 | |

| Public Protection | 10 | |

| Infrastructure for Natural Resources Management (Capital Asset) | 6 | |

| Natural Resource Management (Operating Asset) | 1 | |

| Infrastructure for Public Safety and Emergency Response | <1 | |

| Ministry of Public and Business Service Delivery | ||

| Various Programs | 27 | |

| Ministry of Seniors and Accessibility | ||

| Ontario Seniors Care at Home Tax Credit | 12 | |

| Ministry of the Solicitor General | ||

| Various Programs | 130 | |

| Ministry of Tourism, Culture and Sport | ||

| Tourism and Culture Capital – Repairs and Rehabilitation Capital | 5 | |

| Tourism and Culture Capital – Other | 3 | |

| Tourism and Culture Capital – Agencies and Attractions Capital Sector Support | 2 | |

| Office of the Lieutenant Governor | ||

| Office of the Lieutenant Governor | <1 | |

| Treasury Board Secretariat | ||

| Treasury Board Support (Capital Asset) | 6 | |

| Labour Relations and Compensation (Capital Asset) | 1 | |

| Total Fourth Quarter Transfers to the Contingency Fund | 1,876 | |

| Contingency Fund Balance at Year-End | 1,855 |

Footnotes

[1] Temporary spending authority is first granted by the Legislature through the Interim Appropriation Act, with final spending authority then granted through the Supply Act. Permanent spending authority is also granted through other legislation for a limited number of programs.

[2] The $197.3 billion spending plan excludes $7.4 billion in additional planned spending by the broader public sector organizations controlled by the Province (hospitals, school boards, colleges and Children’s Aid Societies), the Province’s agencies and the legislative offices. The $7.4 billion in additional planned spending is not reviewed in this report as the Province does not actively monitor or control this spending. As well, the $197.3 billion spending plan excludes $1.4 billion in planned spending on operating assets and $4.7 billion in planned spending on capital assets.

[3] The FAO’s spending forecast is primarily based on provincial spending information as of April 22, 2024. The Province’s spending forecast is primarily based on information available as of February 28, 2024 (2024 Ontario Budget, p. 145).

[4] Temporary spending authority is first granted by the Legislature through the Interim Appropriation Act, with final spending authority then granted through the Supply Act. Permanent spending authority is also granted through other legislation for a limited number of programs.

[5] The $197.3 billion spending plan excludes $7.4 billion in additional planned spending by the broader public sector organizations controlled by the Province (hospitals, school boards, colleges and Children’s Aid Societies), the Province’s agencies and the legislative offices. The $7.4 billion in additional planned spending is not reviewed in this report as the Province does not actively monitor or control this spending. As well, the $197.3 billion spending plan excludes $1.4 billion in planned spending on operating assets and $4.7 billion in planned spending on capital assets.

[6] The Province had not recorded spending for the procurement of PPE and other supplies through the Population and Public Health Program as of April 22, 2024. However, the FAO expects that the Province will record additional spending in this vote as part of the process to finalize the 2023-24 Public Accounts of Ontario.

[7] The Province had not recorded spending for the procurement of PPE and other supplies through Enterprise Business and Financial Services as of April 22, 2024. However, the FAO expects that the Province will record additional spending in this vote as part of the process to finalize the 2023-24 Public Accounts of Ontario.

[8] The Province had not recorded spending in Ontario Electricity Financial Corporation Dedicated Electricity Earnings as of April 22, 2024. However, the FAO expects that the Province will record additional spending in this vote-item as part of the process to finalize the 2023-24 Public Accounts of Ontario.

[9] The Province presents interest on debt spending net of interest revenue earned from provincial financial assets.

[10] The FAO expects that the Province will record additional spending in this vote as part of the process to finalize the 2023-24 Public Accounts of Ontario.

[11] For more analysis see FAO, “Ministry of Education: Spending Plan Review,” 2022.

[12] For more analysis see FAO, “Ministry of Children, Community and Social Services: Spending Plan Review,” 2024.

[13] The FAO expects that the Province will record additional spending in this vote as part of the process to finalize the 2023-24 Public Accounts of Ontario.

[14] The FAO expects that the Province will record additional spending in this vote-item as part of the process to finalize the 2023-24 Public Accounts of Ontario.

[15] The Province presents interest on debt spending net of interest revenue earned from provincial financial assets.

[16] The FAO’s spending forecast is primarily based on provincial spending information as of April 22, 2024. The Province’s spending forecast is primarily based on information available as of February 28, 2024 (2024 Ontario Budget, p. 145).