Table of Abbreviations

|

Abbreviation |

Long Form |

|---|---|

|

Bill 4 |

Bill 4, the Cap and Trade Cancellation Act, 2018 |

|

Climate Change Act |

Climate Change Mitigation and Low-carbon Economy Act, 2016 |

|

CTWDA |

Cap and Trade Wind Down Account |

|

FAO |

Financial Accountability Office |

|

Federal backstop |

Federal carbon pricing backstop |

|

GGRA |

Greenhouse Gas Reduction Account |

|

GHG |

Greenhouse Gas |

|

MPPs |

Members of Provincial Parliament |

|

NAFTA |

North American Free Trade Agreement |

1. Essential Points

Ontario’s cap and trade program began on January 1, 2017 and was a central part of the Government of Ontario’s (the Province’s) plan to achieve its greenhouse gas (GHG) emission reduction targets.

The cap and trade program raised revenue for the Province through the auction of emissions allowances, which gave participants the right to emit GHGs. The Province used the auction revenue to fund initiatives that were reasonably likely to reduce GHG emissions.

In July 2018, the Province ended the cap and trade program by revoking the cap and trade regulation, ending the auction of emission allowances and prohibiting all trading in allowances.[1] The Province also introduced Bill 4, the Cap and Trade Cancellation Act, 2018 (Bill 4). If passed, Bill 4 would repeal the Climate Change Mitigation and Low-carbon Economy Act, 2016 (Climate Change Act) officially ending the cap and trade program, retire and cancel all existing cap and trade allowances and credits, provide compensation for some participants in the cap and trade program, and immunize the Province from civil liability. Finally, the Province noted that it would immediately begin to wind down all spending programs funded by the revenue generated from the auction of emissions allowances.[2]

Budgetary Impact to Ontario

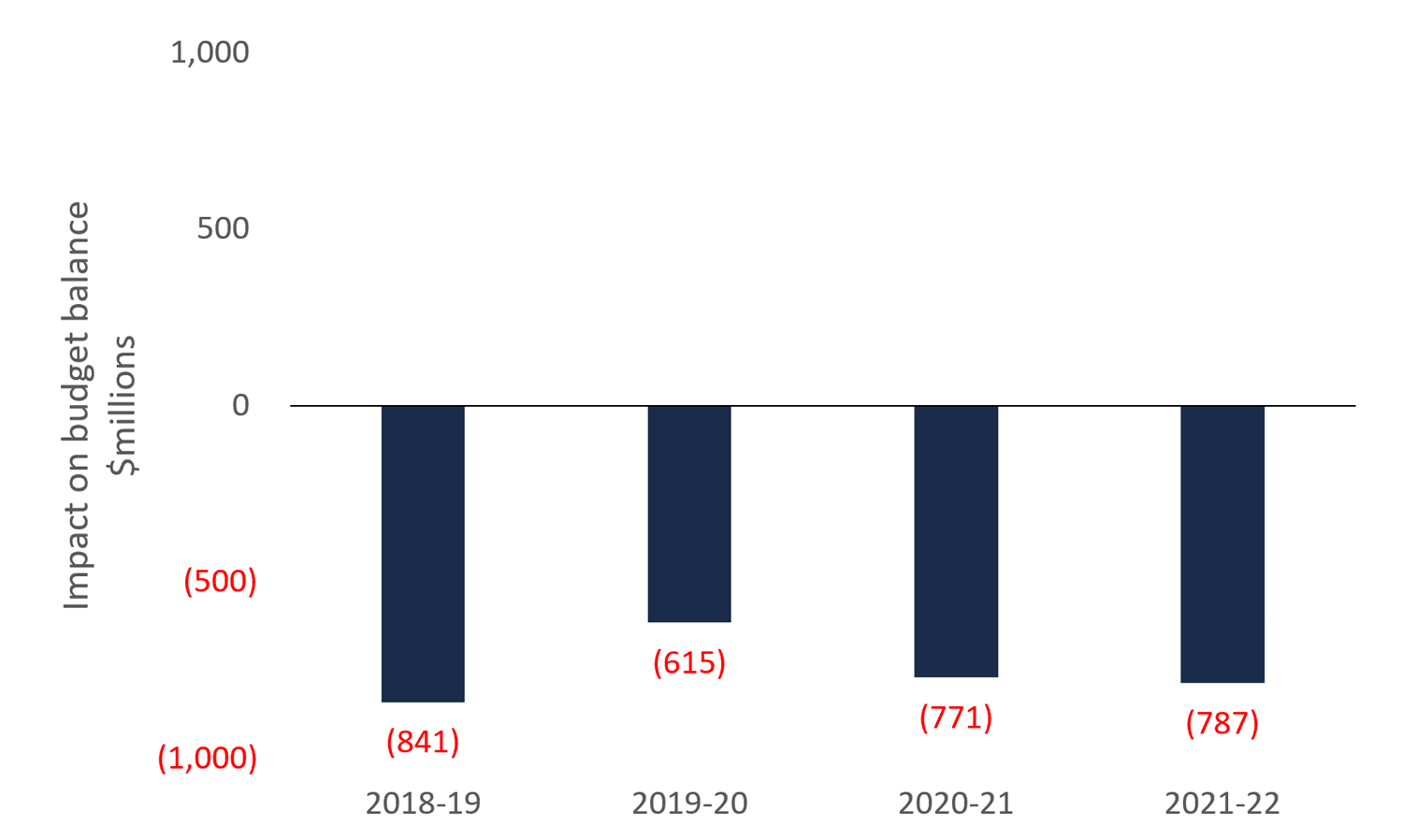

- The FAO estimates that the Province’s annual budget balance will worsen by a total of $3.0 billion over fiscal years 2018-19 through 2021-22 due to the cancellation of the cap and trade program. For the fiscal year 2018-19, the Province’s budget balance is expected to deteriorate by $841 million, followed by a drop of $615 million in 2019-20, $771 million in 2020-21 and $787 million in 2021-22.

Estimated impact on the Province’s budget balance from ending the cap and trade program, 2018-19 to 2021-22

Sources: FAO calculations from public information and information provided by the Ministries of the Environment, Conservation and Parks and Finance, and Treasury Board Secretariat.

Notes: FAO projections are subject to change based on final program spending and any subsequent decisions made by the Province. The FAO estimates that net debt will increase by $2.3 billion over the same period.

- Overall, the Province’s budget balance worsens because the loss of cap and trade revenue from ending the auction of emission allowances is greater than the savings achieved from cancelling cap and trade related spending programs. The difference occurs for two reasons. First, a number of the cancelled spending programs funded infrastructure projects that will not provide immediate savings to the Province’s budget balance.[3] Second, not all of the spending programs have been cancelled by the Province. The remaining programs account for about $500 million (or 25%) of planned cap and trade related program spending in 2018-19.[4]

- In addition, the negative budget impact of $841 million in 2018-19 includes one-time costs to wind down some cap and trade related spending programs and for expected compensation costs as set out in the proposed Bill 4.[5]

Comparing Cap and Trade versus Federal Carbon Pricing

- Under the federal Pan-Canadian Framework on Clean Growth and Climate Change, all provinces and territories are required to have carbon pricing in place by 2018.

- Jurisdictions that do not have a carbon pricing system in place will become subject to the federal carbon pricing backstop (the federal backstop). By ending the cap and trade program, and barring a successful legal challenge,[6] Ontario will become subject to the federal carbon pricing backstop beginning in 2019.

Impact on Households

- Carbon pricing (through a cap and trade program or the federal backstop) mainly impacts households by increasing heating and transportation fuel costs.[7]

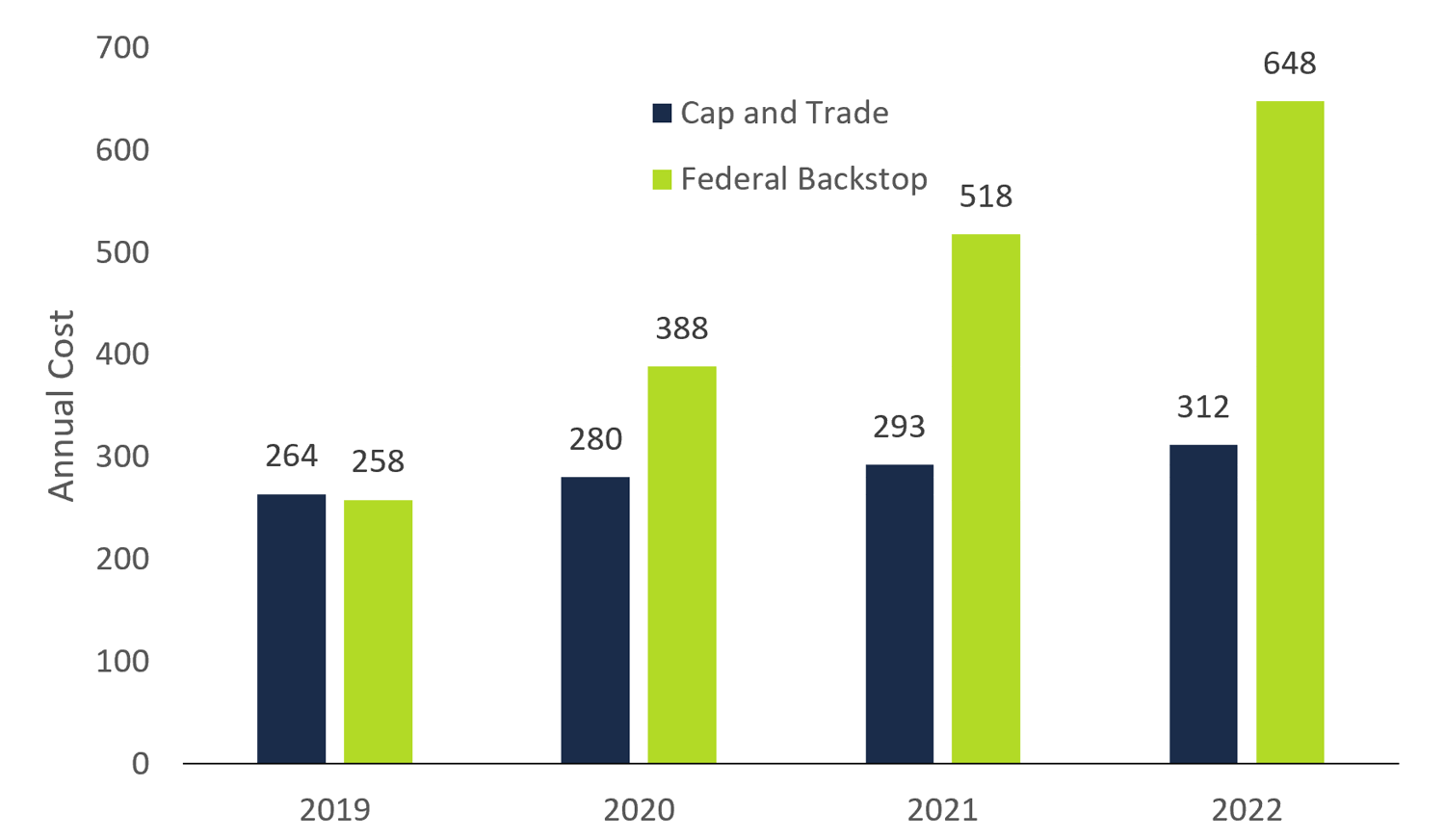

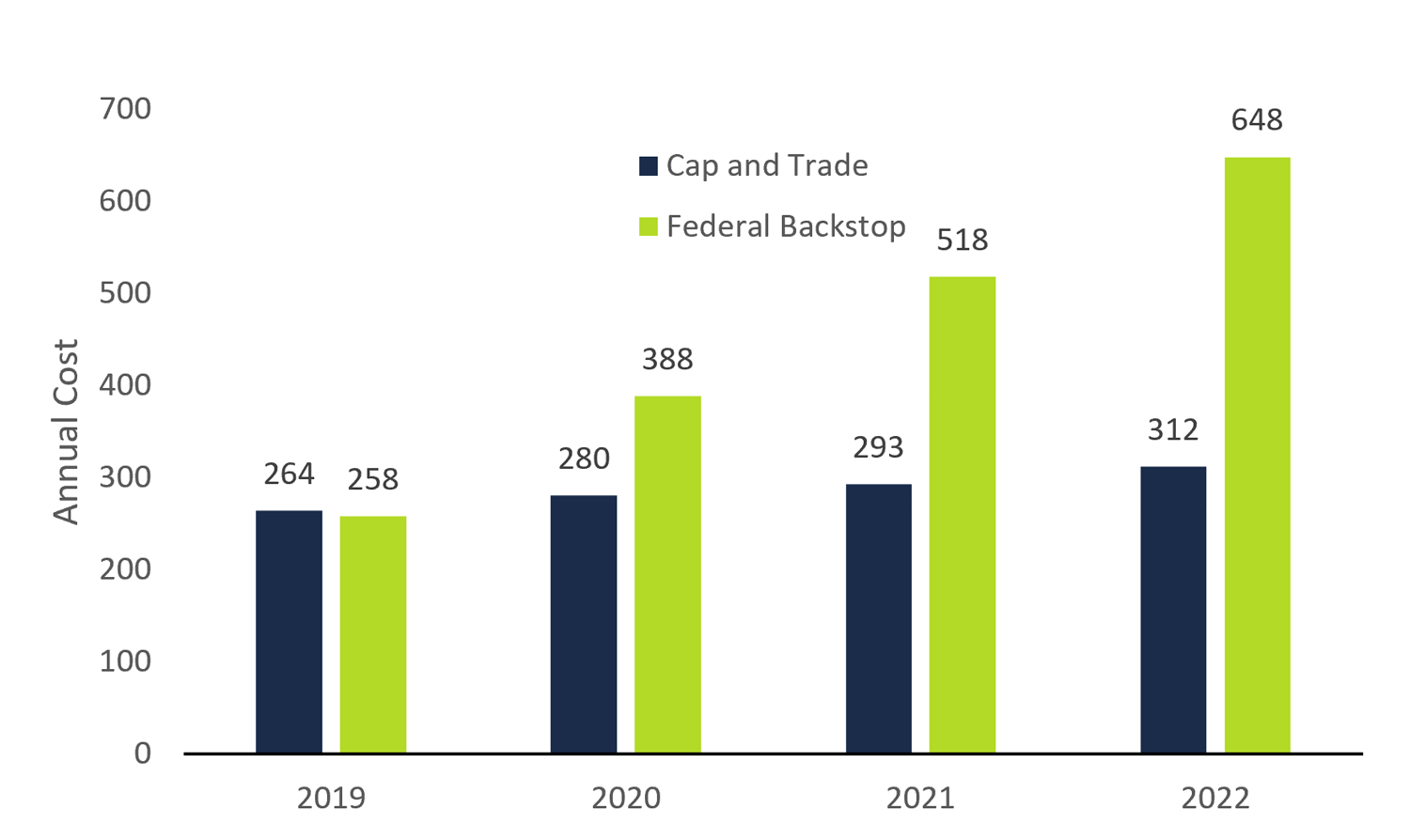

- The FAO estimates that a typical Ontario household would pay additional costs of $264 in 2019 under the cancelled cap and trade program, rising to $312 by 2022. Under the federal backstop, a typical Ontario household would pay additional costs of $258 in 2019, rising to $648 in 2022.

Comparison of typical household costs, cap and trade vs. federal carbon pricing backstop, 2019 to 2022 ($)

Notes: Direct costs are based on annual electricity consumption of 9 MWh, natural gas consumption of 2,200 M3 and gasoline consumption of 2,000 L. Indirect costs estimated using Statistics Canada Social Policy Simulation Database and Model v. 26.0.

- Both the cap and trade program and the federal backstop are intended to be revenue neutral, meaning all revenue raised by the Province or the federal government is recycled through investments. Therefore, the net impact on households depends on how the revenue raised from carbon pricing is used.

- Under the cancelled cap and trade program, approximately 1/3 of revenue raised by the Province was remitted to Ontario households through programs (mainly the Green Ontario Fund and the Electric and Hydrogen Vehicle Incentive Program). Consequently, the net impact to Ontario households under the cancelled cap and trade program would depend on each household’s ability to take advantage of programs funded by cap and trade revenue.

- Under the federal backstop, the net impact to households will depend on how the revenue is recycled by the federal government. If the federal government were to recycle federal backstop revenue through an equivalent carbon dividend to Ontario households it would offset the cost of carbon pricing to over 80% of Ontario households.[8]

Considerations for Businesses

- Carbon pricing impacts businesses primarily through direct increases in fuel prices. The impact on any individual business will depend on how emissions intensive the business is, and the ability of the business to pass the cost of carbon pricing through to customers.

- Businesses in Canada have expressed preferences for both cap and trade and a carbon levy pricing system such as the federal backstop, and there does not appear to be a consensus as to which method of carbon pricing is preferred.[9]

- Both the cancelled cap and trade program and the federal backstop offer transitional support to businesses in emission intensive and trade exposed industries. The cancelled cap and trade program offered free emission allowances to eligible participants that would have declined over time with the emissions cap. The federal backstop will allow large industrial emitters to only pay the carbon levy on emissions above a set limit (the output-based standards). The output-based standards are still under development. However, the federal government has indicated that the stringency of the standards will increase over time.

2. Introduction

The Government of Ontario (the Province) has targets for reducing greenhouse gas (GHG) emissions below 1990 levels by 2020 (15% below), 2030 (37% below) and 2050 (80% below).[10] The previous government’s cap and trade program, which began on January 1, 2017, was a central part of the Province’s plan to achieve its GHG emission reduction targets.

The cap and trade program set a cap on GHG emissions. The cap was made up of tradable allowances. Each allowance permitted one tonne of emissions and the cap was scheduled to decline each year to meet the Province’s emissions targets. The allowances were either distributed free of charge or sold at auction by the Province. At the end of each compliance period, emitters were required to hold allowances equal to their emissions over that period.

The emission allowances sold at auction raised revenue for the Province. The Province used the auction revenue to fund initiatives that were reasonably likely to reduce GHG emissions. In the 2018 Ontario Budget, the Province projected $2.0 billion in auction revenue in 2018-19 and an equal amount of spending on cap and trade related initiatives.[11]

On July 3, 2018, the Province revoked the cap and trade regulation and prohibited all trading in allowances, effectively ending the cap and trade program.[12] As part of the cap and trade wind down process, the Province also announced that it would end the related spending programs that were funded by the proceeds raised from the auction of allowances.[13]

On July 25, 2018, the Province introduced Bill 4, the Cap and Trade Cancellation Act, 2018 (Bill 4). If passed, Bill 4 would officially end the cap and trade program by:

- Repealing the Climate Change Mitigation and Low-carbon Economy Act, 2016, which is the enabling legislation that created the cap and trade program and established GHG emission reduction targets;

- Retiring and cancelling all the existing cap and trade allowances and credits; and

- Outlining a compensation framework for certain “participants” in the cap and trade program and immunizing the Province from civil liability.

In 2016, the Government of Canada (the federal government) introduced its plan to ensure that carbon pricing applies to GHG emissions across Canada by 2018. The plan provided provinces and territories with flexibility to implement their own carbon pricing systems or choose a backstop designed by the federal government. By cancelling the cap and trade program, Ontario no longer has a carbon pricing system, which means the Province will be subject to the federal government’s backstop carbon pricing plan, barring a successful court challenge.[14],[15]

The purpose of this report is to estimate the budgetary impact to the Province from ending the cap and trade program. The report also compares the financial impact on households and businesses of Ontario’s now cancelled cap and trade program against the federal government’s proposed carbon pricing plan, which, barring a successful court challenge, is expected to apply in Ontario starting January 1, 2019.

This report does not seek to:

- Assess the economic costs or benefits associated with carbon pricing programs, including the economic impact of government spending in connection with carbon pricing;

- Assess the potential environmental or public health benefits associated with the reduction in GHG emissions or other co-pollutants in connection with carbon pricing; or

- Comment on the ability of the Province to meet its current or future GHG emission targets.

Appendix B provides more information on the development of this report.

3. Budgetary Impact to Ontario

Budget Balance

The FAO estimates that the Province’s budget balance will worsen by a total of $3.0 billion over fiscal years 2018-19 through 2021-22 due to the cancellation of the cap and trade program. For fiscal year 2018-19, the Province’s budget balance is expected to deteriorate by $841 million, followed by a drop of $615 million in 2019-20, $771 million in 2020-21 and $787 million in 2021-22.

Overall, the Province’s budgetary position worsens because the loss of revenue from ending the auction of emission allowances is greater than the savings achieved from cancelling cap and trade related spending programs.

Table 3-1 summarizes the FAO’s estimate of the fiscal impact of cancelling the cap and trade program on the Province’s annual budget balance over the four-year period from 2018-19 to 2021-22.

Table 3‑1: Estimated impact on the Province’s budget balance from ending the cap and trade program, 2018-19 to 2021-22

|

$ millions |

2018-19 |

2019-20 |

2020-21 |

2021-22 |

Total |

|---|---|---|---|---|---|

|

Revenue |

|||||

|

Loss of Auction Revenue |

-1,507 |

-1,923 |

-1,889 |

-1,912 |

-7,230 |

|

Impact on Federal Transfers |

r |

r |

r |

r |

r |

|

Total Revenue Change |

-1,507 |

-1,923 |

-1,889 |

-1,912 |

-7,230 |

|

Expense |

|||||

|

Savings from Cancelled Programs |

-1,271 |

-1,308 |

-1,118 |

-1,125 |

-4,822 |

|

Program Wind Down Costs |

600 |

0 |

0 |

0 |

600 |

|

Compensation for Allowance |

5 |

0 |

0 |

0 |

5 |

|

Other Potential Legal Liabilities |

r |

r |

r |

r |

r |

|

Total Expense Change |

-666 |

-1,308 |

-1,118 |

-1,125 |

-4,217 |

|

Impact to Budget Balance |

-841 |

-615 |

-771 |

-787 |

-3,013 |

r = risk that the Province will lose federal transfer revenue or that legal liabilities could materialize.

Sources: FAO calculations from public information and information provided by the Ministries of the Environment, Conservation and Parks and Finance, and Treasury Board Secretariat.

Notes: FAO projections are subject to change based on final program spending and any subsequent decisions made by the Province. The FAO estimates that net debt will increase by $2.3 billion over the same period.

Loss of Auction Revenue

The cap and trade program generated revenue for the Province though the auction of allowances, which gave allowance holders the right to emit GHGs. Prior to ending the cap and trade program, the Province generated about $2.9 billion in revenue from six cap and trade auctions over two fiscal years. Table 3‑2 shows the revenue generated by the Province before the program was cancelled on July 3, 2018.

Table 3‑2: Total auction revenue generated from cap and trade

|

$ millions |

2017-18 |

2018-19 |

Total |

|---|---|---|---|

|

Cap and Trade Auction Revenue |

2,401 |

472 |

2,873 |

Source: Government of Ontario. Post-Joint Auction Public Proceeds Report. May 2018 Joint Auction #15. https://files.ontario.ca/post-auction_public_proceeds_report_en_2018-05-15.pdf.

The last cap and trade auction was held in May 2018 and generated $472 million in revenue for the Province. The Province announced the end of the cap and trade program in July 2018, thereby eliminating all future auction revenue from the Province’s budget. For 2018-19, the loss of auction revenue is partly offset by the May 2018 auction, resulting in a net revenue reduction to the Province of $1.5 billion. From 2019-20 to 2021-22, the FAO estimates that the loss of auction revenue from the cancelled cap and trade program will be approximately $1.9 billion each year. In total, for the four-year period from 2018-19 to 2021-22, the FAO estimates that ending the cap and trade program will result in a reduction in revenue to the Province of $7.2 billion.

Impact on Federal Transfers

As part of the federal government’s Pan-Canadian Framework on Clean Growth and Climate Change, the federal government announced a five-year, $2 billion Low Carbon Economy Fund.[16] Of the $2 billion fund, the federal government has committed to provide “$1.4 billion to provinces and territories that have adopted the Pan-Canadian Framework on Clean Growth and Climate Change to help [provinces and territories] deliver on leadership commitments to reduce greenhouse gas emissions…”[17]

It was expected that Ontario would receive approximately $420 million of the $1.4 billion earmarked for the provinces and territories. However, if Bill 4 is passed, the Climate Change Act will be repealed, which will officially end the cap and trade program and eliminate the Province’s GHG emission reduction targets. Bill 4 would also set out requirements for the Province to develop new emissions reduction targets and to prepare a new climate change plan.

Until the Province’s new climate change plan is announced, along with new emissions reductions targets, there is a significant risk that the $420 million in federal funding earmarked for Ontario may not be provided to the Province.[18]

Savings from Cancelled Programs

Under the previous government, the 2018 Ontario Budget outlined a plan to spend $2.0 billion in 2018-19 on approximately 57 programs[19] that were “reasonably likely to reduce or support the reduction of greenhouse gas emissions”.[20] The $2.0 billion cost of the 57 programs was to be matched to the revenue generated from the auctions of emissions allowances, which, prior to the cancellation of the cap and trade program, was also expected to generate approximately $2.0 billion in revenue in 2018-19.

When the Province announced on July 3, 2018, that it would end the cap and trade program, the Province also stated that it would immediately begin the wind down of all programs funded by the revenue generated from the auction of emissions allowances.[21] Based on information provided to the FAO, the Province has made the decision to end most of the programs, with funding continuing for a few remaining programs.[22]

Overall, the FAO estimates that the cancelled programs will result in savings of approximately $1.3 billion in 2018-19 and 2019-20, and $1.1 billion in each of 2020-21 and 2021-22.

Importantly, in each year, the expected budgetary program savings is not enough to match the loss of revenue from the auction of allowances. There are two main reasons for the difference. The first reason is that a number of the cancelled programs funded various infrastructure projects.[23] Although cancelling these programs results in cash savings averaging $190 million a year, the savings to the budget balance will only materialize over the planned life of the asset.[24] The second reason is that the cap and trade spending programs that were not cancelled by the Province accounted for approximately $500 million (or 25%) of planned cap and trade related spending in 2018-19.

Program Wind Down Costs

Although the Province has cancelled most cap and trade related spending programs, many of those programs will still incur spending in 2018-19.[25] Overall, the FAO estimates that the cancelled programs will incur $600 million in spending in 2018-19. This amount reflects program activity undertaken starting April 1, 2018 until the decision to end the programs was made. The spending also reflects decisions on how to wind down the various programs. For example, although the Green Ontario Fund and Electric and Hydrogen Vehicle Incentive Program were both cancelled by the Province, some aspects of the programs will continue to be honoured through November 30, 2018 for the Green Ontario Fund and through September 10, 2018 for the Electric and Hydrogen Vehicle Incentive Program.[26]

Compensation for Allowance Credits

Bill 4 includes a proposed compensation framework for some of the holders of emissions allowances. Under Bill 4, compensation would be provided to holders of emissions allowances that meet the following criteria:

- The holder is a cap and trade program participant facing a compliance obligation;

- The holder must have incurred costs that they were not able to recover from customers[27]; and

- The total number of permits the emitter is holding exceeds its total GHG emissions obligations.

The compensation framework the Province has proposed excludes more than 99 per cent of allowance holders, including: allowance holders that are not located in Ontario; emitters holding allowances that match their emissions during the period that the cap and trade program was active or where costs were passed to consumers; and holdings by market traders (i.e., holders that do not have emissions obligations).

Overall, the FAO expects that the proposed compensation framework would result in a cost to the Province of approximately $5 million.

Other Potential Legal Liabilities

There is a risk that legal liabilities could arise as a result of ending the cap and trade program. The FAO did not attempt to quantify the potential liability or measure the likelihood that any legal liability could materialize. However, the FAO offers the following considerations for Members of Provincial Parliament (MPPs).

Broadly speaking there are two components to the decision to end the cap and trade program:

- Ending the cap and trade program itself, including the auction of emission allowances and the requirement that emitters hold allowances that correspond to their emissions; and

- Ending most of the spending programs funded by the revenue generated from the auction of emissions allowances.

Considerations on Ending the Cap and Trade Program

With the end of the cap and trade program, potential provincial liability could arise in connection with the holders of the cancelled emission allowances. Potential provincial liability could also arise from persons or businesses that undertook activities based on the requirements of the Climate Change Mitigation and Low-Carbon Economy Act, 2016 (the Climate Change Act) and the regulations made under the Climate Change Act (e.g. investments made to reduce emissions).

To address this potential liability, the proposed Bill 4 includes a compensation framework for some holders of emissions allowances (section 8) and also a blanket waiver of provincial liability (sections 9 and 10) that would protect the Province from any liability against holders of emissions allowances not covered by the compensation framework and also from any other potential liability in connection with revoking the Climate Change Act and its regulations and introducing Bill 4.

Finally, although the proposed Bill 4 would appear to protect the Province from liability in Ontario, there is also the possibility that a claim could be brought in a jurisdiction outside of Ontario (e.g. the US) or through Chapter Eleven of the North American Free Trade Agreement (NAFTA).[28]

Considerations on Ending Cap and Trade Funded Spending Programs

With the end of most cap and trade related spending programs, there are two main ways that potential liability could arise. First, if the Province entered into a contract in connection with a cancelled program, the Province will still need to meet its obligations under the contract.[29] Second, as part of the wind down of the spending programs, the Province will be exercising its discretionary administrative authority. The recent court decision regarding Tesla Motors and the Electric and Hydrogen Vehicle Incentive Program noted that the Province cannot exercise its administrative discretion in an arbitrary way.[30]

Greenhouse Gas Reduction Account Spending Commitments

The Greenhouse Gas Reduction Account (GGRA) was created under subsection 71(1) of the Climate Change Act. The GGRA is a designated purpose account which tracks the revenue raised from the sale of emissions allowances against the Province’s commitment to spend the revenue on programs that were “reasonably likely to reduce or support the reduction of greenhouse gas emissions”.[31]

The amounts allocated to the GGRA are spending commitments only and are not supported by set-aside cash or other assets in the financial accounts of the Province.

At the end of 2017-18, the GGRA had a remaining spending commitment (i.e. the difference between total cap and trade revenue and total cap and trade program spending) of $553 million.[32] Combined with the revenue generated from the last cap and trade auction in May 2018 of $472 million, the GGRA would have a total spending commitment, before taking into account 2018-19 program spending, of just over $1.0 billion.

Under the proposed Bill 4, the GGRA would be renamed the Cap and Trade Wind Down Account (CTWDA) and would maintain the $1.0 billion spending commitment from the GGRA as of the last auction in May 2018.

Overall, if Bill 4 is passed, the FAO expects that the $1.0 billion spending commitment in the CTWDA will be met by the end of 2018-19, based on expected program wind down costs of $600 million and the $500 million in 2018-19 cap and trade related program spending that has not been cancelled by the Province.[33]

4. Comparing Cap and Trade versus Federal Carbon Pricing

Transitioning to the Pan-Canadian Framework

Under the federal Pan-Canadian Framework on Clean Growth and Climate Change, all provinces and territories are required to have carbon pricing in place by 2018. Jurisdictions have the choice to implement either a carbon tax or a cap and trade program that meets the benchmarks set out by the federal government.

Jurisdictions that do not have a carbon pricing system in place will become subject to the federal carbon pricing backstop (the federal backstop). The federal backstop consists of a carbon levy that will be applied to fossil fuels as well as an output-based pricing system that will be applied to industrial facilities. By ending the cap and trade program, and barring a successful legal challenge,[34] Ontario will become subject to the federal carbon pricing backstop beginning in 2019.

There are important differences between the price of emissions and the use of revenue under the federal backstop compared with the cancelled cap and trade program. This chapter will outline key differences between the two carbon pricing programs and how the change from the cap and trade program to the federal backstop will impact Ontario households and businesses.

Price and Cost of Carbon Emissions

Price of Carbon

Ontario’s cap and trade program did not place an explicit price on carbon. The program required participants (fuel distributors and large greenhouse gas emitters) to obtain allowances equal to their emissions.[35] Allowances were sold at quarterly auctions and the settlement price at those auctions represented the effective price of carbon in Ontario. Most of the emissions allowances were purchased by fuel suppliers and natural gas distributors and the cost was reflected in the price of fuels.

|

Example: Cost of Complying with cap and trade The regulated natural gas sector in Ontario provides an example of how the cost of complying with cap and trade affects fuel prices. For example, Union Gas reported estimated costs of $274 million to comply with cap and trade in 2018. This includes the cost of purchasing an estimated 14.4 million allowances at an average cost of $18.99/tonne. That cost translated into an estimated increase in the price of natural gas of 3.56 ₵/m3 or 11.7%. |

Source: Union Gas, Ontario Energy Board application.

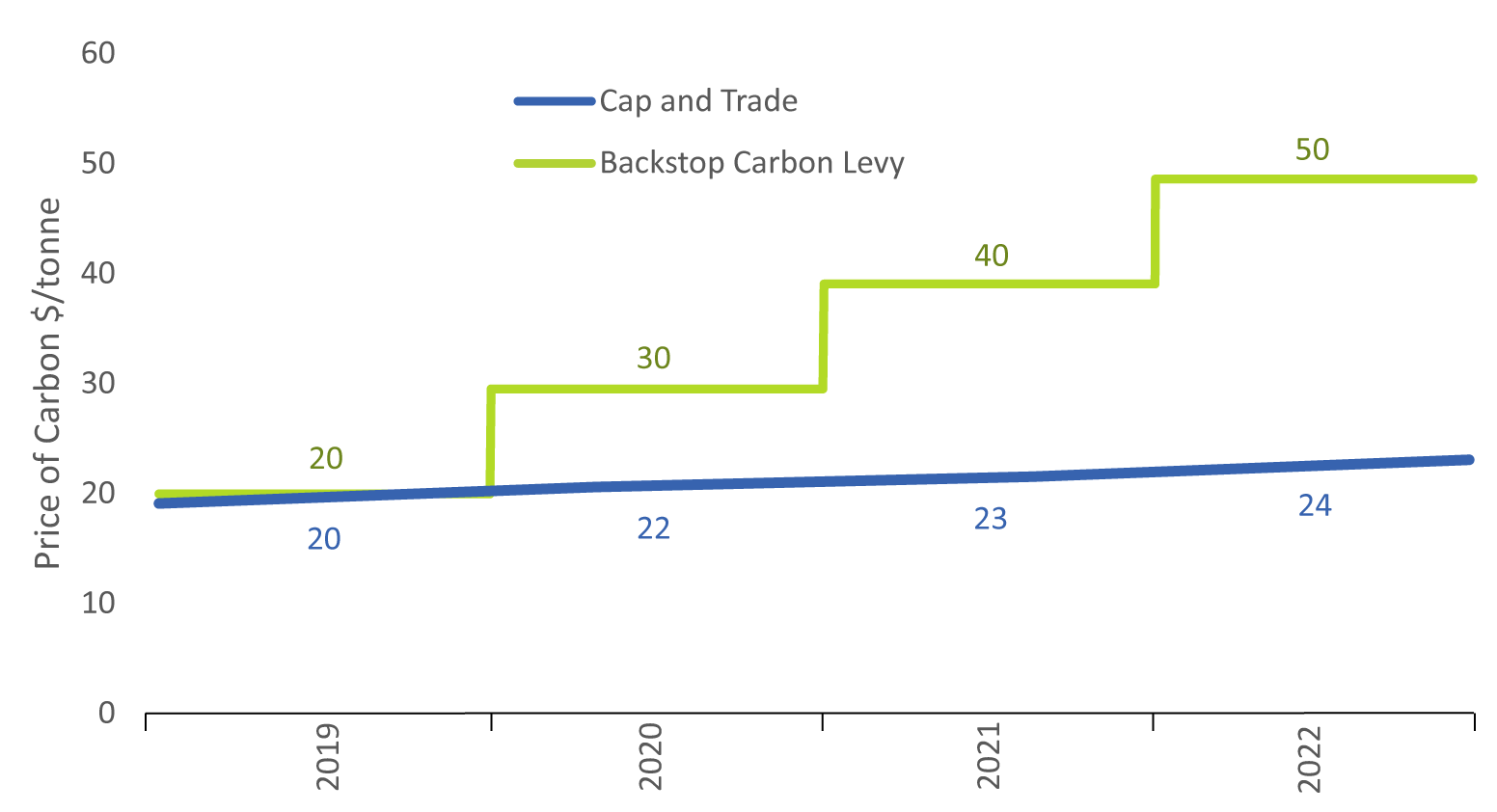

When Bill 4, the Cap and Trade Cancellation Act, 2018, was introduced in July 2018, the price of carbon in Ontario was approximately $18.7/tonne.[36] By 2022, the FAO estimates that the price of carbon would have risen to approximately $23.9/tonne.[37]

Unlike the cap and trade program, the federal backstop places an explicit price on carbon emissions. Natural gas distributors and fuel suppliers will no longer have the obligation to acquire emissions allowances. Instead, the carbon levy will be applied directly to the cost of fuels at the producer/distributor level and passed through to the end consumer. The price will align with the federal benchmark that will begin at $20/tonne in 2019 and will rise to $50/tonne in 2022.

Overall, the FAO estimates that beginning in 2020, the price of carbon in Ontario will be higher under the federal government’s carbon pricing plan than it would have been under the cap and trade program. By 2022, the FAO estimates that the federal carbon levy will be more than double the cost of cap and trade allowances.

Figure 4‑1: Comparison of cap and trade price and federal backstop carbon levy

Source: Pan-Canadian Carbon Pricing Framework, californiacarbon.info information and FAO calculations.

Beyond 2022, the price of carbon under the cap and trade program was expected to increase more rapidly as the emissions cap tightened. The price was projected to reach $50/tonne by 2026, rising to $70/tonne in 2028.[38] The federal government has committed to review the federal carbon pricing benchmark by 2022 to determine the path forward.[39] Therefore, beyond 2022, it is not yet clear how the price placed on carbon emissions by the federal backstop carbon levy compares to the price under the cancelled cap and trade program.

Cost of Carbon Pricing to Households and Businesses

The total cost of carbon pricing in Ontario depends both on the carbon price and the amount of emissions subject to carbon pricing. Ontario emits approximately 160 Mt of GHG’s annually, most of which are from the combustion of fossil fuels for transportation and heating.[40] The price that is placed on carbon increases the price of fuels which increases the costs to households and businesses. Table 4‑1 outlines the FAO’s estimate of how the price of carbon under both plans would affect the price of fuels.

Table 4‑1: Comparison of cap and trade and federal backstop effect on fuel prices

|

2019 |

2022 |

|||

|---|---|---|---|---|

|

Fuel |

Cap & Trade |

Backstop |

Cap & Trade |

Backstop |

|

Gasoline |

4.7 ₵/L |

4.4 ₵/L |

5.5 ₵/L |

11.1 ₵/L |

|

Diesel |

5.6 ₵/L |

5.4 ₵/L |

6.6 ₵/L |

13.4 ₵/L |

|

Natural Gas |

3.8 ₵/m3 |

3.9 ₵/m3 |

4.5 ₵/m3 |

9.8 ₵/m3 |

Source: Pan-Canadian Framework on Clean Growth and Climate Change and FAO calculations.

However, not all Ontario emissions are covered by either carbon pricing program. The cap and trade program covered approximately 82% of emissions and excluded emissions from agriculture, waste, aviation and marine transportation as well as some process emissions.[41] On top of the excluded sectors, the Province provided emissions allowances free of charge to certain participants. In 2017 and 2018, participants that were not natural gas distributors, electricity importers or petroleum suppliers received the vast majority of their allowances free of charge.[42]

The federal backstop is estimated to cover 84% of Ontario emissions. In Ontario, most emissions (61%) will be subject to the carbon levy while 23% will be covered by the output-based pricing system.[43] The federal backstop also excludes emissions from agriculture, waste and certain process emissions but includes domestic aviation and marine emissions. Like the cap and trade program, certain facilities will be able to emit free of charge under the output-based pricing system. Businesses covered by the output-based system will not pay the carbon levy on fuels, they will only pay the levy on emissions above a specified production standard.[44]

Overall, taking into account the covered sectors and the allocation of free emissions, the FAO estimates that through 2022, approximately 60-65% of Ontario emissions would be subject to carbon pricing under both programs.

Considering the price of carbon and the amount of emissions subject to carbon pricing the FAO estimates the cost of cap and trade to households and businesses would have been approximately $2.1 billion in 2019, rising to $2.4 billion in 2022.[45] This represents the cost to Ontario cap and trade participants to acquire enough allowances to cover their emissions. For comparison, the FAO estimates that the total federal backstop carbon levy cost to households and businesses in Ontario will be approximately $2.0 billion in 2019, rising to $5.0 billion in 2022.[46]

Table 4‑2: Cap and trade and federal backstop comparison summary

|

Cap and Trade |

Federal Backstop |

|

|---|---|---|

|

Structure |

Emissions allowances are sold at auction to participants |

Carbon levy is applied to fuels |

|

Price |

$20/tonne in 2019 |

$20/tonne in 2019 |

|

Coverage |

Prices 60-65% of Ontario emissions |

Prices 60-65% of Ontario emissions |

|

Total cost to households and businesses |

$2.1 billion in 2019 |

$2.0 billion in 2019 |

Use of Carbon Pricing Revenue

Ontario generated cap and trade revenue by selling Ontario emissions allowances into the joint cap and trade market that Ontario participated in with Quebec and California. The number of emissions allowances sold declined each year in line with the cap on Ontario emissions. Allowances could be purchased by participants in any jurisdiction, therefore, the cost to Ontario participants did not necessarily match the amount of revenue generated by the Province.[47] As outlined in chapter 3, the FAO estimates that cap and trade would have generated ongoing revenue for the Province of approximately $1.9 billion though 2021-22.[48]

The federal backstop generates revenue primarily by applying the carbon levy to fossil fuels in Ontario.[49] The FAO estimates that beginning in 2020, the federal backstop will generate significantly more revenue than the cancelled cap and trade program. In line with the increasing carbon levy, the FAO estimates the federal backstop will generate approximately $2.0 billion of revenue in 2019, rising to $5.0 billion in 2022.

Both the cap and trade program and the federal backstop are intended to be revenue neutral, meaning all carbon proceeds are recycled through investments. Jurisdictions have numerous options with respect to recycling carbon revenue including direct transfers to households, tax cuts, investments in green initiatives, investments in government priorities and providing support to industrial emitters.[50] How carbon proceeds are recycled is a significant factor in determining the impact of carbon pricing on households and businesses.

Under the Province’s cancelled cap and trade program, cap and trade proceeds were required to be spent on initiatives that were reasonably likely to reduce or support the reduction of greenhouse gas emissions.[51] The 2018 Ontario Budget projected $2.0 billion in cap and trade revenue in 2018-19, the majority of which was to be invested in green initiatives and public infrastructure.[52]

Under the federal backstop, the federal government has committed to return all direct revenues to the jurisdiction of origin. Provinces will be able to use the revenue based on their individual priorities.[53] For example, Alberta has implemented a carbon pricing system that is similar to the federal backstop. In addition to funding investments in green infrastructure, innovation and technology development, and reducing small business taxes, Alberta uses carbon tax revenue to provide rebates to over 60% of residents.[54]

However, in Ontario, it is not clear how the federal backstop revenue will be recycled. The Province has cancelled the cap and trade program and is challenging the federal government’s ability to impose carbon pricing through the federal backstop.[55] At this time, the federal government has not outlined how revenue from non-compliant provinces would be recycled, but the federal government has indicated that it might choose to bypass non-compliant provinces and remit revenues directly to residents.[56]

Impact on Households

In 2019, the FAO estimates that $1.5 billion of the $2.1 billion cost of cap and trade would have been passed through to households. This includes $1.1 billion of direct increases in heating and transportation fuel costs and $0.4 billion of indirect costs passed through to households from businesses. Overall, the FAO estimates that the cap and trade program would have cost a typical Ontario household $264 in 2019.[57] This cost includes $185 of direct costs and $79 of indirect costs.[58]

Table 4‑3: Cost of cap and trade to typical Ontario household in 2019

|

Category |

Annual Cost ($) |

|---|---|

|

Electricity |

6 |

|

Heating fuel |

85 |

|

Transportation fuel |

94 |

|

Total Direct Costs |

185 |

|

Indirect Costs |

79 |

|

Total Cost |

264 |

Direct costs are based on annual electricity consumption of 9 MWh, natural gas consumption of 2,200 M3 and gasoline consumption of 2,000 L. Indirect costs estimated using Statistics Canada Social Policy Simulation Database and Model v. 26.0.

For comparison, the FAO estimates that the cost of the federal backstop to a typical household will be $258 in 2019. By 2022, the FAO estimates that the costs incurred by a typical household will increase to $648 under the federal backstop carbon pricing plan, compared to $312 under the cancelled cap and trade program.

Figure 4‑2: Comparison of typical household costs, cap and trade vs. federal carbon pricing backstop, 2019 to 2022 ($)

Household cost estimates do not factor in changes in household energy consumption resulting from the carbon price.

Net Impact on Households

As noted above, both the cap and trade program and the federal backstop are intended to be revenue neutral, meaning that all carbon pricing revenue is recycled through investments. Therefore, the net impact of carbon pricing on households depends on how the revenue is used.

Under the cap and trade program, households were able to recover some of their costs by taking advantage of green programs that were funded by cap and trade revenue. The FAO estimates that of the $2.0 billion in expected cap and trade revenue in 2018-19, approximately $640 million was to be allocated to fund programs that would remit carbon revenue directly back to households. Most of this funding was through the Green Ontario Fund, which provided rebates to homeowners for investments to reduce home energy costs, and the Electric and Hydrogen Vehicle Incentive Program, which provided rebates for electric vehicle purchases.

Of the remaining $1.3 billion in cap and trade revenue expected in 2018-19, approximately $1 billion was to be allocated to government investments, the largest of which were school and hospital retrofits and transit infrastructure. The remaining $320 million was to be allocated to the commercial and industrial sectors which included research and development funding and electric vehicle incentives.

Table 4‑4: 2018 Ontario Budget planned allocation of cap and trade revenue in 2018-19 ($millions)

|

Sector |

Allocation |

|---|---|

|

Households |

640 |

|

Government |

1,020 |

|

Business |

320 |

|

Total |

1,980 |

Source: FAO analysis of 2018 Ontario Budget and information provided by the Province.

As noted above, the method of recycling federal backstop revenue has not been officially announced, so the FAO cannot provide definitive analysis on the net impact of the federal backstop on Ontario households. The FAO analyzed one method of remitting federal backstop revenue directly to residents through an equivalent carbon dividend to households. The FAO estimates that in 2019, this would result in a carbon dividend of $355 per household, which would completely off-set the cost of carbon pricing to over 80% of households.[59] However, this method of revenue recycling would not provide any funding for investments in green technology, infrastructure or direct support for businesses.[60]

Table 4‑5: Household impact summary

|

Cap and Trade |

Federal Backstop |

|

|---|---|---|

|

Carbon pricing cost to typical household |

$264 in 2019 $312 in 2022 |

$258 in 2019 $648 in 2022 |

|

Revenue recycling |

Approximately 1/3 of carbon revenue was remitted to Ontario households, mainly through the Green Ontario Fund and the Electric and Hydrogen Vehicle Incentive Program |

To be determined |

|

Net impact to households |

Depends on household’s ability to take advantage of programs funded by cap and trade revenue |

Depends on method of revenue recycling Equivalent carbon dividend would offset cost of carbon pricing to over 80% of Ontario households |

Considerations for Businesses

Carbon pricing impacts business primarily through direct increases in fuel prices. The commercial and industrial sectors in Ontario are responsible for over half of Ontario’s combustion emissions, therefore, the increase in fuel price represents a significant cost to business. For reference, in 2019 under the cap and trade program the FAO estimates that businesses would have incurred a total cost of $0.9 billion.[61] The impact on any individual business will depend on how emissions intensive the business is, and the ability of the business to pass the cost of carbon pricing through to customers.

Businesses in Canada have expressed preferences for both cap and trade and a carbon levy pricing system such as the federal backstop, and there does not appear to be a consensus as to which method of carbon pricing is preferred.[62]

Structurally, the cap and trade program and the federal backstop have advantages and disadvantages for business. Although cap and trade would have imposed a lower carbon price, the price was set based on auction settlement prices in the cap and trade market which are more uncertain than the fixed carbon levy under the federal backstop. Cap and trade can also be very complex to administer for participants of the program. The federal backstop imposes a higher carbon price which increases the risk of carbon leakage. Carbon leakage occurs when businesses move carbon intensive operations out of jurisdictions with carbon pricing. This is undesirable because it harms the Ontario economy while not reducing global emissions. However, the carbon levy under the federal backstop is simpler to administer and provides businesses with price certainty.[63]

One of the key features of both programs is the transitional support provided to businesses in emissions intensive and trade exposed industries. Those industries are vulnerable to carbon pricing because it puts them at a disadvantage relative to competitors in jurisdictions that do not impose carbon pricing.

Under the cap and trade program, participants that were not petroleum suppliers, natural gas distributors or electricity importers were eligible to receive free emissions allowances. Ontario provided those participants a total of 68.7 MT of free emissions allowances in 2017 and 2018. This is equivalent to a subsidy of approximately $1.28 billion. Beyond 2018, the number of free allowances issued would have gradually declined in line with the emissions cap.

The federal backstop output-based pricing system offers transitional supports to industrial facilities that emit over 50,000 tonnes of GHG’s.[64] Those facilities will only pay the carbon levy on emissions above the limit set by the output-based standard.[65] The emissions limit for a facility will be calculated based on that facility’s production and the standard for the product it is producing. The standard will begin at 90% of the national average emissions intensity for cement, iron and steel, lime and nitrogen fertilizers and 80% for remaining industrial sectors. Similar to cap and trade, this will allow large emitters to emit GHG’s up to a certain amount free of charge. The output-based standards are still under development, however, the federal government has indicated that the stringency of the standards will increase over time.

In addition to transitional support provided under both programs, businesses could also recover carbon costs from the recycling of carbon revenue. Under the cancelled cap and trade program, the FAO estimates that $320 million of 2018-19 cap and trade revenue was to be allocated to investments that directly benefited commercial and industrial sectors. In addition, businesses also benefitted from the investments in green industry provided to households and government infrastructure. Depending on how the federal backstop revenue is recycled, businesses could receive additional transitional support through tax cuts, subsidies or green investments. However, if the federal backstop revenue is recycled through an equivalent carbon dividend to Ontario households, then businesses would not receive any additional direct support.[66]

Table 4‑6: Considerations for businesses

|

Cap and Trade |

Federal Backstop |

|

|---|---|---|

|

Key Features |

Lower cost More difficult to administer Price uncertainty |

Higher cost Increased risk of carbon leakage Simple to administer |

|

Transitional Support |

Free allowances provided to certain large final emitters that were not fuel distributors |

Industrial emitters only pay carbon levy on emissions above the limit set by the output-based standard |

|

Use of Revenue |

$320 million of 2018-19 revenue allocated to programs that directly benefit commercial and industrial emitters |

To be determined |

5. Appendices

Appendix A: List of Cap and Trade Related Spending Programs

2018 Ontario Budget spending programs in 2018-19

Agriculture, Lands and Forests

50 Million Tree Program

Soil Health (Agricultural Soil GHG Mitigation)

Land Use Carbon Inventory

Organics Action Plan

Biogas-Based Fuelling "Agri-Food Renewable Natural Gas for Transportation Demonstration Program"

Food Security and Climate Change Impact Fund

Optimization of Municipal Wastewater Treatment Processes

Governments and Partnerships

Municipal Action Plan Program

Climate Change Partnerships

Climate Change Tools

Indigenous Partnerships

Municipal GHG Challenge Fund and Climate Change Plans

Microgrid Projects

Whitesands First Nation Bio-Economy Centre

Ontario Public Service Low-Carbon Demonstration Projects

Greenhouse Gas Projects/2030 Emissions Target Program

Ontario Public Service Carbon Challenge Program

Cap and Trade Implementation Costs

Homes and Businesses

Green Ontario Fund (Including Woodstoves Program)

Social Housing Apartment Improvement Program

Broader Public Service Retrofits – Universities and Colleges (Postsecondary GHG Campus Retrofits)

Broader Public Service Retrofits – Hospitals (Hospital Energy Efficiency Program)

Broader Public Service Retrofits – School Boards

Mass Timber Building Project

Building Code Climate Change Research

Low Carbon Building Skills

Renewable Content Requirement for Natural Gas

Heritage Retrofits Program

Research and Development

Low Carbon Innovation Fund

Global Market Acceleration Fund

Cleantech Accelerators Program

Low Carbon Mobility Centre

Raw Sewage Purification Program

Electric Vehicles

Electric and Hydrogen Vehicle Incentive Program

Electric Vehicle Chargers Ontario

Government Wide Initiatives – Electric Vehicle Charging Infrastructure

Electric Vehicle Discovery Centre

Vehicle Scrappage Incentive

Overnight Electric Vehicle Charging

Electric and Hydrogen Vehicle Advancement Program

Electric Vehicle Education and Awareness

Electric Vehicle Charging Infrastructure Program

Transit

Cycling - Commuter Program

Cycling - Education and Awareness

Electric School Bus Pilot

Electric Municipal Bus Program

Toronto Transit Commission Fare Integration Program

Green Commercial Vehicle Program

Biofuel Blender Support Program for Transportation Fuels

GO Rail Expansion

Shortline Rail Program

High Speed Rail

Hydrail Pilot Project

Transportation Demand Management Funding Program

Green Ferries

Hydrogen Fuel Cell Vehicle Infrastructure Initiative

First Mile Last Mile

Appendix B: Development of this Report

Authority

The Financial Accountability Officer accepted a request from a member of the Legislative Assembly to undertake the analysis presented in this report under paragraph 10(1)(b) of the Financial Accountability Officer Act, 2013.

Key Questions

The following key questions were used as a guide while undertaking research for this report:

- What is the estimated fiscal impact to the Province from ending the cap and trade program?

- How much revenue will the Province lose, including from the federal government?

- What programs will the Province cancel to offset the lost revenue?

- By what amount is the Province’s program spending expected to decrease?

- What are the potential legal liabilities to the Province from cancelling the cap and trade program?

- Are there any other potential financial risks to the Province from cancelling cap and trade, including with the Province’s carbon market partners?

- What is the estimated impact to Ontario’s households and businesses by moving from Ontario’s cap and trade program to the federal government’s proposed carbon tax?

- How much does cap and trade cost households and businesses, including gasoline prices and household heating bills?

- How much would a carbon tax cost households and businesses, including gasoline prices and household heating bills?

Methodology

This report has been prepared with the benefit of information provided by the Ministries of the Environment, Conservation and Parks and Finance, and Treasury Board Secretariat.

All dollar amounts are in Canadian, current dollars (i.e. not adjusted for inflation) unless otherwise noted.

6. About this Document

Established by the Financial Accountability Officer Act, 2013, the Financial Accountability Office (FAO) provides independent analysis on the state of the Province’s finances, trends in the provincial economy and related matters important to the Legislative Assembly of Ontario.

The FAO produces independent analysis on the initiative of the Financial Accountability Officer. Upon request from a member or committee of the Assembly, the Officer may also direct the FAO to undertake research to estimate the financial costs or financial benefits to the Province of any bill or proposal under the jurisdiction of the legislature.

This report was prepared on the initiative of the Financial Accountability Officer in response to a request from a member of the Assembly. In keeping with the FAO’s mandate to provide the Legislative Assembly of Ontario with independent economic and financial analysis, this report makes no policy recommendations.

This analysis was prepared by Greg Hunter and Matt Gurnham under the direction of Jeffrey Novak.

A number of external reviewers reviewed early drafts of the report. The assistance of external reviewers implies no responsibility for the final product, which rests solely with the FAO.

[1] O. Reg. 144/16 was revoked, ending the cap and trade program. O. Reg. 386/18, Prohibition Against the Purchase, Sale and Other Dealings with Emission Allowances and Credits, prohibited trading in allowances.

[2] “Premier Doug Ford Announces the End of the Cap-and-Trade Carbon Tax Era in Ontario”, July 3, 2018, accessed on September 20, 2018, https://news.ontario.ca/opo/en/2018/07/premier-doug-ford-announces-the-end-of-the-cap-and-trade-carbon-tax-era-in-ontario.html.

[3] Although cancelling the programs results in cash savings averaging $190 million a year, the savings to the budget balance will only materialize over the planned life of the asset. See chapter 3 for more details.

[4] The FAO cannot disclose the remaining cap and trade related spending programs as the Province has deemed this information to be a Cabinet record. The FAO is prevented from disclosing Cabinet records under s. 12(2) of the Financial Accountability Officer Act, 2013 and Order-in-Council 1002/2018.

[5] The FAO also identified two potential risks that could further impact the Province’s budget position: the potential loss of federal transfer revenue from the Low Carbon Economy Fund and the potential that legal liabilities could materialize. See chapter 3 for details.

[6] On August 1, 2018, the Province filed a reference with the Ontario Court of Appeal to challenge the constitutionality of the federal government’s Greenhouse Gas Pollution Pricing Act. August 2, 2018, “Ontario Announces Constitutional Challenge to Federal Government’s Punishing Carbon Tax Scheme”, https://news.ontario.ca/mag/en/2018/09/notice-of-ontarios-reference-for-federal-greenhouse-gas-pollution-pricing-act.html (accessed on September 25, 2018). The Province of Saskatchewan launched its own constitutional challenge in April 2018.

[7] Households will also pay higher indirect costs reflected in higher prices charged by businesses.

[8] On average, households with income under $150,000 would receive more revenue than their total cap and trade costs.

[9] Smart Prosperity Institute. “Canadian Business Preference on Carbon Pricing.” Jan 2011. See chapter 4 for more details.

[10] The targets are set out in the Climate Change Mitigation and Low-carbon Economy Act, 2016, which will be repealed if Bill 4, the Cap and Trade Cancellation Act, 2018 is passed. If Bill 4 is passed, the Province would be required to establish new targets for reducing GHG emissions in Ontario (see sections 3 and 4 of Bill 4).

[11] 2018 Ontario Budget, p. 117.

[12] O. Reg. 144/16 was revoked, ending the cap and trade program. O. Reg. 386/18, Prohibition Against the Purchase, Sale and Other Dealings with Emission Allowances and Credits, prohibited trading in allowances.

[13] “Premier Doug Ford Announces the End of the Cap-and-Trade Carbon Tax Era in Ontario”, July 3, 2018, accessed on September 20, 2018, https://news.ontario.ca/opo/en/2018/07/premier-doug-ford-announces-the-end-of-the-cap-and-trade-carbon-tax-era-in-ontario.html.

[14] Government of Canada, "Technical Paper: Federal Carbon Pricing Backstop." Web. 7 Sept. 2018; and Greenhouse Gas Pollution Pricing Act.

[15] On August 1, 2018, the Province filed a reference with the Ontario Court of Appeal to challenge the constitutionality of the federal government’s Greenhouse Gas Pollution Pricing Act. August 2, 2018, “Ontario Announces Constitutional Challenge to Federal Government’s Punishing Carbon Tax Scheme”, https://news.ontario.ca/mag/en/2018/09/notice-of-ontarios-reference-for-federal-greenhouse-gas-pollution-pricing-act.html (accessed on September 25, 2018). The Province of Saskatchewan launched its own constitutional challenge in April 2018.

[16] Government of Canada. Budget 2016: Chapter 4 - A Clean Growth Economy. For details about the Low Carbon Economy Fund, see: https://www.canada.ca/en/environment-climate-change/news/2017/06/low_carbon_economyfund.html.

[17] Federal government website, accessed on September 20, 2018, https://www.canada.ca/en/environment-climate-change/news/2017/06/low_carbon_economyfund.html.

[18] For example, $100 million in federal funding from the Low Carbon Economy Fund was to be provided to Ontario to support the Province’s GreenON program. This funding was not provided to the Province after the cap and trade program was cancelled. In addition, the federal Environment Minister has stated that the federal government is evaluating the status of Ontario’s funding under the Low Carbon Economy Fund. See https://globalnews.ca/news/4312147/ontario-cancels-cap-and-trade-federal/ dated July 4, 2018, accessed September 11, 2018.

[19] See appendix A for the list of programs.

[20] 2018 Ontario Budget, p. 117 and FAO analysis of information provided by the Province.

[21] “Premier Doug Ford Announces the End of the Cap-and-Trade Carbon Tax Era in Ontario”, July 3, 2018, accessed on September 20, 2018, https://news.ontario.ca/opo/en/2018/07/premier-doug-ford-announces-the-end-of-the-cap-and-trade-carbon-tax-era-in-ontario.html.

[22] The FAO cannot disclose the remaining cap and trade related spending programs as the Province has deemed this information to be a Cabinet record. The FAO is prevented from disclosing Cabinet records under s. 12(2) of the Financial Accountability Officer Act, 2013 and Order-in-Council 1002/2018.

[23] The FAO cannot identify the programs that funded infrastructure projects as the Province has deemed this information to be a Cabinet record. The FAO is prevented from disclosing Cabinet records under s. 12(2) of the Financial Accountability Officer Act, 2013 and Order-in-Council 1002/2018.

[24] According to the Province, the useful life of buildings ranges from 20 to 40 years (see 2016-17 Public Accounts, p. 80). The FAO uses the mid-point of this range for its estimated amortization of the assets, of which about 70% would have been buildings, according to FAO estimates. Note also that the cash savings would immediately impact the Province’s net debt. Consequently, the FAO estimates that the Province’s net debt will increase by only $2.3 billion from 2018-19 to 2021-22, less than the $3.0 billion deterioration of the budget balance.

[25] The FAO cannot disclose the programs as the Province has deemed this information to be a Cabinet record. The FAO is prevented from disclosing Cabinet records under s. 12(2) of the Financial Accountability Officer Act, 2013 and Order-in-Council 1002/2018.

[26] For further details on the Green Ontario Fund see https://greenon.ca/ (accessed on September 21, 2018). For further details on the Electric and Hydrogen Vehicle Incentive Program see http://www.mto.gov.on.ca/english/vehicles/electric/electric-vehicle-incentive-program.shtml (accessed on September 21, 2018).

[27] This would not apply to emitters, such as large fuel suppliers, that were able to pass costs on to consumers.

[28] The FAO has not assessed the proposed United-States-Mexico-Canada Agreement.

[29] Based on the advice of FAO staff counsel, it is not clear to the FAO whether the proposed waiver of liability in sections 9 and 10 of Bill 4 would apply in this case.

[30] For more analysis on administrative discretion see Tesla Motors Canada ULC v. Ontario (Ministry of Transportation), 2018 ONSC 5062.

[31] See subsections 71(1) and 71(2) of the Climate Change Act for more details.

[32] 2017-18 Public Accounts of Ontario, 2-453. This amount excludes funds transferred to government agencies or organizations of $136 million that was not spent as of March 31, 2018.

[33] See above for details. The final 2018-19 year-end remaining spending commitment in the CTWDA could vary depending on final spending amounts.

[34] On August 1, 2018, the Province filed a reference with the Ontario Court of Appeal to challenge the constitutionality of the federal government’s Greenhouse Gas Pollution Pricing Act. August 2, 2018, “Ontario Announces Constitutional Challenge to Federal Government’s Punishing Carbon Tax Scheme”, https://news.ontario.ca/mag/en/2018/09/notice-of-ontarios-reference-for-federal-greenhouse-gas-pollution-pricing-act.html (accessed on September 25, 2018). The Province of Saskatchewan launched its own constitutional challenge in April 2018.

[35] For fuel distributors, the emissions are calculated based on the emissions resulting from the consumption of the fuel.

[36] This was the settlement price at the final auction that Ontario participated in on May 15, 2018.

[37] Calculated using californiacarbon.info forward prices converted into CAD.

[38] Ontario Energy Board. “Long-term Carbon Price Forecast.” 19 Jul. 2017. Values converted to nominal dollars.

[39] Government of Canada. “Technical paper: federal carbon pricing backstop.” 1 Jan. 2018.

[40] Environment and Climate Change Canada, National Inventory Report 1990-2016: Greenhouse Gas Sources and Sinks in Canada (2018).

[41] Sawyer, Peters & Stiebert. “Impact Modelling and Analysis of Ontario’s Proposed Cap and Trade Program.” 27 May 2016.

[42] Those participants purchased 2.9 million allowances at auction and received 58 million allowances free of charge.

[43] Note that 84% was estimated based on 2015 Ontario emissions. Dobson, Winter and Boyd. “The Greenhouse Gas Emissions Coverage of Carbon Pricing Instruments for Canadian Provinces.” July 2018.

[44] The output-based standards are still under development.

[45] Cap and trade costs to Ontario households and businesses do not match the revenue forecast in Table 3-1 because Ontario cap and trade participants were able to purchase emissions allowances from other jurisdictions.

[46] Note that under both programs, the cost of carbon pricing is passed through to Ontario households and businesses primarily through increases in the price of fuels.

[47] In 2017 and 2018, entities in Quebec and California purchased $250 million of Ontario allowances. Starting in 2019 the FAO projects that the amount of allowances purchased by Ontario participants would have exceeded the number of available Ontario allowances.

[48] The difference between the cost to households and businesses and the revenue generated by cap and trade is the net cost of Quebec/California allowances purchased by Ontario participants.

[49] The federal backstop also generates revenue from emitters covered by the output-based pricing system that exceed the limit set by the output-based standard.

[50] See the Ecofiscal Commission’s 2016 report for a more detailed explanation of revenue recycling options and how different approaches impact economic growth.

[51] Climate Change Mitigation and Low-carbon Economy Act, 2016, s. 71(2).

[52] 2018 Ontario Budget, p. 117 and appendix A.

[53] Government of Canada. “Pan Canadian Approach to Pricing Carbon Pollution.” 3 Oct. 2016.

[54] Source: Alberta Climate Leadership Plan.

[55] See beginning of this chapter for more details.

[56] The Globe and Mail. “Carbon tax revenue could go straight to Ontario residents, McKenna says.” 4 Apr. 2018.

[57] The FAO estimates that a typical household has electricity consumption of 9 MWh, natural gas consumption of 2,200 M3 and gasoline consumption of 2,000 L.

[58] Direct costs are calculated based on household energy consumption data from Statistics Canada Natural Resources Canada and the Ontario Energy Board. Indirect costs are estimated using average household costs which are calculated using Statistics Canada Social Policy Simulation Database and Model v. 26.0.

[59] On average, households with income under $150,000 would receive more revenue than their total cap and trade costs.

[60] Businesses would still receive direct support from the output-based pricing system.

[61] Some of that cost would be passed through to households which is reflected in the indirect household costs.

[62] Smart Prosperity Institute. “Canadian Business Preference on Carbon Pricing.” Jan. 2011.

[63] Goulder, Lawrence H., and Andrew R. Schein. "Carbon taxes versus cap and trade: a critical review." Climate Change Economics 4.03 (2013): 1350010.

[64] Facilities that emit between 10,000 and 50,000 tonnes can opt in on a voluntary basis.

[65] Facilities can also use eligible off-set or surplus credits to cover emissions above the emissions limit.

[66] See Impact on Households section for more details.

Estimated impact on the Province’s budget balance from ending the cap and trade program, 2018-19 to 2021-22

This chart shows the FAO’s estimate of the impact of cancelling the cap and trade program on the Province’s budget balance from fiscal year 2018-19 to 2021-22. For fiscal year 2018-19, the Province’s budget balance is expected to deteriorate by $841 million, followed by a drop of $615 million in 2019-20, $771 million in 2020-21 and $787 million in 2021-22.

Comparison of typical household costs, cap and trade vs. federal carbon pricing backstop, 2019 to 2022 ($)

This chart shows a comparison of the costs to households of cap and trade versus the federal carbon pricing backstop from 2019 to 2022. The FAO estimates that the cost of cap and trade to a typical household would have been $264 in 2019, $280 in 2020, $293 in 2021 and $312 in 2022. The FAO estimates that the cost of the federal backstop to a typical household will be $258 in 2019, $388 in 2020, $518 in 2021 and $648 in 2022.

Figure 4-1: Comparison of cap and trade price and federal backstop carbon levy

This chart compares the price of carbon in Ontario under cap and trade with the federal backstop carbon levy. The FAO estimates that the price of carbon under cap and trade would have been $20/tonne in 2019, $22/tonne in 2020, $23/tonne in 2021 and $24/tonne in 2022. The Federal backstop carbon levy will be $20/tonne in 2019, $30/tonne in 2020, $40/tonne in 2021 and $50/tonne in 2022.

Figure 4-2: Comparison of typical household costs, cap and trade vs. federal carbon pricing backstop, 2019 to 2022 ($)

This chart shows a comparison of the costs to households of cap and trade versus the federal carbon pricing backstop from 2019 to 2022. The FAO estimates that the cost of cap and trade to a typical household would have been $264 in 2019, $280 in 2020, $293 in 2021 and $312 in 2022. The FAO estimates that the cost of the federal backstop to a typical household will be $258 in 2019, $388 in 2020, $518 in 2021 and $648 in 2022.