Key Points

- Ontario’s debt is rated by four principal international credit rating agencies,[1] based on their assessments of the province’s economic and financial outlook, and future risks. These credit ratings represent the agencies’ opinions on Ontario’s ability to meet its debt-related financial obligations.

- Although the COVID-19 pandemic is expected to weaken Ontario’s fiscal position in the medium term, resulting in larger deficits and a higher debt burden, the credit rating agencies have all reaffirmed their rating and outlook for Ontario as stable in their updated assessments.

- Credit rating agencies have highlighted Ontario’s diversified economy, broad access to credit markets, prudent debt management practices and the support of the federal government as key drivers behind maintaining Ontario’s credit rating.

- Ontario’s credit rating relative to other Canadian provinces was unchanged in 2020, ranking sixth among the 10 provinces.

- However, all four credit rating agencies highlight the risk of a downgrade to Ontario’s credit rating if the Province does not return to a sustainable fiscal plan in the post-pandemic period, which would include steady decreases in the budget deficit and a lower debt burden.

Ontario’s Credit Rating Reaffirmed

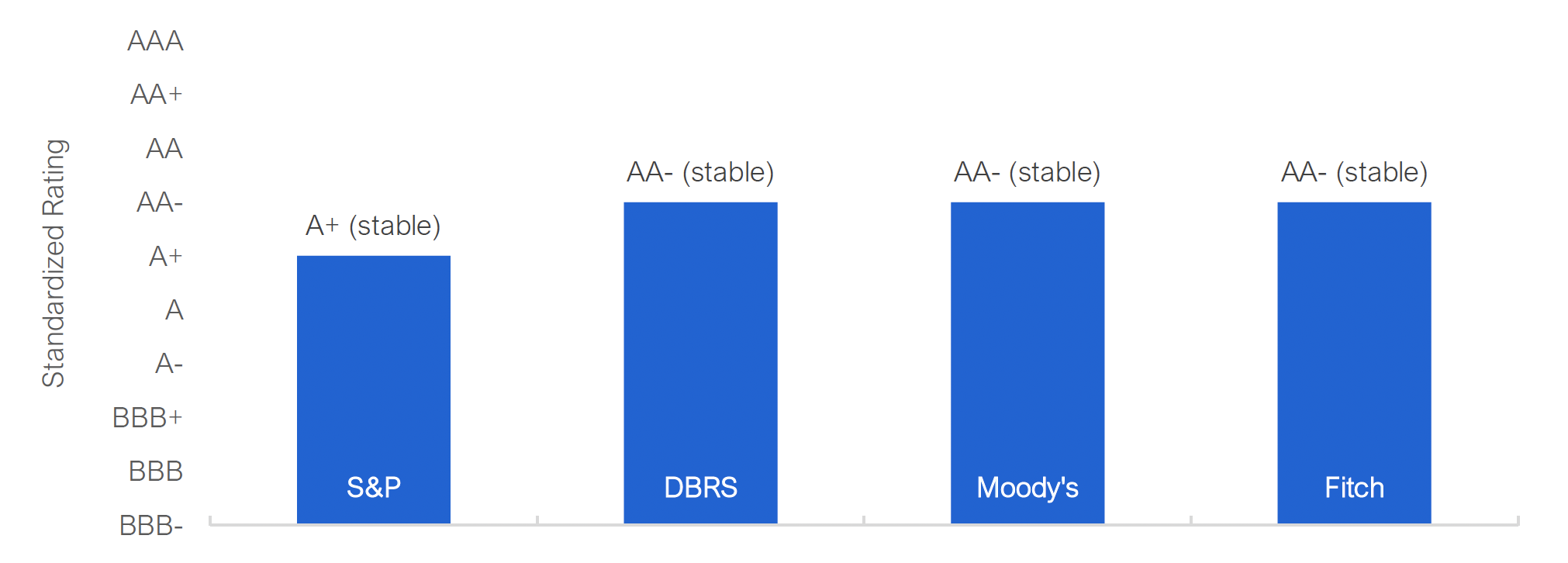

Despite a sharp economic downturn and significant deterioration in the Province’s finances due to the COVID-19 pandemic, all four credit rating agencies have recently reaffirmed Ontario’s credit rating and outlook. Based on a standardized scale,[2] Ontario’s debt is currently rated AA- (fourth highest rating) by three of the four credit rating agencies and A+ (fifth highest) by S&P. In general, the agencies continue to rate Ontario as an “extremely strong”, investment-grade borrower.

Figure 1 Ontario’s 2020 Credit Ratings Unchanged in the Pandemic

Source: S&P, DBRS, Fitch, Moody’s and FAO.

Accessible version

This chart shows Ontario’s standardized credit rating for 2020 from all four credit rating agencies. The chart highlights that Ontario’s debt is currently rated A+(stable) by S&P and AA-(stable) by DBRS, Moody’s, and Fitch.

The decision by the agencies to reaffirm Ontario’s credit rating is based on several factors, including projections for a strong post-pandemic economic recovery, revenue growth supported by a diversified economy and broad tax base, and expectations for a pragmatic fiscal consolidation plan that results in debt sustainability. Fitch recently downgraded the Canadian federal government’s credit rating from AAA to AA+, but indicated that this decision does not directly affect Ontario’s rating. However, Fitch did note that the significant increase in federal government debt associated with its fiscal response to the pandemic can impact the credit quality of individual provinces, as Fitch’s calculation of provincial debt includes each province’s proportional share of federal debt.

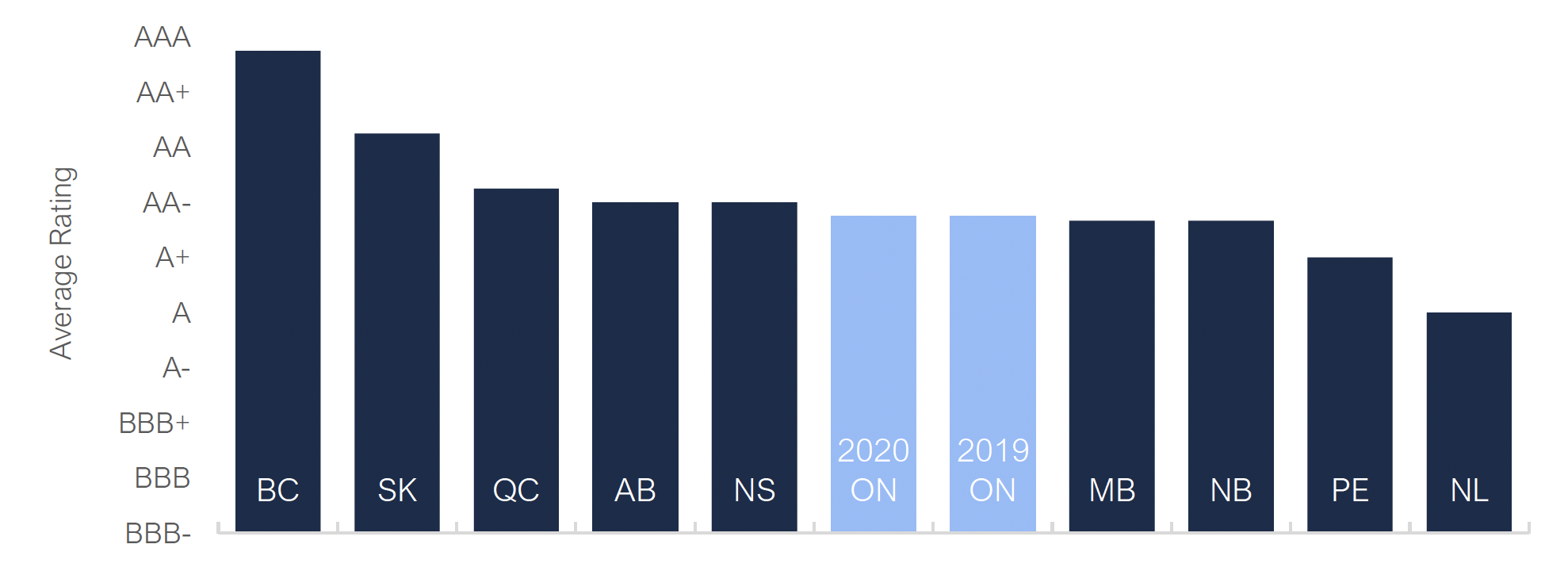

Ontario’s Credit Rating Relative to Other Provinces Unchanged

Ontario’s credit rating compared to other Canadian provinces was unchanged in 2020, ranking sixth among the 10 provinces. Alberta saw a significant deterioration in its average credit rating, with three of the four agencies downgrading the province’s debt over the last year. Saskatchewan was the only other Canadian province to see a downgrade to its credit rating in 2020, as one of the four rating agencies took a negative rating action against the province. The deterioration in the credit rating of Alberta and Saskatchewan largely reflects the sharp drop in the economic prospects of these provinces due to the decline in oil prices.

Ontario’s rating outlook remains at “stable” by all four agencies, indicating a low likelihood of a deterioration in the province’s credit rating over the medium term, subject to the province’s fiscal consolidation efforts in the post-pandemic period. In contrast, the credit rating outlook of British Columbia, Alberta, and Newfoundland and Labrador were revised to “negative” by one or more credit rating agencies, indicating a higher risk of credit downgrade over the medium term.

Figure 2 Average Credit Rating by Province as of July 2020[3]

Source: S&P, DBRS, Fitch, Moody’s and FAO.

Accessible version

This chart shows the average credit rating as of July 2020 for each Canadian province, with the highest rating in British Columbia and lowest in Newfoundland & Labrador. The chart highlights that in 2020 and 2019, Ontario’s credit rating remained unchanged and ranked sixth among the 10 provinces.

Commitment to Fiscal Sustainability Important for Ontario’s Future Credit Rating

The four credit rating agencies expect that the annual decline in Ontario’s economic activity in 2020 will be the worst on record,[4] based on their own forecasts.[5] Most rating agencies have flagged the overall weakening of the Province’s fiscal position, with large budget deficits, higher debt burden and increased interest-on-debt costs, as a key challenge for Ontario’s credit rating.

Debt sustainability and fiscal management indicators play an important role in determining the credit rating of sub-national governments.[6] While the large budget deficits as a result of the COVID-19 pandemic have not affected the province’s current credit rating or outlook, all four credit rating agencies highlight that Ontario’s future credit rating remains highly contingent on having a fiscal consolidation plan for the post-pandemic period.

Fitch noted that Ontario might face a negative rating action if the Province fails to present a pragmatic and prompt fiscal consolidation plan. Similarly, DBRS and Moody’s emphasized a possible negative rating action if the Province is unable to quickly reduce the deficit and slow debt growth. Importantly, given the dramatic deterioration in Ontario’s fiscal position, Fitch and DBRS expect the government to revise its initial plan[7] to balance the budget by 2023 to a later date. S&P pointed to the risk of persistent increases in the debt burden jeopardizing the government’s commitment to fiscal sustainability.

Ontario’s Interest Rate Spread Relative to Canadian Government Debt Has Stabilized

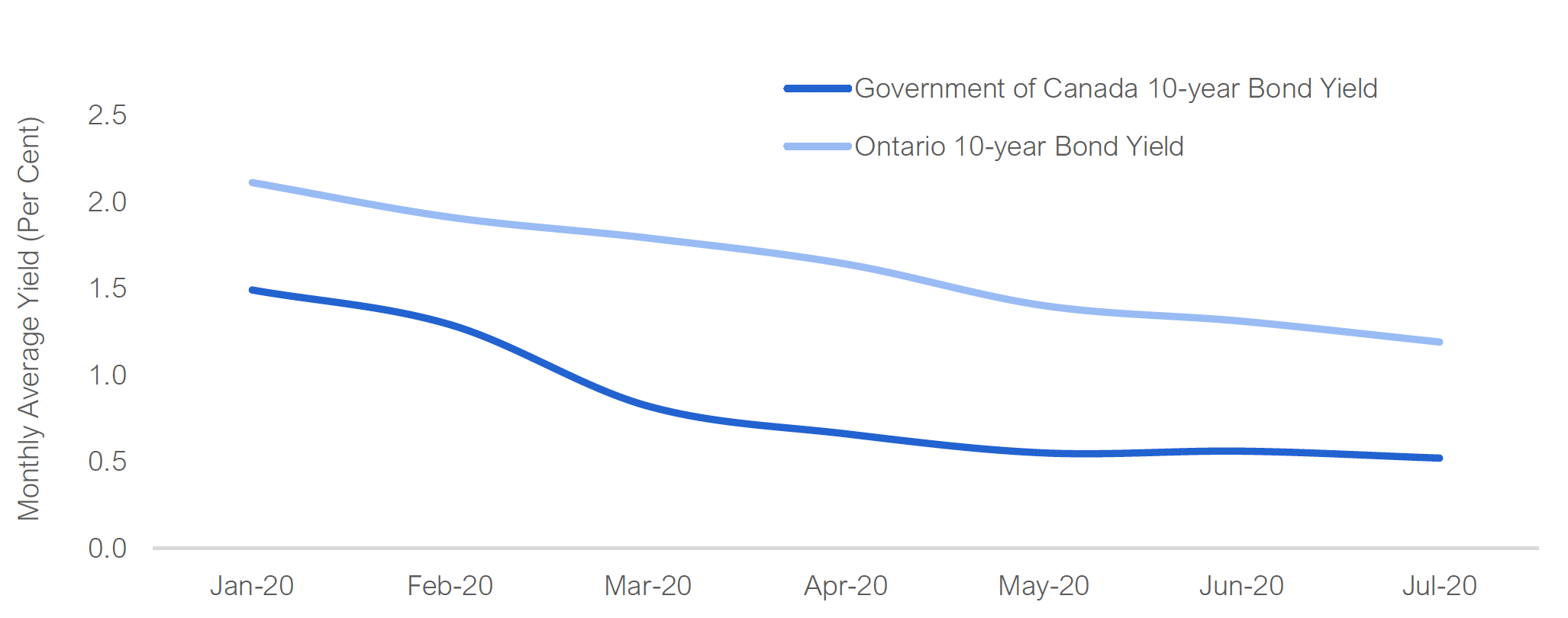

Ontario’s interest rate relative to Canadian bond yields serves as an indicator of the relative riskiness of Ontario government debt compared to Canadian debt, which can influence credit rating actions. Over the first six months of this year, the monthly average yield on 10-year Ontario government bond has declined by 90 basis points, falling from 2.1 per cent in January to 1.2 per cent in July, roughly consistent with the decline in Government of Canada bond yields. The decline in overall bond yields is a direct result of the Bank of Canada’s move to cut its policy interest rate by 150 basis points, in response to the economic downturn.[8]

Initially, the bond market’s response to the pandemic crisis led to a doubling in the spread between Ontario and Canada 10-year bonds, from 60 basis points in January to 120 basis points in late March and early April. More recently, the Ontario-Canada 10-year bond yield spread has declined to approximately 70 basis points, close to its pre-pandemic level, and at least partly reflects the result of new Bank of Canada programs to purchase provincial government debt.[9] Despite the temporary widening, the return of the Ontario-Canada bond spread to pre-pandemic levels suggests that the relative riskiness of Ontario government debt compared to Canadian debt has not shifted significantly as a result of the pandemic crisis.

Figure 3 10-year Bond Yields Have Declined since the Beginning of the Year

Source: Bank of Canada and FAO.

Accessible version

This chart shows the monthly average 10-year bond yields (in per cent) for Ontario and Canada from January 2020 to July 2020. Over this period, the monthly average yield on 10-year Ontario government bonds declined by 90 basis points, falling from 2.1 per cent in January to 1.2 per cent in July, roughly consistent with the decline in Government of Canada bond yields.

Looking Forward

The economic outlook for Ontario remains highly uncertain as the COVID-19 pandemic continues to evolve. The government has committed to releasing a budget by November 15, which is expected to outline a medium-term fiscal plan, and a recovery plan as required by the Fiscal Sustainability, Transparency and Accountability Act.[10] While balancing the budget may take longer than previously planned, the government’s commitment to fiscal sustainability in the upcoming budget will be a key factor in maintaining the Province’s credit rating.

Appendix

| Province | S&P | DBRS | Moody’s | Fitch | Average Rating (1 = highest rating) |

|---|---|---|---|---|---|

| British Columbia | AAA (negative) | AA high (stable) | Aaa (stable) | AAA (negative) | 1.25 |

| Alberta | A+ (negative) | AA low (negative) | Aa2 (stable) | AA- (negative) | 4.00 |

| Saskatchewan | AA (stable) | AA low (stable) | Aaa (stable) | AA (stable) | 2.75 |

| Manitoba | A+ (stable) | A high (stable) | Aa2 (stable) | 4.33 | |

| Ontario | A+ (stable) | AA low (stable) | Aa3 (stable) | AA- (stable) | 4.25 |

| Quebec | AA- (stable) | AA low (stable) | Aa2 (stable) | AA- (stable) | 3.75 |

| New Brunswick | A+ (stable) | A high (stable) | Aa2 (stable) | 4.33 | |

| Nova Scotia | AA- (stable) | A high (stable) | Aa2 (stable) | 4.00 | |

| Newfoundland & Labrador | A (negative) | A low (negative) | A1 (negative) | 6.00 | |

| Prince Edward Island | A (stable) | A (stable) | Aa2 (stable) | 5.00 |

| Rating Description | Credit Quality | S&P | DBRS | Moody’s | Fitch | |

|---|---|---|---|---|---|---|

| Long Term | Long Term | Long Term | Long Term | Ranking | ||

| Investment-grade | Extremely Strong | AAA | AAA | Aaa | AAA | 1 |

| AA+ | AA high | Aa1 | AA+ | 2 | ||

| AA | AA | Aa2 | AA | 3 | ||

| AA- | AA low | Aa3 | AA- | 4 | ||

| Very Strong | A+ | A high | A1 | A+ | 5 | |

| A | A | A2 | A | 6 | ||

| A- | A low | A3 | A- | 7 | ||

| Strong | BBB+ | BBB high | Baa1 | BBB+ | 8 | |

| BBB | BBB | Baa2 | BBB | 9 | ||

| BBB- | BBB low | Baa3 | BBB- | 10 | ||

| Non-investment-grade | Speculative | BB+ | BB high | Ba1 | BB+ | 11 |

| BB | BB | Ba2 | BB | 12 | ||

| BB- | BB low | Ba3 | BB- | 13 | ||

| B+ | B high | B1 | B+ | 14 | ||

| B | B | B2 | B | 15 | ||

| B- | B low | B3 | B- | 16 | ||

| CCC | CCC | Caa | CCC | 17 |

Footnotes

[1] The four credit rating agencies are Moody’s Investors Service (Moody’s), S&P Global Ratings (S&P), DBRS Limited (DBRS) and Fitch Ratings (Fitch). The agencies continually review the province’s credit rating and typically publish an update on their view of the Province’s finances and credit quality annually, based on the government’s latest financial reports or statements and their view of the outlook and risks.

[2] See Table 2: The Agencies’ Credit Rating Scales in the Appendix for the scale used by each agency. The FAO’s standardized rating scale is based on the rating classifications used by S&P and Fitch.

[3] The average rating is created by first translating each rating into a standardized rating and then converting all ratings to numerical values, 1 being the highest rating and 17 being the lowest rating. See Table 2: The Agencies’ Credit Rating Scales in the Appendix for translation matrix, where the FAO’s standardized rating scale is based on S&P’s and Fitch’s credit rating classifications. The average numerical ranking is then converted to letter rating. For example, Ontario’s rankings are 5, 4, 4 and 4 from S&P, DBRS, Fitch and Moody’s, respectively, for an average of 4.25, which roughly translates into an AA- letter rating. Additionally, average ratings do not reflect outlooks, only credit ratings.

[4] Data on provincial GDP in the Ontario Economic Accounts begin in 1981. For more details, see Ontario Economic Accounts.

[5] The credit rating agencies developed their own economic and fiscal forecasts, rather than rely on the government’s outlook which was produced before the full impact of the COVID-19 pandemic on the economy became apparent.

[6] For more details on the credit rating methodologies, see S&P: Methodology For Rating Local And Regional Governments Outside Of The U.S., Fitch: Rating Criteria for International Local and Regional Governments, Moody’s: Rating Methodology: Regional and Local Governments, and DBRS: Rating Canadian Provincial and Territorial Governments.

[7] See page 3 of the 2019 Ontario Economic Outlook and Fiscal Review.

[8] The Bank of Canada responded quickly to the economic downturn by lowering its policy interest rate by 1.5 percentage points over three rate decisions in March to 0.25 per cent, the lowest rate since the 2008 global financial and economic downturn.

[9] The Bank of Canada introduced the Provincial Money Market Purchase Program (PMMP) and the Provincial Bond Purchase Program (PBPP) in March and April of this year. These programs were intended to increase liquidity for provincial debt, lowering borrowing costs. The two programs have helped ease the pressure in the short-term provincial borrowing market. In a recent announcement, the Bank of Canada has indicated that it will scale down its purchase of money market securities under the PMMP. For details, see Bank of Canada announces changes to the Provincial Money Market Purchase (PMMP) program.

[10] See page vii of the March 2020 Economic and Fiscal Update.