1. Résumé

Le présent rapport Perspectives économiques et budgétaires décrit les projections du BRF concernant la position financière du gouvernement de l’Ontario pour la période allant de 2022-2023 à 2027-2028. De plus, il compare les perspectives budgétaires du BRF au plan du gouvernement présenté dans le budget de l’Ontario de 2023 pour la période allant de 2022-2023 à 2025-2026 et présente les perspectives économiques mises à jour du BRF. Les projections du BRF relatives aux revenus et aux dépenses de programmes s’appuient sur les politiques actuelles et annoncées du gouvernement.

La croissance économique de l’Ontario ralentira

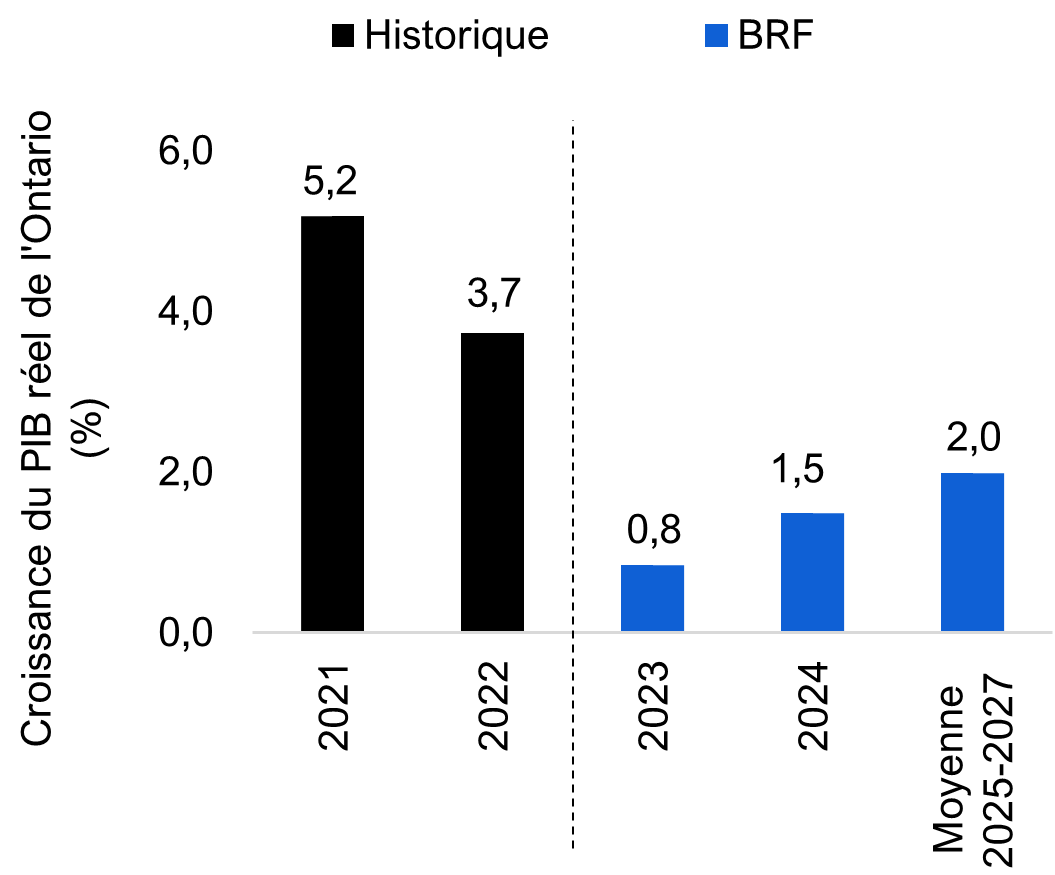

L’économie de l’Ontario a connu une reprise rapide après la pandémie, le PIB réel ayant augmenté de 5,2 % en 2021 et de 3,7 % en 2022. L’inflation et les taux d’intérêt élevés ainsi qu’une conjoncture mondiale moins favorable devraient freiner la croissance économique de l’Ontario, qui tombera à 0,8 % en 2023, avant de remonter à un taux annuel moyen de 2,0 % pendant le reste de la période visée par les perspectives.

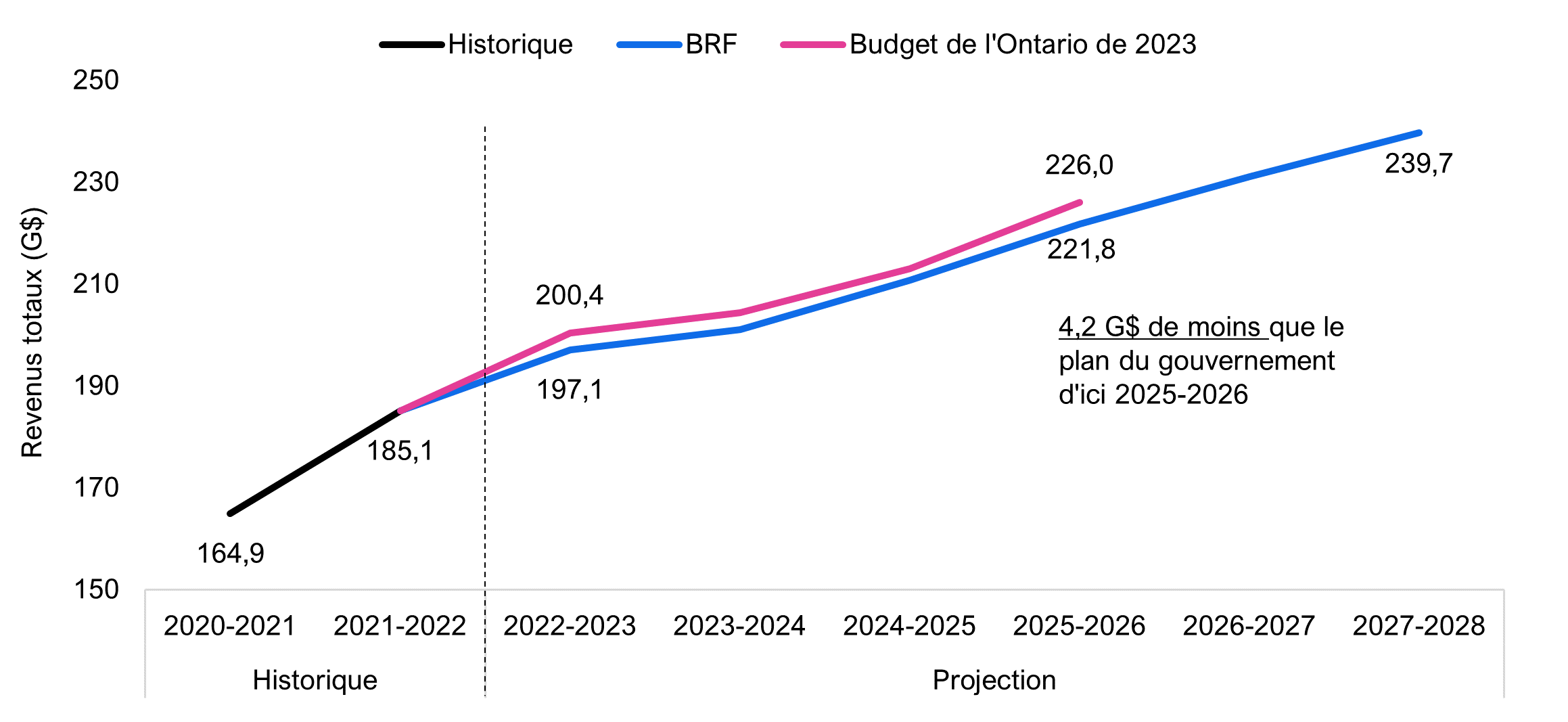

La croissance de revenus fléchira; les perspectives du BRF sont inférieures à celles du budget

Une forte croissance des revenus de 6,5 % est prévue en 2022-2023, après l’augmentation exceptionnelle de 12,2 % enregistrée en 2021-2022. Le ralentissement de l’activité économique fera fléchir cette croissance, qui s’élèvera à 2,0 % en 2023-2024, avant de revenir à un taux proche de la moyenne historique au cours du reste de la période visée par les perspectives. Le BRF prévoit des revenus inférieurs de 3,4 milliards de dollars aux prévisions du gouvernement en 2022-2023, et de 4,2 milliards de dollars d’ici 2025-2026 en raison de sa projection moins optimiste des hausses de revenus attribuables à l’inflation à court terme.

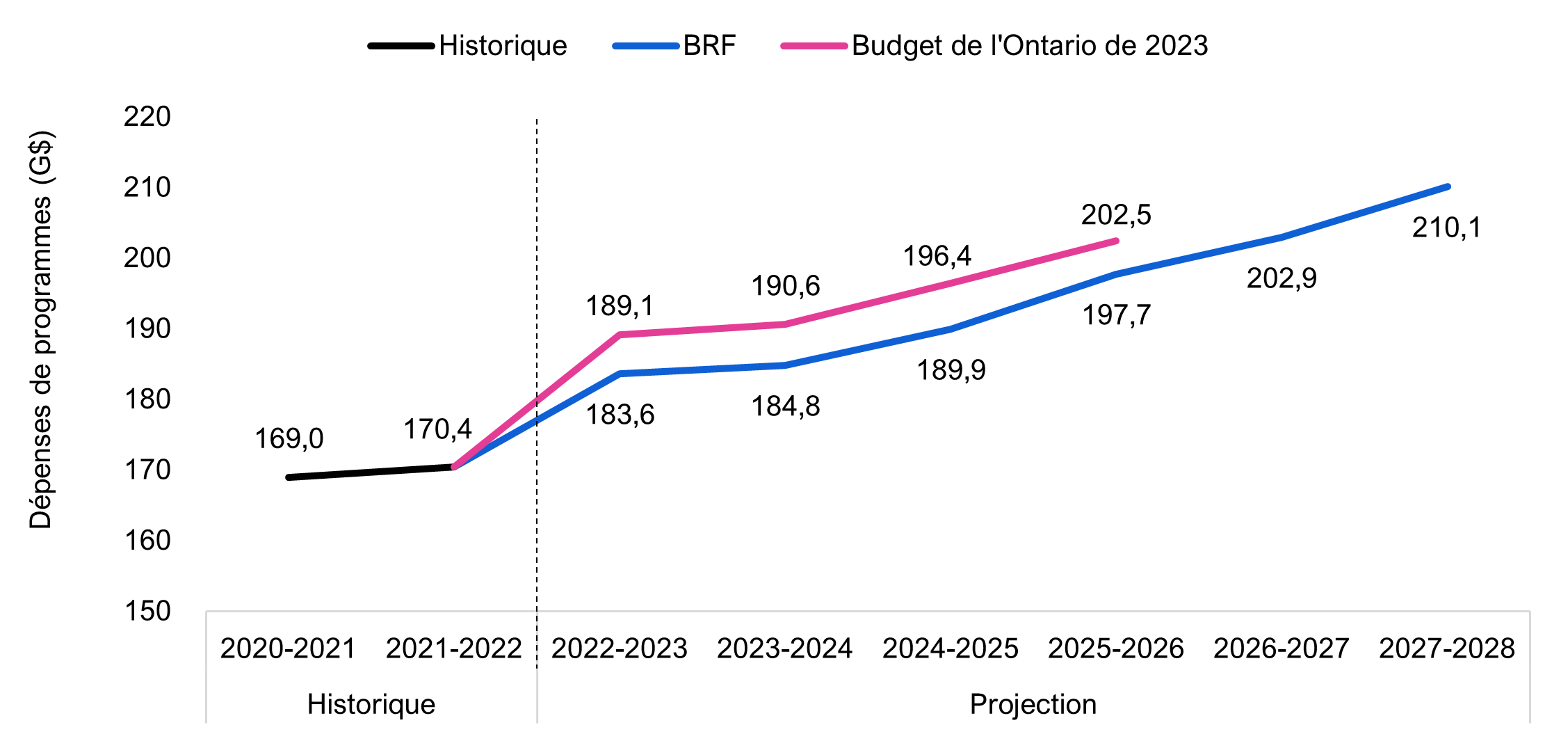

Les perspectives des dépenses de programmes sont inférieures aux prévisions du gouvernement

Le BRF prévoit que la province consacrera 183,6 milliards de dollars aux programmes en 2022-2023, soit une augmentation de 13,2 milliards de dollars (7,7 %) par rapport à l’exercice précédent. De 2022-2023 à 2025-2026, le plan de dépenses du gouvernement est supérieur d’un total de 5,6 milliards de dollars en moyenne chaque année aux estimations du BRF. Cela donne lieu à des fonds excédentaires cumulatifs de 22,6 milliards de dollars qui, selon le BRF, ne sont pas requis pour financer les programmes actuels et les engagements annoncés. Ces fonds excédentaires sont en hausse de 10,8 milliards de dollars par rapport aux prévisions des PEB de l’hiver du BRF, et reflètent les nouveaux fonds que la province a ajoutés dans le budget de l’Ontario de 2023.

La province pourrait utiliser ces fonds excédentaires de 22,6 milliards de dollars pour financer de nouveaux programmes, améliorer les programmes existants ou faire face à des pressions qui pourraient être exercées sur les dépenses. Par ailleurs, si la province décide de ne pas les utiliser, ces fonds excédentaires de 22,6 milliards de dollars pourront servir à améliorer le solde budgétaire et à réduire la dette nette de la province.

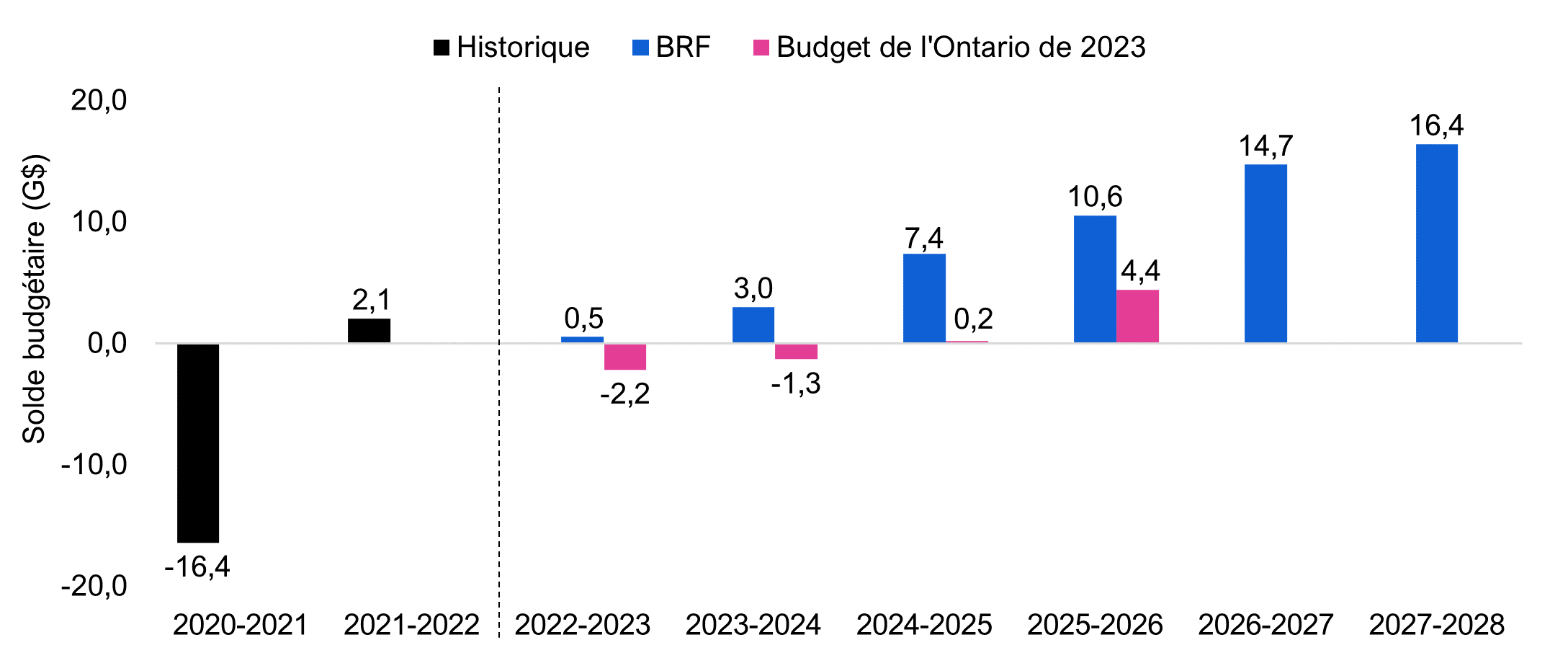

Des excédents budgétaires croissants sont prévus au cours de la période visée par les perspectives

Le BRF prévoit un excédent budgétaire de 0,5 milliard de dollars en 2022-2023, comparativement au déficit de 2,2 milliards de dollars prévu dans le budget de 2023. Des excédents budgétaires croissants sont prévus au cours de la période visée par les perspectives, les revenus croissant à un rythme supérieur aux dépenses de programmes. Le BRF prévoit que d’ici 2025-2026, il y aura un excédent de 10,6 milliards de dollars, comparativement à l’excédent de 4,4 milliards prévu par le gouvernement.

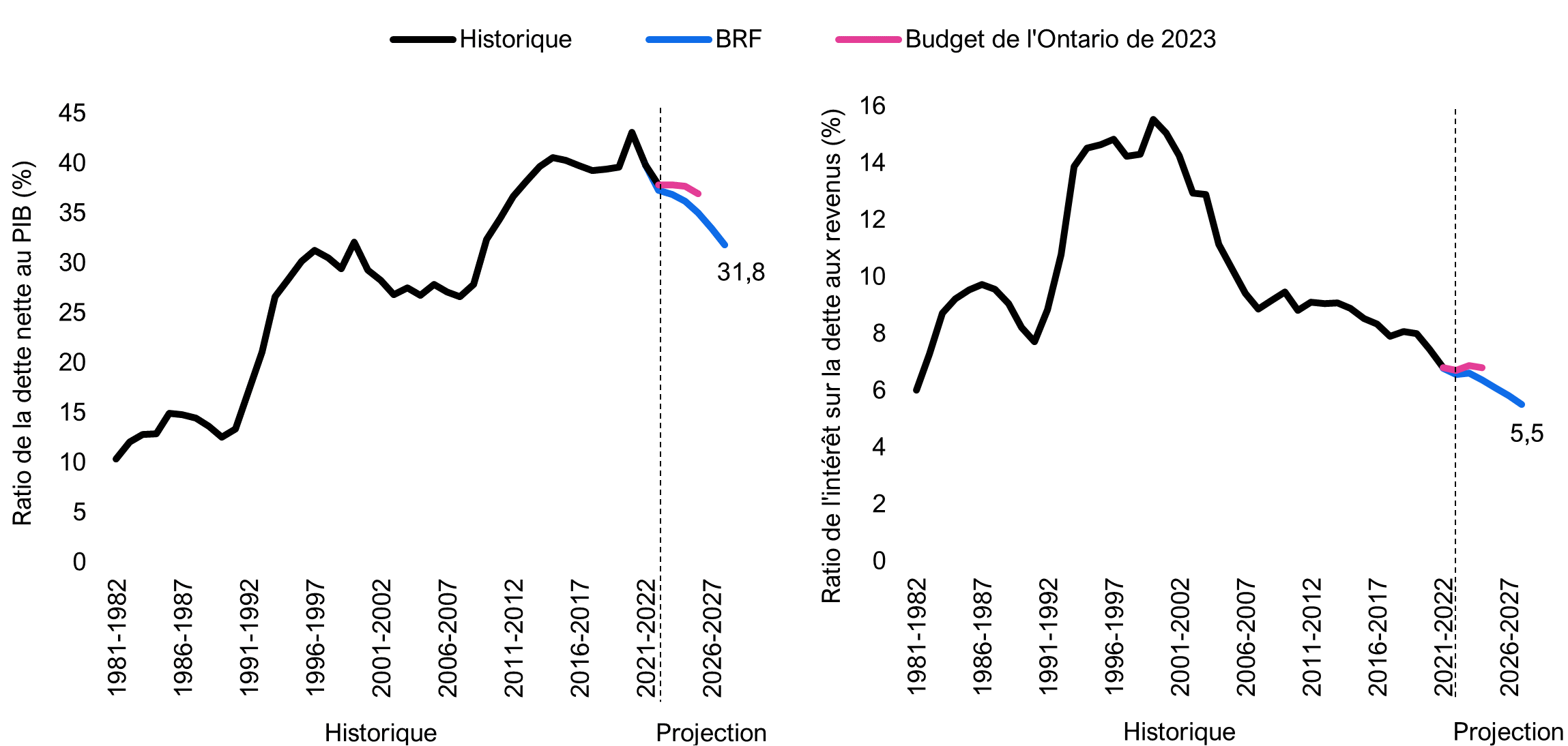

Des excédents budgétaires amélioreraient la viabilité financière de l’Ontario

Si les excédents prévus étaient utilisés pour rembourser la dette publique, le fardeau de la dette de l’Ontario (mesuré selon le ratio de la dette nette au PIB) diminuerait pendant une période sans précédent de sept années consécutives pour atteindre 31,8 % en 2027-2028, le ratio le plus bas depuis 2008-2009. Le ratio de l’intérêt sur la dette aux revenus, qui mesure la souplesse budgétaire, devrait également tomber à un niveau record de 5,5 % d’ici 2027-2028, indiquant que le gouvernement pourra consacrer une proportion plus élevée de ses revenus aux dépenses de programmes.

2. Perspectives du budget et de la dette

Le BRF prévoit des excédents budgétaires croissants

Après l’excédent budgétaire de 2,1 milliards de dollars enregistré en 2021-2022, le BRF prévoit que l’Ontario affichera un excédent de 0,5 milliard de dollars en 2022-2023. Il prévoit également, pour la période visée par les perspectives, que les excédents budgétaires passeront de 3,0 milliards de dollars en 2023-2024 à 16,4 milliards de dollars en 2027-2028, car la croissance des revenus devrait dépasser la croissance des dépenses compte tenu des politiques actuelles du gouvernement et des engagements qu’il a annoncés.

Le BRF prévoit un excédent budgétaire en 2022-2023, alors que le gouvernement, dans le budget de l’Ontario de 2023, a prévu un déficit budgétaire de 2,2 milliards de dollars. Le solde budgétaire supérieur de 2,7 milliards de dollars que prévoit le BRF comparativement aux prévisions du gouvernement est constitué des éléments suivants :

- des dépenses de programmes inférieures de 5,5 milliards de dollars;

- des revenus inférieurs de 3,4 milliards de dollars;

- des paiements d’intérêts sur la dette inférieurs de 0,5 milliard de dollars.

En 2025-2026, soit la dernière année des perspectives budgétaires de 2023, le gouvernement prévoit un excédent de 4,4 milliards de dollars. De son côté, le BRF prévoit que l’Ontario enregistrera un excédent de 10,6 milliards de dollars.

Figure 2.1Le BRF prévoit des excédents budgétaires en hausse au cours de la période visée par les perspectives

Remarque : Le solde budgétaire du budget de l’Ontario de 2023 est présenté après la réserve.

Sources : Comptes publics de l’Ontario, budget de l’Ontario de 2023 et BRF.

Cependant, si le gouvernement annonce de nouvelles politiques, telles que de nouvelles réductions de taxes ou d’impôts, des initiatives de dépenses ou une combinaison des deux, les prévisions budgétaires du BRF se dégraderaient. Les perspectives économiques et budgétaires du BRF comportent également des incertitudes considérables, qui sont analysées au chapitre 6.

Les excédents budgétaires amélioreraient les indicateurs de viabilité financière de l’Ontario

La dette nette en pourcentage du PIB est un indicateur de viabilité financière qui témoigne de la capacité du gouvernement à réunir des fonds pour assurer le service de sa dette[1]. On prévoit que le ratio de la dette nette au PIB de la province chutera pour passer de 39,8 % en 2021-2022 à 35,0 % en 2025-2026, soit 1,9 point de pourcentage sous la projection du gouvernement dans le budget de 2023. Comme il est prévu que l’économie croîtra plus rapidement que la dette, le BRF prévoit que le ratio de la dette nette au PIB baissera pour passer à 31,8 % d’ici 2027-2028, soit le ratio le plus bas depuis 2008-2009 et bien en deçà de la cible du gouvernement qui est fixée à 40,0 %[2].

Le ratio de l’intérêt sur la dette aux revenus est un indicateur de viabilité financière et de souplesse budgétaire; plus ce ratio est élevé, plus est faible la part des revenus que le gouvernement peut consacrer à des programmes clés comme les soins de santé ou l’éducation. On prévoit que les paiements d’intérêt sur la dette de l’Ontario en proportion des revenus chuteront pour passer de 6,8 % en 2021-2022 à 6,1 % en 2025-2026, en deçà de la projection du gouvernement, qui est de 6,7 %. D’ici 2027-2028, on prévoit que ce ratio passera à 5,5 %, le plus faible enregistré depuis le début des années 1980. Malgré des taux d’intérêt plus élevés[3], on prévoit qu’à moyen terme, le ratio de l’intérêt sur la dette aux revenus demeurera inférieur à la cible de 7,5 % qu’a fixée le gouvernement[4].

Figure 2.2Les indicateurs de viabilité financière de l’Ontario s’amélioreront et demeureront en dessous des objectifs du gouvernement

Sources : Comptes publics de l’Ontario, Budget de l’Ontario de 2023 et BRF.

3. Perspectives des revenus

Le BRF prévoit une faible croissance des revenus en 2023-2024

Après avoir connu une hausse historiquement forte de 12,2 % (+20,2 milliards de dollars) en 2021-2022, les revenus totaux devraient croître plus lentement en 2022-2023, à un taux de 6,5 % (+12,0 milliards de dollars), lequel devrait fléchir à nouveau pour s’établir à 2,0 % (+4,0 milliards de dollars) en 2023-2024. Ce ralentissement de la croissance des revenus au cours de cette période procède d’une croissance économique plus faible causée par la décélération de la hausse du revenu du travail et de la réduction des bénéfices des sociétés, de la perte de revenus ponctuels et de l’incidence de mesures déjà annoncées[5]. Au cours de l’ensemble de la période visée par les perspectives, les revenus totaux devraient afficher une croissance annuelle moyenne de 4,4 % à mesure que l’économie reprend une croissance tendancielle au cours des dernières années de la période[6].

La projection des revenus du BRF est inférieure à celle du gouvernement

Le BRF prévoit des revenus inférieurs à ce qu’entrevoit le budget de l’Ontario de 2023; la différence s’établit à 3,4 milliards de dollars pour 2022-2023 et croîtra pour atteindre un écart de 4,2 milliards de dollars d’ici 2025-2026. La différence entre la projection du BRF et celle du gouvernement est attribuable presque entièrement aux revenus fiscaux.

Figure 3.1La croissance des revenus ralentira après la poussée post-pandémique

Sources : Comptes publics de l’Ontario, budget de l’Ontario de 2023 et BRF.

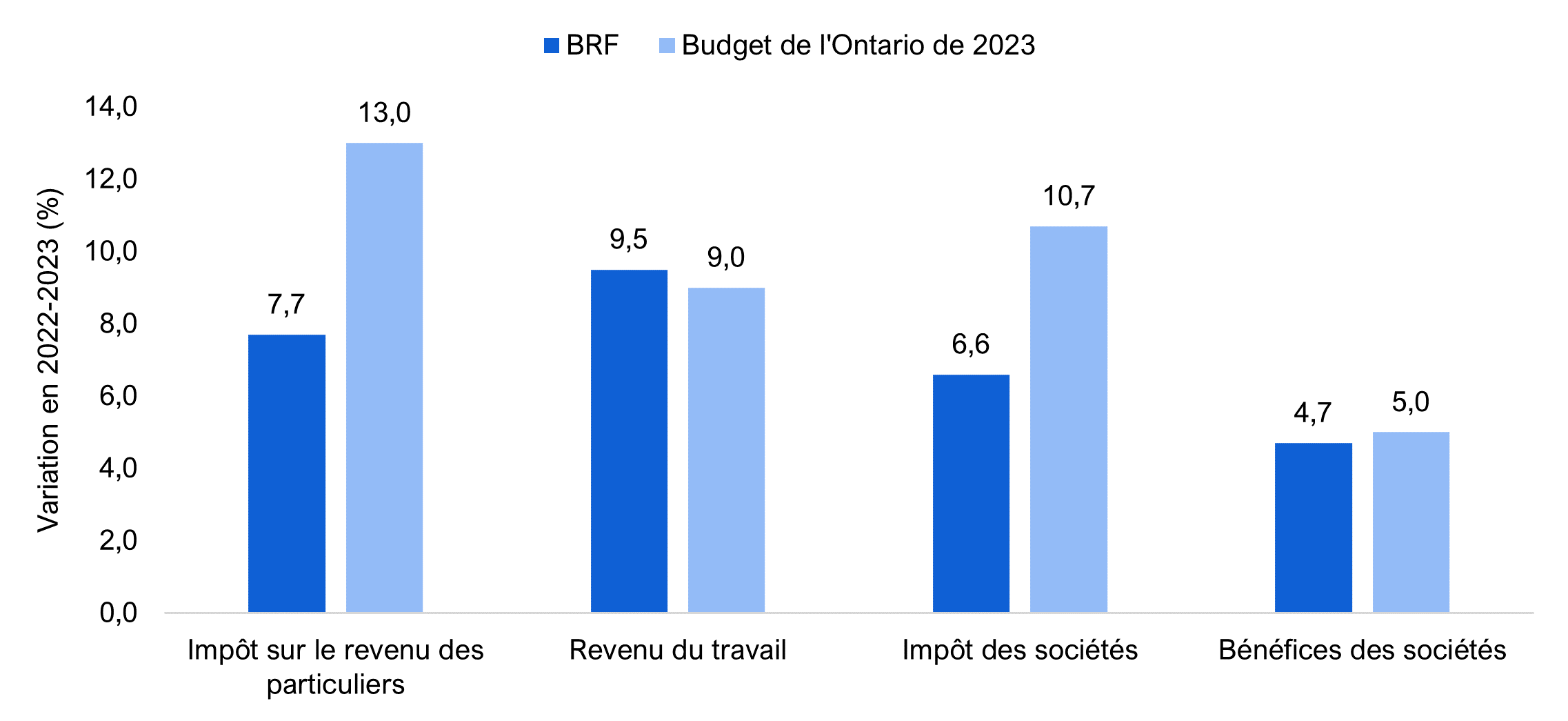

Les perspectives des revenus du BRF sont plus faibles que celles du gouvernement en raison d’hypothèses différentes quant à l’interaction des revenus fiscaux et des facteurs économiques dans la conjoncture actuelle caractérisée par une inflation élevée. Ces hypothèses influent essentiellement sur les revenus tirés de l’impôt sur le revenu des particuliers et de l’impôt des sociétés.

- La croissance du revenu du travail est un moteur clé de l’impôt sur le revenu des particuliers. Bien que les perspectives du BRF et du gouvernement concernant le revenu du travail soient semblables pour 2022-2023, le BRF s’attend à une croissance plus faible de l’impôt sur le revenu des particuliers de 7,7 % cette année-là, contre 13,0 % pour le gouvernement.

- De même, malgré des projections semblables quant aux bénéfices des sociétés pour 2022-2023, le gouvernement prévoit une croissance de l’impôt des sociétés plus élevée que le BRF (10,7 % par rapport à 6,6 %).

Figure 3.2Le BRF prévoit une corrélation plus modérée entre les revenus fiscaux et les facteurs économiques que le gouvernement en 2022-2023

Remarque : Croissance du revenu du travail et des bénéfices des sociétés en 2022.

Sources : Budget de l’Ontario de 2023, Comptes économiques de l’Ontario et BRF.

Au cours des deux derniers exercices, la croissance des revenus a été plus forte que ce que le BRF et le gouvernement avaient prévu[7]. Cette situation était attribuable en partie à la hausse de l’inflation, qui a porté les revenus à un niveau supérieur à celui auquel on aurait pu s’attendre compte tenu de l’activité économique. Les perspectives actuelles du BRF prévoient que cette vigueur se maintiendra en partie en 2022-2023, mais dans une moindre mesure que l’indiquent les projections du gouvernement. Si l’incidence de l’inflation sur les revenus est plus forte que le BRF le prévoit en 2022-2023, les revenus pourraient être bonifiés pendant toute la période visée par les perspectives. Par contre, l’incidence de l’inflation sur les revenus pourrait être plus faible que prévu en 2022-2023, abaissant les perspectives des revenus.

4. Perspectives des dépenses de programmes

La projection des dépenses de programmes du BRF est inférieure à celle du gouvernement

Le BRF prévoit que la province consacrera 183,6 milliards de dollars aux programmes en 2022-2023, soit 13,2 milliards de dollars de plus (7,7 %) qu’à l’exercice précédent. Il prévoit également que d’ici 2027-2028, les dépenses de programmes atteindront 210,1 milliards de dollars, et qu’elles connaîtront donc un taux de croissance annuel moyen de 3,6 % au cours de la période de six ans commençant en 2021-2022[8].

En revanche, de 2022-2023 à 2025-2026, le plan de dépenses du gouvernement est supérieur à la projection du BRF de 5,6 milliards de dollars chaque exercice. Il en résulte des fonds excédentaires cumulatifs de 22,6 milliards de dollars qui, selon les estimations du BRF, ne sont pas requis pour assumer le coût des programmes actuels et des engagements annoncés.

La province pourrait utiliser ces fonds excédentaires de 22,6 milliards de dollars pour créer de nouveaux programmes, améliorer les programmes existants ou faire face aux pressions sur les dépenses qui pourraient se manifester, telles que des règlements salariaux plus élevés que prévu (voir le chapitre 6). Par ailleurs, si la province décide de ne pas les utiliser, ces fonds excédentaires de 22,6 milliards de dollars seraient consacrés à l’amélioration du solde budgétaire et à la réduction de la dette nette de la province.

Figure 4.1La projection des dépenses de programmes du BRF est inférieure à celle du gouvernement jusqu ’en 2025-2026

Source : Analyse par le BRF du budget de l’Ontario de 2023 et des renseignements fournis par le ministère des Finances.

Les secteurs de la santé et des autres programmes comptent pour la plus grande partie des fonds excédentaires

Selon le secteur, le BRF prévoit qu’il y aura des fonds excédentaires dans les secteurs de la santé (4,4 milliards de dollars nets sur quatre ans), de l’éducation postsecondaire (1,1 milliard de dollars) et des autres programmes (17,9 milliards de dollars). Les fonds excédentaires élevés dans le secteur des autres programmes sont attribuables essentiellement au Fonds de prévoyance, qui est utilisé généralement pour financer de nouveaux programmes, améliorer des programmes existants ou faire face à des pressions éventuelles sur les dépenses[9]. Le BRF n’inclut pas le Fonds de prévoyance du gouvernement dans ses prévisions sur les dépenses de programmes car l’usage qui en sera fait n’a pas encore été annoncé.

Le BRF prévoit un léger manque à gagner dans les trois autres secteurs : la justice (0,5 milliard de dollars nets sur quatre ans), les services à l’enfance et les services sociaux (0,2 milliard de dollars) et l’éducation (0,1 milliard de dollars). Ainsi, la province n’a pas affecté suffisamment de fonds à ces secteurs pour assumer le coût des programmes actuels et des engagements annoncés au cours de la période de quatre ans. Pour combler ces manques à gagner, la province pourrait utiliser les fonds excédentaires que le BRF a relevés dans les autres secteurs

| Secteur | Différence entre les projections des dépenses de programmes de la province et du BRF, M$ | ||||

|---|---|---|---|---|---|

| 2022-2023 | 2023-2024 | 2024-2025 | 2025-2026 | Total | |

| Santé | 1 304 | 384 | 1 835 | 921 | 4 444 |

| Éducation | 136 | -216 | 129 | -141 | -92 |

| Éducation postsecondaire | 233 | 248 | 251 | 321 | 1 052 |

| Services à l’enfance et services sociaux | 278 | 274 | -50 | -685 | -182 |

| Justice | 200 | -204 | -193 | -322 | -519 |

| Autres programmes* | 3 370 | 5 323 | 4 525 | 4 654 | 17 872 |

| Différence totale – dépenses de programmes | 5 521 | 5 809 | 6 498 | 4 748 | 22 575 |

Changements depuis les PEB de l’hiver du BRF

L’estimation du BRF selon laquelle la province a affecté 22,6 milliards de dollars en fonds excédentaires sur quatre ans, de 2022-2023 à 2025-2026, est supérieure de 10,8 milliards de dollars à sa projection des PEB de l’hiver. Ce changement est attribuable aux 27,8 milliards de dollars en nouveaux fonds que la province a ajoutés au plan de dépenses du budget de l’Ontario de 2023. Sur cette somme, le BRF estime que :

- 11,3 milliards de dollars sont affectés à de nouvelles mesures et à des changements apportés à des programmes, dont 6,3 milliards de dollars pour des dépenses ponctuelles en 2022-2023[10], une hausse des sommes consacrées au Fonds pour le développement des compétences, des changements au Régime de revenu annuel garanti (RRAG)[11], des fonds affectés au nouveau crédit d’impôt pour l’investissement dans la fabrication en Ontario et de nouveaux changements apportés à des programmes du secteur de la santé[12];

- 5,7 milliards de dollars seront affectés à des estimations mises à jour du coût des programmes actuels et des engagements annoncés, surtout dans les secteurs des autres programmes et de l’éducation postsecondaire;

- 10,8 milliards de dollars sont de nouveaux fonds qui ont été ajoutés au plan de dépenses de la province et qui ne sont pas nécessaires pour assumer le coût des programmes existants et des engagements annoncés.

5. Perspectives économiques

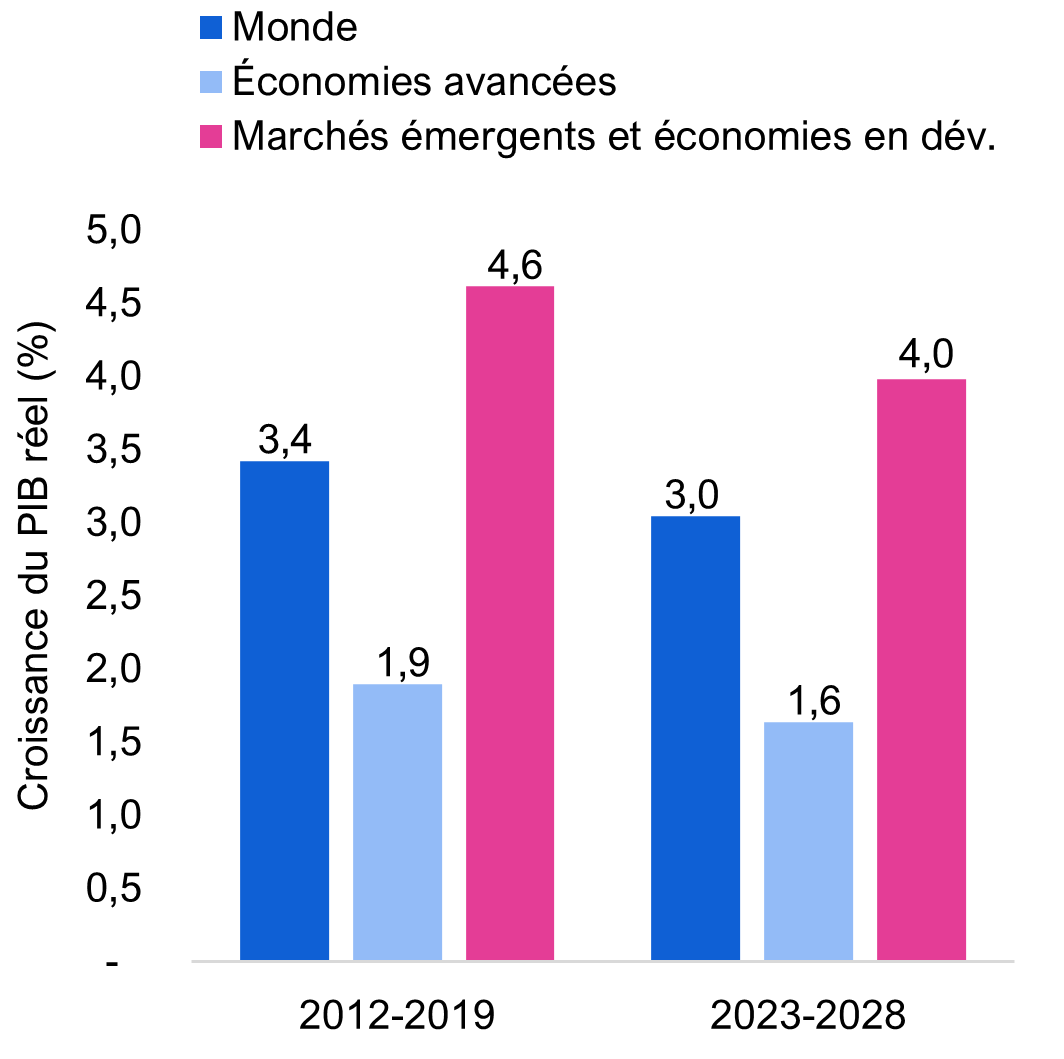

Les perspectives économiques mondiales à court terme demeurent faibles

Après une croissance de l’économie mondiale de 3,4 % en 2022, le Fonds monétaire international (FMI) prévoit que la croissance ralentira en 2023 pour atteindre 2,8 %[13]. Les marchés émergents et les économies en développement devraient maintenir un rythme de croissance semblable, soit 3,9 % en 2023 contre 4,0 % en 2022, tandis que les économies avancées, en particulier le Royaume-Uni et la zone euro, connaîtront un net ralentissement de l’activité économique en raison d’un nouveau resserrement de la politique monétaire.

Les perspectives économiques mondiales présentent toujours un risque de ralentissement. Le taux élevé d’inflation baisse lentement et se maintiendra probablement au-dessus de la cible de la plupart des banques centrales pendant une bonne partie de 2023. La hausse des taux d’intérêt a fait apparaître des vulnérabilités financières, en particulier dans certaines banques commerciales régionales américaines, ce qui a ravivé les craintes de récession, poussé les prêteurs à durcir leurs normes et affaibli la confiance des consommateurs et des entreprises. En revanche, la réouverture complète de la Chine a commencé à stimuler le commerce mondial, et le marché du travail est resté tendu dans les économies avancées, ce qui a soutenu la croissance des salaires et les dépenses des ménages. D’ici 2024, on s’attend à une légère reprise de l’activité économique dans la plupart des pays, et l’économie mondiale devrait croître à un taux annuel moyen de 3,0 % au cours de la période allant de 2023 à 2028, ce qui est légèrement inférieur à la croissance moyenne de 3,4 % observée après la crise financière mondiale de 2007-2008 et avant la pandémie de 2020.

Figure 5.1Perte de vitesse prévue de la croissance économique mondiale

Source : Fonds monétaire international.

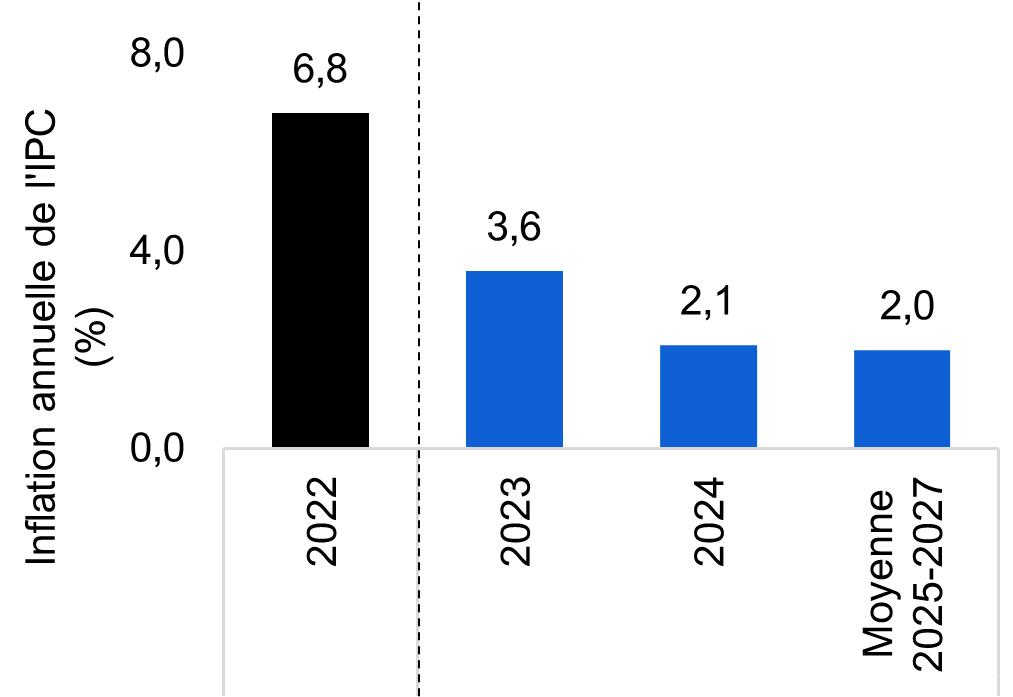

Perspectives pour l’Ontario : diminution de l’inflation et ralentissement de la croissance économique

Figure 5.2 Le taux d’inflation devrait fléchir graduellement en Ontario au cours des deux prochaines années

Sources : Statistique Canada et BRF

Depuis le sommet de 7,9 % atteint en juin 2022, le taux d’inflation sur douze mois de l’Ontario est tombé à 4,2 % en avril 2023. Dans la plupart des catégories, le taux d’inflation a baissé par rapport aux sommets atteints au milieu de l’année 2022, l’inflation des biens diminuant plus rapidement que celle des services. Parmi les principaux groupes de produits de l’IPC, l’inflation des prix des aliments a été la plus élevée (8,0 %), suivie de celles des prix des soins de santé et des soins personnels (6,3 %) et des prix de l’alcool et du tabac (4,8 %)[14] .

L’inflation annuelle de l’IPC devrait rester supérieure aux moyennes historiques en 2023, à 3,6 %, et retomber à une moyenne avoisinant les 2 % pendant le reste de la période visée par les perspectives, l’économie s’adaptant pleinement à la hausse des taux d’intérêt.

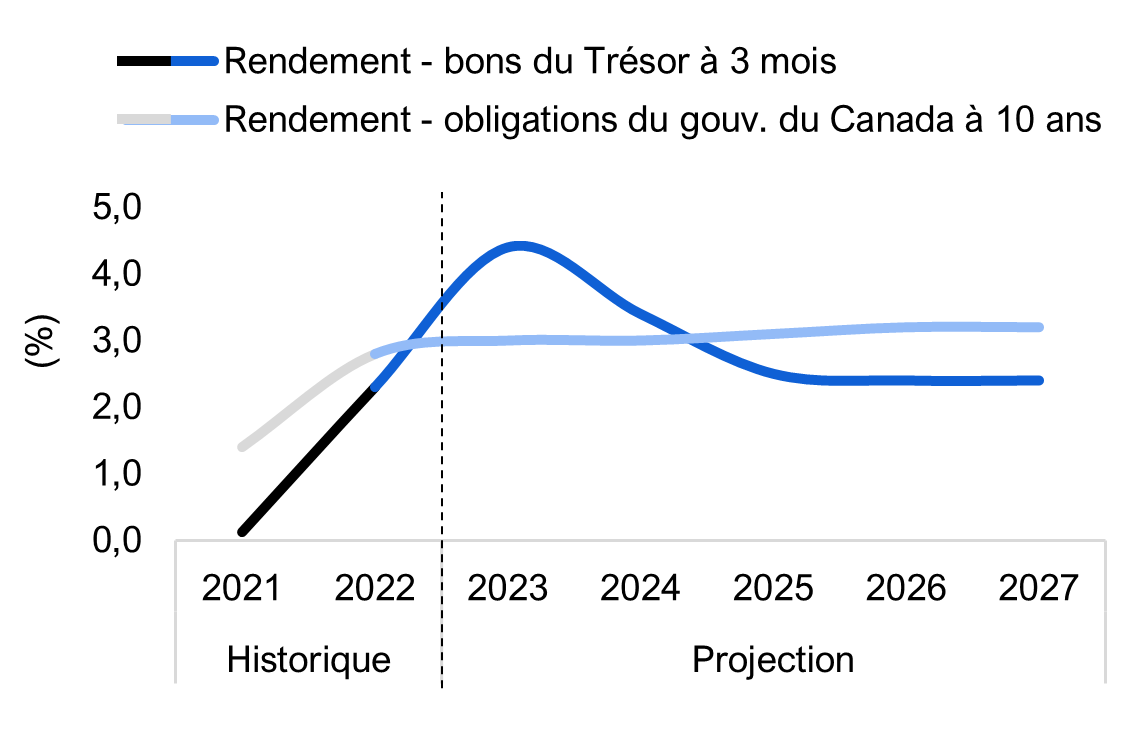

Tout comme la plupart des économistes du secteur privé, le BRF prévoit qu’en 2023, les taux d’intérêt à court terme demeureront supérieurs aux taux à long terme ce qui, historiquement, suggère la possibilité d’une faible croissance économique. À mesure que l’inflation se rapprochera de l’objectif de 2 % de la Banque du Canada, les taux d’intérêt à court terme devraient tomber sous les taux à long terme d’ici 2025

La croissance du PIB réel de l’Ontario ralentira après avoir atteint des sommets historiques

Le PIB réel de l’Ontario s’est accru de 3,7 % en 2022 après une hausse de 5,2 % en 2021, ce qui représente l’augmentation sur deux ans la plus forte en plus de 20 ans. Cependant, la croissance économique a connu un ralentissement tout au long de 2022, l’inflation élevée, la hausse des taux d’intérêt et l’affaiblissement de l’économie mondiale s’étant répercutés sur les ménages et les entreprises.

Figure 5.3 Les taux d’intérêt à court terme demeureront élevés en 2023 et en 2024

Sources : Statistique Canada et BRF.

Il est prévu que le rythme de la croissance économique de l’Ontario diminuera abruptement pour atteindre 0,8 % en 2023, conséquence de l’effet des taux d’intérêt plus élevés sur les dépenses de consommation et le marché de l’habitation. L’investissement résidentiel devrait afficher une baisse pour la deuxième année consécutive, tandis que les coûts d’emprunt élevés et le ralentissement escompté des ventes[15] freineront les investissements des entreprises.

La croissance économique devrait connaître un regain pour atteindre 1,5 % en 2024 et 2,0 % en moyenne au cours de la période allant de 2025 à 2027, une baisse de l’inflation et l’incidence décroissante des taux d’intérêt élevés contribuant à raffermir les dépenses des ménages. Des améliorations de la chaîne d’approvisionnement, de nouveaux investissements dans des usines de fabrication et la reprise de la demande des consommateurs au Canada et aux États-Unis devraient entraîner un regain modéré des exportations ontariennes. Cependant, certains risques planent sur ces perspectives et pourraient entraîner un ralentissement de la croissance économique; voir l’exposé au chapitre 6.

Figure 5.4 La croissance économique de l’Ontario ralentira en 2023

Sources : Comptes économiques de l’Ontario et BRF.

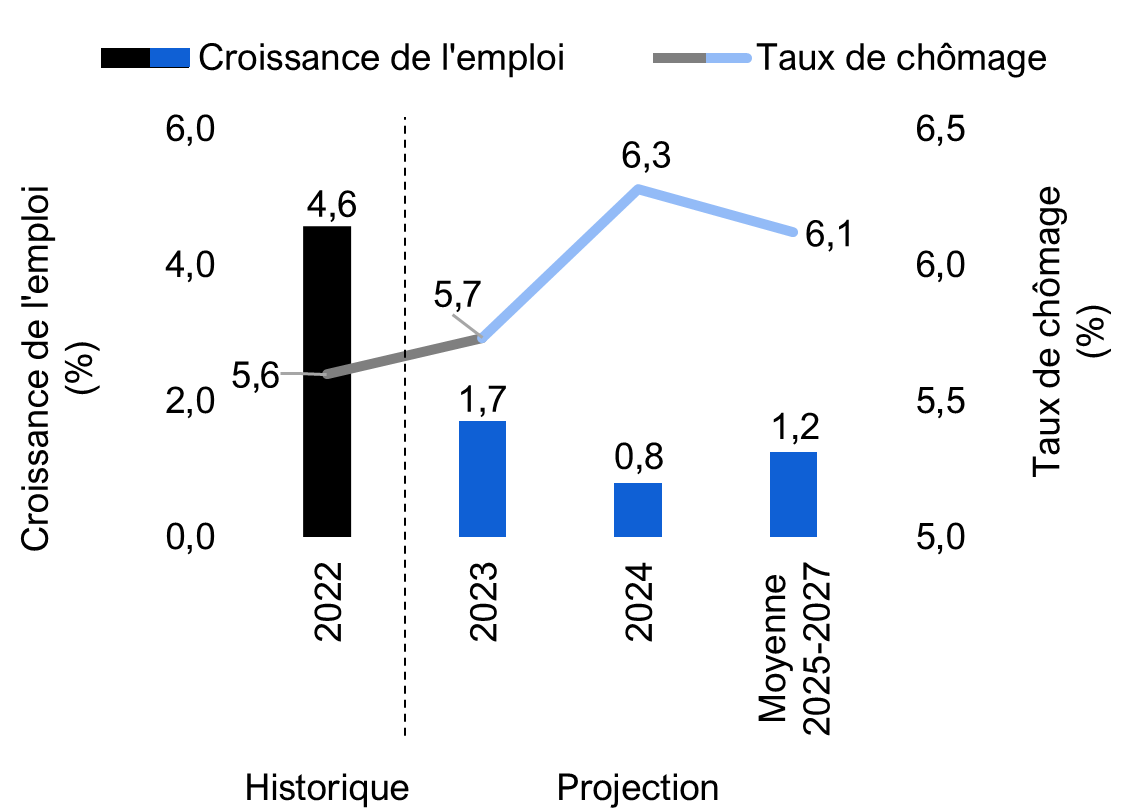

Le marché de l’emploi en Ontario devrait se contracter

La forte création d’emplois en Ontario au lendemain de la pandémie s’est poursuivie en 2022, l’emploi ayant augmenté de 338 300 postes (soit 4,6 %). Conjuguée à la forte hausse affichée en 2021, il s’agit de la plus forte croissance de l’emploi sur deux ans jamais enregistrée[16] . Le taux de chômage annuel dans la province a fléchi pour s’établir à 5,6 % en 2022 – le taux observé en 2019 avant la pandémie.

Le marché du travail en Ontario est demeuré solide au début de 2023; l’emploi a augmenté en avril pour le septième mois consécutif, et le taux de chômage a baissé pour s’établir à 4,9 %.

Pendant le reste de l’année, les postes vacants devraient continuer à diminuer et le taux de chômage annuel devrait remonter légèrement pour atteindre une moyenne de 5,7 % en 2023. En 2024, le taux de chômage devrait augmenter pour s’établir à 6,3 %, car la croissance de la population active sera plus forte que celle de l’emploi. Pour le reste de la période visée par les perspectives, on prévoit que le taux de chômage se situera en moyenne à 6,1 %.

Figure 5.5 On prévoit une hausse du taux de chômage en 2024

Sources : Statistique Canada et BRF.

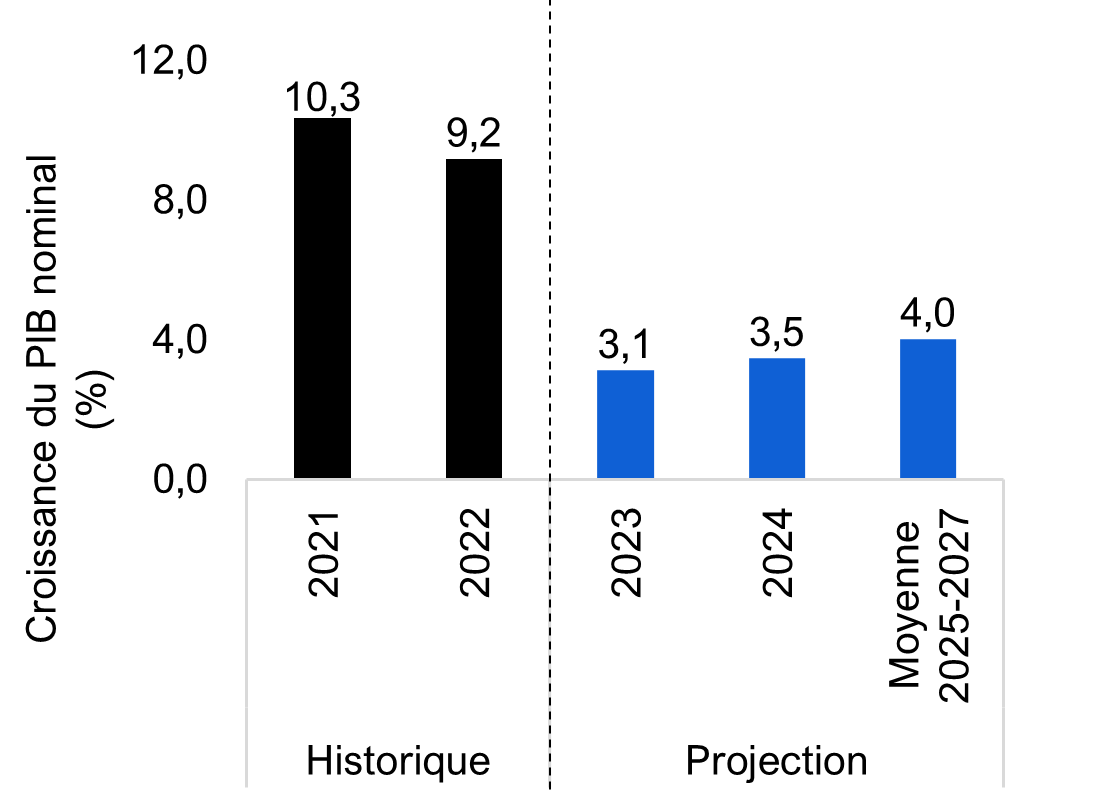

La croissance du PIB nominal de l’Ontario ralentira

Il est prévu qu’après deux années de gains exceptionnels, la croissance du PIB nominal de l’Ontario fléchira en 2023 pour s’établir à 3,1 %. Le rythme de croissance du revenu du travail devrait diminuer du fait que les employeurs réduiront l’embauche et leurs dépenses de salaires, et les bénéfices des sociétés devraient connaître une baisse en raison d’un ralentissement de la croissance des ventes et de taux d’intérêt élevés sur la dette.

La croissance du PIB nominal devrait s’accélérer en 2024 pour s’établir à 3,5 %, et revenir à un taux annuel moyen de 4,0 % au cours de la période allant de 2025 à 2027.

Figure 5.6 La croissance du PIB nominal de l’Ontario ralentira en 2023 et 2024

Sources : Comptes économiques de l’Ontario et BRF.

6. Risques touchant les perspectives économiques et budgétaires

Incertitudes économiques et budgétaires

La croissance économique de l’Ontario a été solide en 2022, mais de nombreux facteurs nationaux et mondiaux pourraient avoir une incidence positive ou négative sur les perspectives économiques du BRF.

- L’inflation pourrait persister plus longtemps que prévu, ce qui pousserait la Banque du Canada à relever à nouveau ses taux d’intérêt. La hausse des coûts d’emprunt accroît le stress financier des ménages; ainsi, un tiers des prêts hypothécaires seront assortis de paiements plus élevés en mai 2023 qu’en février 2022[17] . Des hausses supplémentaires des taux d’intérêt pourraient prolonger plus longtemps que prévu le ralentissement escompté sur le plan des perspectives économiques de l’Ontario et exercer des pressions additionnelles sur le marché du logement et les dépenses des ménages.

- Aux États-Unis, la croissance économique s’est ralentie en raison des délibérations en cours sur le plafond de la dette et des récentes turbulences dans le secteur financier. La Réserve fédérale a également adopté une position plus énergique contre l’inflation que la Banque du Canada, en augmentant le taux des fonds fédéraux de 75 points de base supplémentaires en 2023 pour le porter dans la fourchette de 5,00 à 5,25 %. Si l’économie américaine connaissait une récession, cela entraînerait un recul des exportations de biens intermédiaires et manufacturés de l’Ontario.

- La guerre que mène la Russie en Ukraine perdure, et s’accompagne de coûts budgétaires croissants, de tensions géopolitiques et de répercussions sur les prix de l’énergie et l’inflation à l’échelle mondiale. Cette situation continue d’éclipser la reprise du commerce mondial et de l’investissement international.

- Du côté positif, la résilience des dépenses de consommation et le marché du travail tendu en Ontario pourraient se prolonger plus longtemps que prévu, améliorant les perspectives économiques de l’Ontario par rapport au ralentissement brutal prévu en 2023. Plusieurs indicateurs économiques se sont redressés au cours du premier trimestre de 2023, et le marché du logement s’est stabilisé au cours des derniers mois après avoir reculé pendant la majeure partie de 2022. En outre, la croissance démographique de l’Ontario a dépassé les attentes; au cours du premier trimestre de 2023, on a enregistré la croissance la plus rapide sur 12 mois depuis 1972[18] . Si ces conditions persistent, la croissance de l’économie et des revenus pourrait être supérieure aux prévisions du BRF.

Les perspectives budgétaires de l’Ontario sont exposées aux mêmes risques que les perspectives économiques, en plus de quelques autres facteurs d’incertitude. Voici quelques risques importants qui pourraient affecter les perspectives budgétaires et entraîner des changements significatifs des prévisions du BRF :

- Une inflation élevée pourrait exercer une forte pression à la hausse sur les salaires du secteur public. Ainsi, plus de 60 000 travailleurs du secteur de l’éducation ont conclu récemment des conventions collectives prévoyant des augmentations salariales annuelles moyennes de 4,5 % sur quatre ans[19] .

- La contestation judiciaire de la loi 124[20] . Le 29 novembre 2022, la Cour supérieure de justice de l’Ontario a statué que la loi 124, qui limite les augmentations salariales de base pour la plupart des employés provinciaux à 1 % par année pour une période de trois ans, contrevenait à la Charte canadienne des droits et libertés et était donc nulle et sans effet. Bien que le gouvernement ait interjeté appel de cette décision, certains employés du secteur public ont déjà reçu une rémunération rétroactive. Par exemple, une décision arbitrale a accordé récemment aux membres de l’Association des infirmières et infirmiers de l’Ontario travaillant dans les hôpitaux des hausses de salaire supplémentaires de 0,75 % en 2020, de 1,0 % en 2021 et de 2,0 % en 2022. Les prévisions du BRF concernant les dépenses de programmes tiennent compte des décisions annoncées récemment prévoyant une rémunération rétroactive; cependant, d’autres décisions semblables pourraient donner lieu à des dépenses de programmes supérieures à ces prévisions.

- Tout nouveau programme prévoyant des revenus ou des dépenses se répercuterait sur les perspectives budgétaires du BRF.

Facteurs touchant le budget

Pour illustrer l’incidence possible de changements apportés aux politiques sur les prévisions financières de l’Ontario, le BRF a estimé la sensibilité d’indicateurs clés du budget aux changements dans trois secteurs principaux : revenus fiscaux, transferts fédéraux et dépenses de programmes. Pour chaque élément de politique, le tableau 6.1 fournit une estimation de la variation du solde budgétaire pour l’exercice en cours et pour 2027-2028, de la variation de la dette nette totale d’ici 2027-2028 et de la variation du ratio de la dette nette au PIB en 2027-2028.

| Variation du solde budgétaire | Variation de la dette nette d’ici 2027-2028 | Variation du ratio de la dette nette au PIB d’ici 2027-2028 | ||

|---|---|---|---|---|

| 2023- 2024 | 2027- 2028 | |||

| Politique fiscale* | ||||

| Hausse/baisse annuelle de 500 $ des impôts sur le revenu pour le contribuable moyen | +/- 4,7 G$ | +/- 6,4 G$ | +/- 27,7 G$ | +/- 2,2 pp |

| Hausse/baisse d’un point de pourcentage de l’impôt provincial des sociétés de 11,5 % | +/- 2,2 G$ | +/- 3,0 G$ | +/- 12,9 G$ | +/- 1,0 pp |

| Hausse/baisse d’un point de pourcentage de la TVH provinciale de 8 % | +/- 4,6 G$ | +/- 6,1 G$ | +/- 26,6 G$ | +/- 2,1 pp |

| Transferts fédéraux | ||||

| Hausse/baisse durable d’un point de pourcentage du taux de croissance du Transfert canadien en matière de santé | +/- 0,2 G$ | +/- 1,2 G$ | +/- 3,4 G$ | +/- 0,3 pp |

| Hausse/baisse durable d’un point de pourcentage du taux de croissance du Transfert canadien en matière de programmes sociaux | +/- 0,1 G$ | +/- 0,4 G$ | +/- 1,1 G$ | +/- 0,1 pp |

| Hausse/baisse de 1 G$ des transferts fédéraux** | +/- 1,0 G$ | +/- 1,2 G$ | +/- 5,6 G$ | +/- 0,5 pp |

| Dépenses de programmes | ||||

| Changement permanent de 1 G$ dans les dépenses de programmes** | +/- 1,0 G$ | +/- 1,2 G$ | +/- 5,6 G$ | +/- 0,5 pp |

| Changement durable d’un point de pourcentage du taux de croissance des dépenses en santé au cours de la période de projection | +/- 0,8 G$ | +/- 5,1 G$ | +/- 14,1 G$ | +/- 1,1 pp |

| Changement durable d’un point de pourcentage du taux de croissance des dépenses en éducation au cours de la période de projection | +/- 0,4 G$ | +/- 2,2 G$ | +/- 6,3 G$ | +/- 0,5 pp |

| Changement durable d’un point de pourcentage des salaires et traitements dans le secteur public ontarien au cours de la période de projection | +/- 0,5 G$ | +/- 3,2 G$ | +/- 9,0 G$ | +/- 0,7 pp |

7. Annexe

| (Croissance en pourcentage) | 2021r | 2022r | 2023p | 2024p | Moyenne de 2025p-2027p* |

|---|---|---|---|---|---|

| PIB nominal | |||||

| BRF | 10,3 | 9,2 | 3,1 | 3,5 | 4,0 |

| Budget de l’Ontario de 2023** | 10,3 | 9,4 | 2,8 | 3,6 | 4,6 |

| Revenu du travail | |||||

| BRF | 9,2 | 9,5 | 5,0 | 4,0 | 3,9 |

| Budget de l’Ontario de 2023** | 9,2 | 9,0 | 5,1 | 4,2 | 4,4 |

| Bénéfices des sociétés | |||||

| BRF | 13,7 | 4,7 | – 8,1 | 2,3 | 5,5 |

| Budget de l’Ontario de 2023** | 13,7 | 5,0 | – 8,2 | – 0,5 | 9,2 |

| Consommation des ménages | |||||

| BRF | 7,3 | 12,6 | 5,3 | 4,4 | 4,0 |

| Budget de l’Ontario de 2023** | 7,3 | 12,6 | 5,1 | 4,1 | 4,3 |

| 2021r | 2022r | 2023p | 2024p | Moyenne de 2025p-2027p* | |

|---|---|---|---|---|---|

| Taux de croissance du PIB réel (%) | |||||

| BRF | 5,2 | 3,7 | 0,8 | 1,5 | 2,0 |

| Budget de l’Ontario de 2023** | 5,2 | 3,7 | 0,2 | 1,3 | 2,5 |

| Taux de croissance de l’emploi (%) | |||||

| BRF | 5,2 | 4,6 | 1,7 | 0,8 | 1,2 |

| Budget de l’Ontario de 2023 | 5,2 | 4,6 | 0,5 | 1,0 | 1,7 |

| Taux de chômage (%) | |||||

| BRF | 8,1 | 5,6 | 5,7 | 6,3 | 6,1 |

| Budget de l’Ontario de 2023 | 8,1 | 5,6 | 6,4 | 6,6 | 6,3 |

| Taux d’inflation de l’IPC (%) | |||||

| BRF | 3,5 | 6,8 | 3,6 | 2,1 | 2,0 |

| Budget de l’Ontario de 2023 | 3,5 | 6,8 | 3,6 | 2,1 | 2,0 |

| Taux des bons du Trésor à 3 mois (%) | |||||

| BRF | 0,1 | 2,3 | 4,4 | 3,4 | 2,4 |

| Budget de l’Ontario de 2023 | 0,1 | 2,3 | 4,3 | 3,3 | 2,5 |

| Taux des obligations d’État à 10 ans (%) | |||||

| BRF | 1,4 | 2,8 | 3,0 | 3,0 | 3,2 |

| Budget de l’Ontario de 2023 | 1,4 | 2,8 | 3,1 | 3,1 | 3,2 |

| (G$) | 2020-2021r | 2021-2022r | 2022-2023p | 2023-2024p | 2024-2025p | 2025-2026p | 2026-2027p | 2027-2028p |

|---|---|---|---|---|---|---|---|---|

| Revenus | ||||||||

| Impôt sur le revenu des particuliers | 40,3 | 46,8 | 50,3 | 54,0 | 56,6 | 59,3 | 61,8 | 64,3 |

| Taux annuel de croissance (%) | 6,9 | 15,9 | 7,7 | 7,4 | 4,7 | 4,7 | 4,3 | 4,1 |

| Taxe de vente | 26,6 | 30,4 | 35,8 | 35,1 | 36,7 | 38,2 | 39,7 | 41,2 |

| Taux annuel de croissance (%) | – 7,1 | 14,2 | 17,8 | – 1,9 | 4,6 | 4,0 | 4,0 | 3,8 |

| Impôt des sociétés | 17,8 | 25,2 | 26,9 | 23,9 | 25,2 | 26,8 | 28,0 | 28,9 |

| Taux annuel de croissance (%) | 15,3 | 41,9 | 6,6 | – 11,3 | 5,5 | 6,4 | 4,4 | 3,3 |

| Tous les autres taxes et impôts | 26,2 | 29,3 | 28,5 | 28,5 | 30,9 | 32,0 | 33,1 | 34,1 |

| Taux annuel de croissance (%) | – 1,1 | 12,0 | – 2,9 | – 0,1 | 8,7 | 3,3 | 3,4 | 3,3 |

| Revenus fiscaux totaux | 110,9 | 131,7 | 141,5 | 141,4 | 149,4 | 156,2 | 162,5 | 168,6 |

| Taux annuel de croissance (%) | 2,4 | 18,8 | 7,5 | – 0,0 | 5,6 | 4,5 | 4,1 | 3,7 |

| Transferts du gouvernement du Canada | 33,9 | 30,6 | 31,1 | 34,3 | 35,5 | 37,1 | 39,0 | 40,6 |

| Taux annuel de croissance (%) | 33,6 | – 9,8 | 1,6 | 10,4 | 3,3 | 4,7 | 5,0 | 4,0 |

| Revenus provenant d’entreprises d’État | 5,0 | 6,4 | 6,5 | 6,3 | 6,7 | 8,5 | 8,8 | 9,2 |

| Taux annuel de croissance (%) | – 15,1 | 28,6 | 0,9 | – 2,6 | 5,1 | 27,8 | 4,0 | 3,7 |

| Autres revenus non fiscaux | 15,1 | 16,3 | 18,0 | 19,0 | 19,2 | 20,0 | 20,7 | 21,4 |

| Taux annuel de croissance (%) | – 8,8 | 8,4 | 10,0 | 5,5 | 1,4 | 3,9 | 3,7 | 3,4 |

| Revenus totaux | 164,9 | 185,1 | 197,1 | 201,1 | 210,7 | 221,8 | 231,1 | 239,7 |

| Taux annuel de croissance (%) | 5,6 | 12,2 | 6,5 | 2,0 | 4,8 | 5,2 | 4,2 | 3,7 |

| Charges | ||||||||

| Secteur de la santé | 69,5 | 75,7 | 78,5 | 80,6 | 82,4 | 86,7 | 90,5 | 95,1 |

| Taux annuel de croissance (%) | 9,0 | 9,0 | 3,6 | 2,7 | 2,2 | 5,2 | 4,4 | 5,1 |

| Secteur de l’éducation* | 32,9 | 31,5 | 34,9 | 36,6 | 37,7 | 39,5 | 40,9 | 41,7 |

| Taux annuel de croissance (%) | 3,6 | – 4,2 | 10,7 | 5,0 | 3,0 | 4,6 | 3,5 | 2,1 |

| Secteur des services à l’enfance et des services sociaux | 17,4 | 17,1 | 18,1 | 19,1 | 19,9 | 20,6 | 21,2 | 21,9 |

| Taux annuel de croissance (%) | 2,4 | – 2,1 | 6,2 | 5,3 | 4,2 | 3,6 | 3,1 | 3,2 |

| Secteur de l’éducation postsecondaire | 9,8 | 10,6 | 11,1 | 11,9 | 12,2 | 12,6 | 13,0 | 13,4 |

| Taux annuel de croissance (%) | – 6,6 | 8,0 | 4,7 | 6,8 | 2,9 | 3,2 | 3,0 | 3,2 |

| Secteur de la justice | 4,8 | 4,9 | 5,3 | 5,6 | 5,6 | 5,6 | 5,8 | 5,9 |

| Taux annuel de croissance (%) | 2,8 | 4,1 | 7,2 | 4,8 | 0,3 | 0,0 | 3,9 | 1,5 |

| Autres programmes* | 34,6 | 30,6 | 35,7 | 31,0 | 32,1 | 32,8 | 31,6 | 32,1 |

| Taux annuel de croissance (%) | 40,6 | – 11,8 | 16,8 | – 13,1 | 3,5 | 2,1 | – 3,8 | 1,9 |

| Total des dépenses de programmes | 169,0 | 170,4 | 183,6 | 184,8 | 189,9 | 197,7 | 202,9 | 210,1 |

| Taux annuel de croissance (%) | 11,0 | 0,8 | 7,7 | 0,6 | 2,8 | 4,1 | 2,6 | 3,5 |

| Intérêt sur la dette | 12,3 | 12,6 | 12,9 | 13,3 | 13,4 | 13,5 | 13,4 | 13,2 |

| Taux annuel de croissance (%) | – 1,7 | 2,3 | 2,6 | 2,7 | 1,4 | 0,4 | – 0,6 | – 1,8 |

| Dépenses totales | 181,3 | 183,0 | 196,5 | 198,1 | 203,4 | 211,2 | 216,3 | 223,3 |

| Taux annuel de croissance (%) | 10,0 | 0,9 | 7,4 | 0,8 | 2,7 | 3,9 | 2,4 | 3,2 |

| Solde budgétaire | – 16,4 | 2,1 | 0,5 | 3,0 | 7,4 | 10,6 | 14,7 | 16,4 |

| (G$) | 2020-2021r | 2021-2022r | 2022-2023p | 2023-2024p | 2024-2025p | 2025-2026p | 2026-2027p | 2027-2028p |

|---|---|---|---|---|---|---|---|---|

| Solde budgétaire | – 16,4 | 2,1 | 0,5 | 3,0 | 7,4 | 10,6 | 14,7 | 16,4 |

| Déficit accumulé | 239,3 | 236,9 | 236,3 | 233,3 | 225,9 | 215,4 | 200,7 | 184,2 |

| Dette nette | 373,6 | 380,4 | 389,3 | 396,3 | 403,0 | 406,5 | 404,6 | 398,5 |

| Ratio de la dette nette au PIB (%) | 43,1 | 39,8 | 37,3 | 36,8 | 36,2 | 35,0 | 33,4 | 31,8 |

| Changements apportés à la projection des revenus du BRF, G$ | ||||||

|---|---|---|---|---|---|---|

| 2022- 2023 | 2023- 2024 | 2024- 2025 | 2025- 2026 | 2026- 2027 | Total | |

| PEB de l’hiver | 188,5 | 194,7 | 204,8 | 212,5 | 221,0 | – |

| Nouvelles mesures du gouvernement | 0,0 | 0,1 | 0,0 | 0,0 | 0,0 | 0,2 |

| Mises à jour des prévisions | 8,5 | 6,3 | 5,9 | 9,3 | 10,0 | 40,1 |

| Changements totaux | 8,5 | 6,4 | 6,0 | 9,3 | 10,1 | 40,2 |

| PEB du printemps | 197,1 | 201,1 | 210,7 | 221,8 | 231,1 | – |

| Changements apportés à la projection des dépenses de programmes du BRF, G$ | ||||||

|---|---|---|---|---|---|---|

| 2022- 2023 | 2023- 2024 | 2024- 2025 | 2025- 2026 | 2026- 2027 | Total | |

| PEB de l’hiver | 178,3 | 180,5 | 187,1 | 193,3 | 199,4 | – |

| Nouvelles mesures du gouvernement | 6,5 | 2,0 | 1,3 | 1,5 | 1,3 | 12,6 |

| Mises à jour des prévisions | – 1,2 | 2,3 | 1,6 | 3,0 | 2,2 | 7,9 |

| Changements totaux | 5,3 | 4,3 | 2,9 | 4,4 | 3,5 | 20,5 |

| PEB du printemps | 183,6 | 184,8 | 189,9 | 197,7 | 202,9 | – |

Description des graphiques

| Solde budgétaire (G$) | |||

|---|---|---|---|

| Historique | BRF | Budget de l’Ontario de 2023 | |

| 2020-2021 | – 16,4 | ||

| 2021-2022 | 2,1 | ||

| 2022-2023 | 0,5 | – 2,2 | |

| 2023-2024 | 3,0 | – 1,3 | |

| 2024-2025 | 7,4 | 0,2 | |

| 2025-2026 | 10,6 | 4,4 | |

| 2026-2027 | 14,7 | – | |

| 2027-2028 | 16,4 | – | |

| Ratio de la dette nette au PIB (%) | Historique | BRF | Budget de l’Ontario de 2023 | |

|---|---|---|---|---|

| Historique | 1981-1982 | 10,4 | ||

| 1982-1983 | 12,1 | |||

| 1983-1984 | 12,8 | |||

| 1984-1985 | 12,9 | |||

| 1985-1986 | 14,9 | |||

| 1986-1987 | 14,8 | |||

| 1987-1988 | 14,4 | |||

| 1988-1989 | 13,6 | |||

| 1989-1990 | 12,5 | |||

| 1990-1991 | 13,4 | |||

| 1991-1992 | 17,1 | |||

| 1992-1993 | 21,1 | |||

| 1993-1994 | 26,6 | |||

| 1994-1995 | 28,3 | |||

| 1995-1996 | 30,1 | |||

| 1996-1997 | 31,2 | |||

| 1997-1998 | 30,5 | |||

| 1998-1999 | 29,4 | |||

| 1999-1900 | 32,1 | |||

| 2000-2001 | 29,3 | |||

| 2001-2002 | 28,2 | |||

| 2002-2003 | 26,8 | |||

| 2003-2004 | 27,5 | |||

| 2004-2005 | 26,8 | |||

| 2005-2006 | 27,8 | |||

| 2006-2007 | 27,1 | |||

| 2007-2008 | 26,6 | |||

| 2008-2009 | 27,8 | |||

| 2009-2010 | 32,3 | |||

| 2010-2011 | 34,5 | |||

| 2011-2012 | 36,6 | |||

| 2012-2013 | 38,2 | |||

| 2013-2014 | 39,7 | |||

| 2014-2015 | 40,5 | |||

| 2015-2016 | 40,3 | |||

| 2016-2017 | 39,7 | |||

| 2017-2018 | 39,3 | |||

| 2018-2019 | 39,4 | |||

| 2019-2020 | 39,6 | |||

| 2020-2021 | 43,1 | |||

| 2021-2022 | 39,8 | |||

| Projection | 2022-2023 | 37,3 | 37,8 | |

| 2023-2024 | 36,8 | 37,8 | ||

| 2024-2025 | 36,2 | 37,7 | ||

| 2025-2026 | 35,0 | 36,9 | ||

| 2026-2027 | 33,4 | – | ||

| 2027-2028 | 31,8 | – | ||

| Ratio de la dette nette au PIB (%) | Historique | BRF | Budget de l’Ontario de 2023 | |

| Historique | 1981-1982 | 6,0 | ||

| 1982-1983 | 7,3 | |||

| 1983-1984 | 8,7 | |||

| 1984-1985 | 9,2 | |||

| 1985-1986 | 9,5 | |||

| 1986-1987 | 9,7 | |||

| 1987-1988 | 9,6 | |||

| 1988-1989 | 9,1 | |||

| 1989-1990 | 8,2 | |||

| 1990-1991 | 7,7 | |||

| 1991-1992 | 8,8 | |||

| 1992-1993 | 10,8 | |||

| 1993-1994 | 13,9 | |||

| 1994-1995 | 14,5 | |||

| 1995-1996 | 14,6 | |||

| 1996-1997 | 14,8 | |||

| 1997-1998 | 14,2 | |||

| 1998-1999 | 14,3 | |||

| 1999-1900 | 15,5 | |||

| 2000-2001 | 15,0 | |||

| 2001-2002 | 14,2 | |||

| 2002-2003 | 12,9 | |||

| 2003-2004 | 12,9 | |||

| 2004-2005 | 11,1 | |||

| 2005-2006 | 10,3 | |||

| 2006-2007 | 9,4 | |||

| 2007-2008 | 8,9 | |||

| 2008-2009 | 9,2 | |||

| 2009-2010 | 9,5 | |||

| 2010-2011 | 8,8 | |||

| 2011-2012 | 9,1 | |||

| 2012-2013 | 9,0 | |||

| 2013-2014 | 9,1 | |||

| 2014-2015 | 8,9 | |||

| 2015-2016 | 8,5 | |||

| 2016-2017 | 8,3 | |||

| 2017-2018 | 7,9 | |||

| 2018-2019 | 8,1 | |||

| 2019-2020 | 8,0 | |||

| 2020-2021 | 7,4 | |||

| 2021-2022 | 6,8 | |||

| Projection | 2022-2023 | 6,6 | 6,7 | |

| 2023-2024 | 6,6 | 6,9 | ||

| 2024-2025 | 6,4 | 6,8 | ||

| 2025-2026 | 6,1 | – | ||

| 2026-2027 | 5,8 | – | ||

| 2027-2028 | 5,5 | – | ||

| Exercice | Revenus totaux (G$) | |||

|---|---|---|---|---|

| Historique | BRF | Budget de l’Ontario de 2023 | ||

| Historique | 2019-2020 | 156,1 | ||

| 2020-2021 | 164,9 | |||

| 2021-2022 | 185,1 | |||

| Projection | 2022-2023 | 197,1 | 200,4 | |

| 2023-2024 | 201,1 | 204,4 | ||

| 2024-2025 | 210,7 | 213,1 | ||

| 2025-2026 | 221,8 | 226,0 | ||

| 2026-2027 | 231,1 | – | ||

| 2027-2028 | 239,7 | – | ||

| Variation en 2022-2023 (%) | ||

|---|---|---|

| BRF | Budget de l’Ontario de 2023 | |

| Impôt sur le revenu des particuliers | 7,7 | 13,0 |

| Revenu du travail | 9,5 | 9,0 |

| Impôt des sociétés | 6,6 | 10,7 |

| Bénéfices des sociétés | 4,7 | 5,0 |

| Exercice | Dépenses de programmes (G$) | |||

|---|---|---|---|---|

| Historique | BRF | Budget de l’Ontario de 2023 | ||

| Historique | 2020-2021 | 169,0 | ||

| 2021-2022 | 170,4 | |||

| Projection | 2022-2023 | 183,6 | 189,1 | |

| 2023-2024 | 184,8 | 190,6 | ||

| 2024-2025 | 189,9 | 196,4 | ||

| 2025-2026 | 197,7 | 202,5 | ||

| 2026-2027 | 202,9 | – | ||

| 2027-2028 | 210,1 | – | ||

| Années | Croissance du PIB réel (%) | ||

|---|---|---|---|

| Monde | Économies avancées | Marchés émergents et économies en développement | |

| 2012-2019 | 3,4 | 1,9 | 4,6 |

| 2023-2028 | 3,0 | 1,6 | 4,0 |

| Historique | Projection | |||

|---|---|---|---|---|

| 2022 | 2023 | 2024 | Moyenne 2025-2027 | |

| Inflation annuelle de l’IPC (%) | 6,8 | 3,6 | 2,1 | 2,0 |

| (%) | Historique | Projection | |||||

|---|---|---|---|---|---|---|---|

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| Rendement des bons du Trésor à 3 mois | 0,1 | 2,2 | 4,4 | 3,4 | 2,5 | 2,4 | 2,4 |

| Rendement des obligations du gouvernement du Canada à 10 ans | 1,4 | 2,8 | 3,0 | 3,0 | 3,1 | 3,2 | 3,2 |

| Croissance du PIB réel de l’Ontario (%) | 2021 | 2022 | 2023 | 2024 | Moyenne 2025-2027 |

|---|---|---|---|---|---|

| Historique | 5,2 | 3,7 | |||

| BRF | 0,8 | 1,5 | 2,0 |

| Per Cent | Historique | BRF | ||

|---|---|---|---|---|

| 2022 | 2023 | 2024 | Moyenne 2025-27 | |

| Croissance de l’emploi | 4,6 | 1,7 | 0,8 | 1,2 |

| Taux de chômage | 5,6 | 5,7 | 6,3 | 6,1 |

| Année | Croissance du PIB nominal (%) | |

|---|---|---|

| Historique | 2021 | 10,3 |

| 2022 | 9,2 | |

| Projection | 2023 | 3,1 |

| 2024 | 3,5 | |

| Moyenne 2025-2027 | 4,0 | |

Notes de bas de page

[1] Pour en savoir plus sur les indicateurs de viabilité financière, consulter le rapport Perspectives budgétaires à long terme : Évaluation de la viabilité financière de l’Ontario de 2021 à 2050 du BRF.

[2] Le budget de l’Ontario de 2023 a mis à jour le ratio cible de la dette nette au PIB en indiquant qu’il devrait demeurer sous la barre de 40 %, comparativement à l’objectif de 42 % du budget de l’Ontario de 2022. Voir le budget de l’Ontario de 2023, page 173.

[3] L’incidence de la hausse des taux d’intérêt sur la dette est partiellement atténuée par la structure des échéances de la dette de l’Ontario, l’échéance moyenne étant de 11,1 ans en 2022-2023. Voir le budget de l’Ontario de 2023, page 171.

[4] Le budget de l’Ontario de 2023 a mis à jour le ratio cible de l’intérêt sur la dette au revenu en indiquant qu’il devrait demeurer sous la barre de 7,5 %, comparativement à l’objectif de 8 % du budget de l’Ontario de 2022. Voir le budget de l’Ontario de 2023, page 173.

[5] La perte de revenus ponctuels comprend une réduction des fonds de durée limitée en raison de la COVID-19 et des cotisations fiscales plus élevées en 2021-2022 et au cours des exercices précédents. Les mesures qui abaissent les revenus totaux en 2022-2023 et qui ont été annoncées par l’Ontario dans des budgets et des perspectives économiques et revues financières antérieurs comprennent le crédit d’impôt pour les personnes et les familles à faible revenu (CIPFR) bonifié et la réduction des taxes sur l’essence et le carburant.

[6] Pour des précisions sur les changements apportés à la projection des revenus du BRF par rapport aux PEB de l’hiver, voir l’annexe.

[7] Par exemple, les revenus totaux en 2021-2022 étaient de 185,1 milliards de dollars, soit 5,0 % de plus que les prévisions du printemps 2022 du BRF et 6,6 % de plus que les prévisions du budget de l’Ontario de 2022.

[8] Pour des précisions sur les changements que le BRF a apportés à ses projections comparativement aux PEB de l’hiver, consulter l’annexe.

[9] En date du budget de l’Ontario de 2023, il restait 1,8 milliard de dollars dans le Fonds de prévoyance pour 2022-2023 et 4,0 milliards de dollars pour 2023-2024. Pour 2024-2025 et 2025-2026, le ministère des Finances a affirmé que la divulgation du solde du Fonds de prévoyance révélerait un document du Conseil des ministres. Le BRF a accepté de ne pas divulguer de documents du Conseil des ministres aux termes de l’alinéa 2 f) du décret 1086/2022.

[10] Comprend 5,0 milliards de dollars pour les revendications territoriales et les revendications liées au territoire en cours avec les communautés autochtones et 1,3 milliard de dollars pour des « investissements ponctuels » du Secrétariat du Conseil du Trésor (voir le budget de l’Ontario de 2023, p. 153).

[11] Comme il est proposé dans le budget de l’Ontario de 2023 (p. 81), la Loi sur le revenu annuel garanti en Ontario a été modifiée afin d’élargir l’admissibilité au RRAG et de rajuster la prestation annuellement en fonction de l’inflation.

[12] Voir Secteur de la santé de l’Ontario : Examen du plan de dépenses du budget 2023.

[13] Perspectives de l’économie mondiale, Fonds monétaire international, avril 2023.

[14] Taux d’inflation sur 12 mois en date d’avril 2023.

[15] Enquête sur les perspectives des entreprises – Premier trimestre de 2023, Banque du Canada, avril 2023.

[16] Pour un compte rendu de la performance du marché du travail de l’Ontario en 2022, consulter le rapport Le marché du travail de l’Ontario en 2022 du BRF.

[17] Revue du système financier – 2023, Banque du Canada, 2023.

[18] Du premier trimestre de 2022 au premier trimestre de 2023, la population de l’Ontario a connu une croissance d’environ 3,0 %, le gain le plus élevé depuis le deuxième trimestre de 1972, où ce taux s’était établi à 3,2 %.

[19] La province a conclu récemment de nouvelles ententes avec environ 55 000 travailleuses et travailleurs en éducation qui sont membres du Syndicat canadien de la fonction publique (SCFP) et environ 7 000 travailleuses et travailleurs en éducation représentés par le Conseil des travailleurs de l’éducation de l’Ontario (CTEO). Le BRF estime que ces travailleurs recevront une augmentation de salaire annuelle moyenne d’environ 4,5 % pendant quatre ans, ce qui se situe au-dessus de la moyenne historique à long terme de 2,2 %.

[20] La loi 124 est la Loi de 2019 visant à préserver la viabilité du secteur public pour les générations futures.